- United States

- /

- Software

- /

- NasdaqGS:IIIV

Exploring 3 Undervalued Small Caps In US With Insider Action

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet over the past year it has risen by 20%, with earnings projected to grow by 15% annually in the coming years. In this context, identifying stocks that are considered undervalued and have insider activity can be an intriguing strategy for investors looking to capitalize on potential growth opportunities within small-cap companies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| OptimizeRx | NA | 1.2x | 41.66% | ★★★★★☆ |

| German American Bancorp | 14.3x | 4.8x | 48.26% | ★★★★☆☆ |

| First United | 12.6x | 3.4x | 36.46% | ★★★★☆☆ |

| Quanex Building Products | 30.5x | 0.8x | 44.26% | ★★★★☆☆ |

| Arrow Financial | 15.2x | 3.3x | 42.36% | ★★★☆☆☆ |

| West Bancorporation | 15.4x | 4.7x | 43.74% | ★★★☆☆☆ |

| ChromaDex | 284.6x | 4.6x | 34.30% | ★★★☆☆☆ |

| Franklin Financial Services | 14.6x | 2.3x | 27.62% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -74.79% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -42.37% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

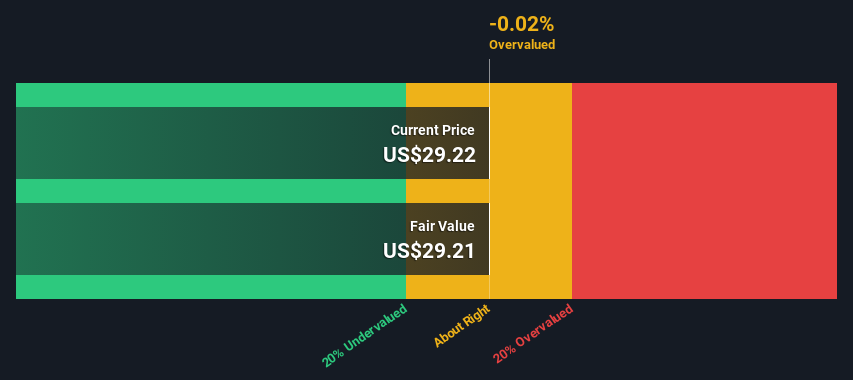

i3 Verticals (NasdaqGS:IIIV)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: i3 Verticals is a technology and payment processing company that provides integrated software and services across various sectors, including healthcare and the public sector, with a market capitalization of approximately $1.24 billion.

Operations: The company generates revenue primarily from the Public Sector and Healthcare segments, with recent figures showing $190.13 million and $47.16 million respectively. Over time, the gross profit margin has shown a notable increase, reaching 93.22% in September 2023 before slightly decreasing to 91.53% by December 2024. Operating expenses are significant, with General & Administrative expenses consistently being a major component of costs across periods analyzed.

PE: -9.7x

i3 Verticals, a smaller company in the U.S. market, recently reported first-quarter sales of US$61.69 million, up from US$55.05 million the previous year, with net income rising to US$2.06 million from US$1.1 million. Demonstrating insider confidence, Gregory Daily acquired 88,544 shares for over US$2.1 million between August and September 2024. The company reaffirms its revenue guidance for fiscal 2025 at US$243-263 million and continues exploring acquisitions in the public sector space to bolster growth prospects further.

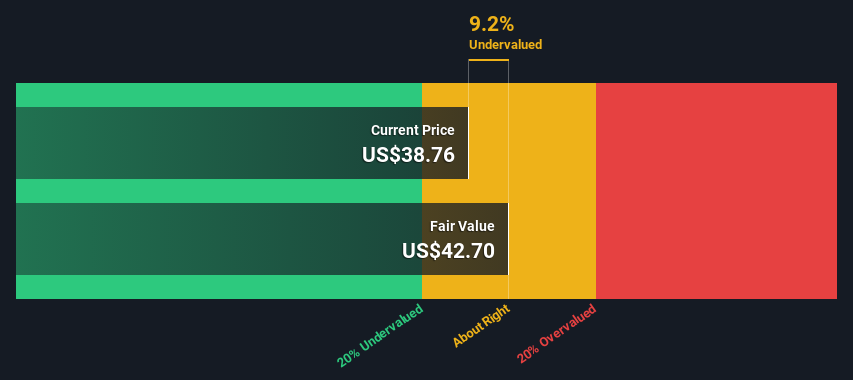

Ultra Clean Holdings (NasdaqGS:UCTT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ultra Clean Holdings specializes in providing critical subsystems, components, and services for the semiconductor capital equipment industry, with a market cap of approximately $1.81 billion.

