- United States

- /

- Semiconductors

- /

- NYSE:ONTO

Onto Innovation (ONTO) Is Up 12.6% After AI-Fueled Capital Raise - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In late November 2025, Onto Innovation Inc. filed and then closed a shelf registration for 641,771 common shares, raising about US$80.39 million out of a registered US$87.86 million.

- This capital move followed stronger-than-expected third-quarter results and upbeat guidance tied to AI-driven advanced packaging and the Semilab acquisition, underscoring management’s confidence in funding growth.

- We’ll now examine how Onto Innovation’s stronger AI-packaging outlook and new capital from the shelf registration reshape its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Onto Innovation Investment Narrative Recap

To own Onto Innovation, you need to believe that AI-driven advanced packaging and the Semilab acquisition can translate into durable demand, despite cyclical swings and customer concentration. The recent US$80.39 million shelf takedown modestly strengthens the balance sheet but does not materially change the key near term catalyst, which is a rebound in AI packaging and advanced nodes, or the biggest risk, which is that this spending recovery proves slower or weaker than expected.

The most relevant recent announcement is Onto’s upbeat fourth quarter revenue and EPS guidance tied to AI packaging demand and higher DRAM and logic spending. That outlook, combined with the new equity capital, supports management’s focus on funding tools like Dragonfly and integrating Semilab to capture more of the 2.5D and 3D packaging opportunity, but it also raises the stakes if customers delay or trim their capex plans in the months ahead. Yet investors should also be aware that...

Read the full narrative on Onto Innovation (it's free!)

Onto Innovation's narrative projects $1.4 billion revenue and $311.2 million earnings by 2028. This requires 11.0% yearly revenue growth and a roughly $111 million earnings increase from $199.9 million today.

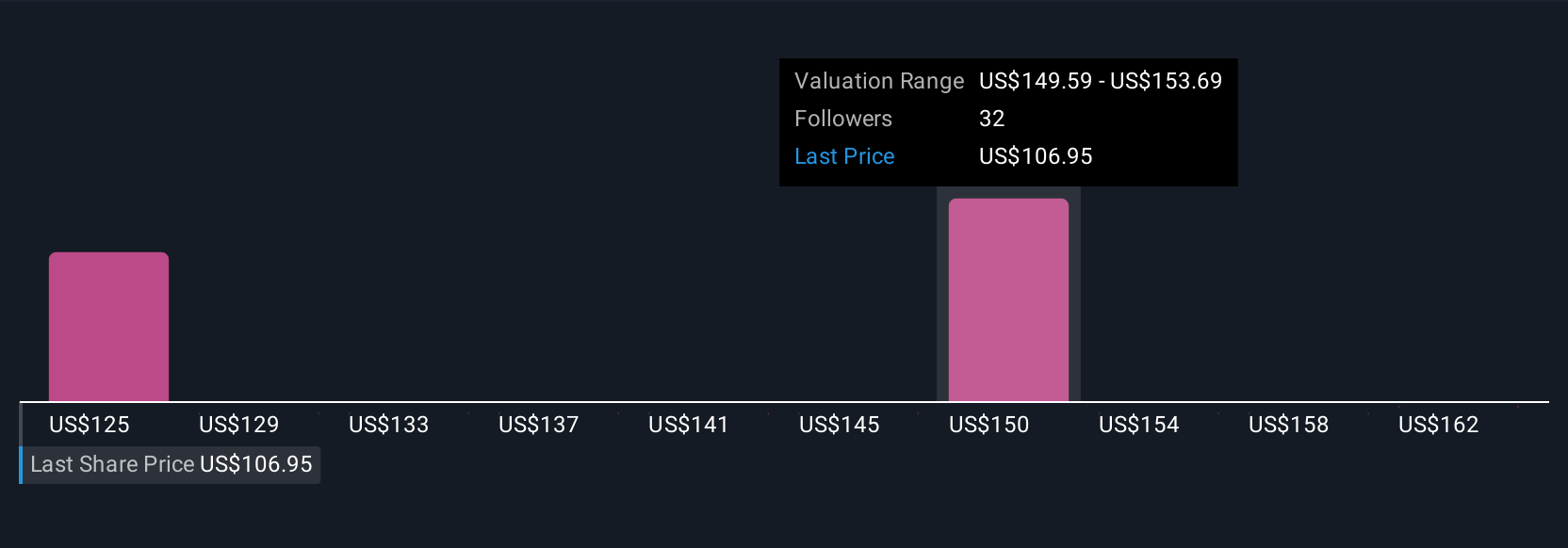

Uncover how Onto Innovation's forecasts yield a $157.00 fair value, in line with its current price.

Exploring Other Perspectives

The Simply Wall St Community’s 2 fair value estimates for Onto Innovation range from US$157 to about US$165.96, showing how far individual views can spread. You can weigh those opinions against the central risk that AI packaging and advanced node demand might fall short of expectations, with clear implications for revenue, margins and how the recent equity raise is ultimately judged.

Explore 2 other fair value estimates on Onto Innovation - why the stock might be worth as much as $165.96!

Build Your Own Onto Innovation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Onto Innovation research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Onto Innovation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Onto Innovation's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONTO

Onto Innovation

Engages in the design, development, manufacture, and support of process control tools that performs optical metrology and inspection worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026