Operations: Ultra Clean Holdings generates revenue primarily from its Products segment, contributing approximately $1.74 billion, and a smaller portion from Services at $239.2 million. The company's gross profit margin has shown fluctuations over the years, peaking at 20.21% in mid-2020 before declining to 16.95% by late 2023 and early 2024. Operating expenses have consistently impacted profitability, with significant allocations to General & Administrative and R&D expenses across periods analyzed.

PE: 467.6x

Ultra Clean Holdings, a smaller player in the U.S. market, is catching attention due to its potential for growth, with earnings projected to rise by 41.63% annually. Despite relying solely on external borrowing for funding, which carries higher risk, the company shows promise with insider confidence reflected in recent share purchases. The appointment of Joanne Solomon to the board adds seasoned financial leadership, potentially steering future strategies and enhancing value within its industry context.

- Get an in-depth perspective on Ultra Clean Holdings' performance by reading our valuation report here.

Gain insights into Ultra Clean Holdings' past trends and performance with our Past report.

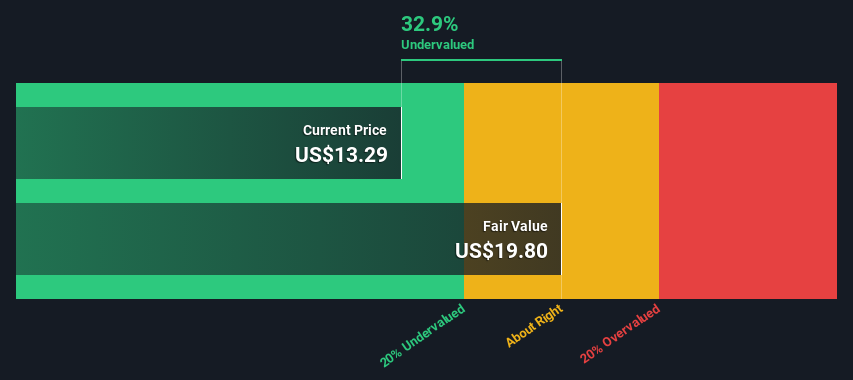

LendingClub (NYSE:LC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: LendingClub operates as a financial services company specializing in offering personal loans and other credit products, with a market capitalization of approximately $1.21 billion.

Operations: LendingClub generates revenue primarily through its lending activities, with a notable increase in gross profit margin from 2014 to 2025, peaking at 106.86% in mid-2015 before stabilizing around the 60% range by late 2024. The company incurs costs related to goods sold and operating expenses, including significant allocations towards sales and marketing as well as general and administrative expenses. Over time, net income has fluctuated but showed improvement with positive figures appearing consistently from late 2021 onwards.

PE: 29.8x

LendingClub, a smaller player in the financial sector, recently reported full-year net income of US$51.33 million for 2024, up from US$38.94 million the previous year. Despite facing higher risk due to reliance on external borrowing rather than customer deposits, they show promise with earnings projected to grow by 42% annually. Insider confidence is evident as insiders purchased shares in January 2025, indicating belief in future potential despite challenges like net charge-offs of US$45.98 million last quarter.

- Take a closer look at LendingClub's potential here in our valuation report.

Explore historical data to track LendingClub's performance over time in our Past section.

Taking Advantage

- Embark on your investment journey to our 49 Undervalued US Small Caps With Insider Buying selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if i3 Verticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IIIV

i3 Verticals

i3 Verticals, Inc. builds, acquires, and grows software solutions in the public sector and healthcare vertical markets in the United States and Canada.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives