- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Texas Instruments (TXN) Valuation Check After Recent Momentum Cools and Shares Drift Slightly Lower

Reviewed by Simply Wall St

Texas Instruments (TXN) has been drifting slightly lower this week, but the bigger story sits beneath the share price. Even with a modest pullback, the chipmaker’s multiyear returns still outpace the broader market.

See our latest analysis for Texas Instruments.

The recent pullback leaves Texas Instruments’ share price at $177.99, after an 11.71% 1 month share price return that has eased off and a more muted 1 year total shareholder return of negative 3 percent. This suggests momentum is cooling rather than accelerating.

If Texas Instruments’ steady but slowing trajectory has you thinking about what else is out there, this could be a smart moment to explore high growth tech and AI stocks.

With shares now sitting just below analyst targets, solid long term returns, and steady profit growth, investors face a familiar dilemma: is Texas Instruments quietly undervalued, or is the market already pricing in years of future gains?

Most Popular Narrative: 5.8% Undervalued

Compared with the last close at $177.99, the most widely followed narrative sees Texas Instruments’ fair value sitting modestly higher, hinting at upside driven by long term fundamentals rather than short term momentum.

Management is signaling that the benefits of recent U.S. tax incentives and R&D/capex expensing will materially lower future cash tax rates, bolstering free cash flow and enabling increased capital returns (dividends/buybacks), contributing to long term earnings per share expansion even in periods of muted sales growth.

Curious how tax savings, margin recovery, and a richer earnings base all feed into that higher valuation tag? Discover the precise growth and profitability path this narrative is betting on, and which future earnings multiple it assumes investors will still be willing to pay.

Result: Fair Value of $188.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained margin pressure from underutilized fabs or intensified competition in analog chips could quickly undermine the case for a steady, tax-fueled recovery.

Find out about the key risks to this Texas Instruments narrative.

Another View: Multiples Point to Richer Pricing

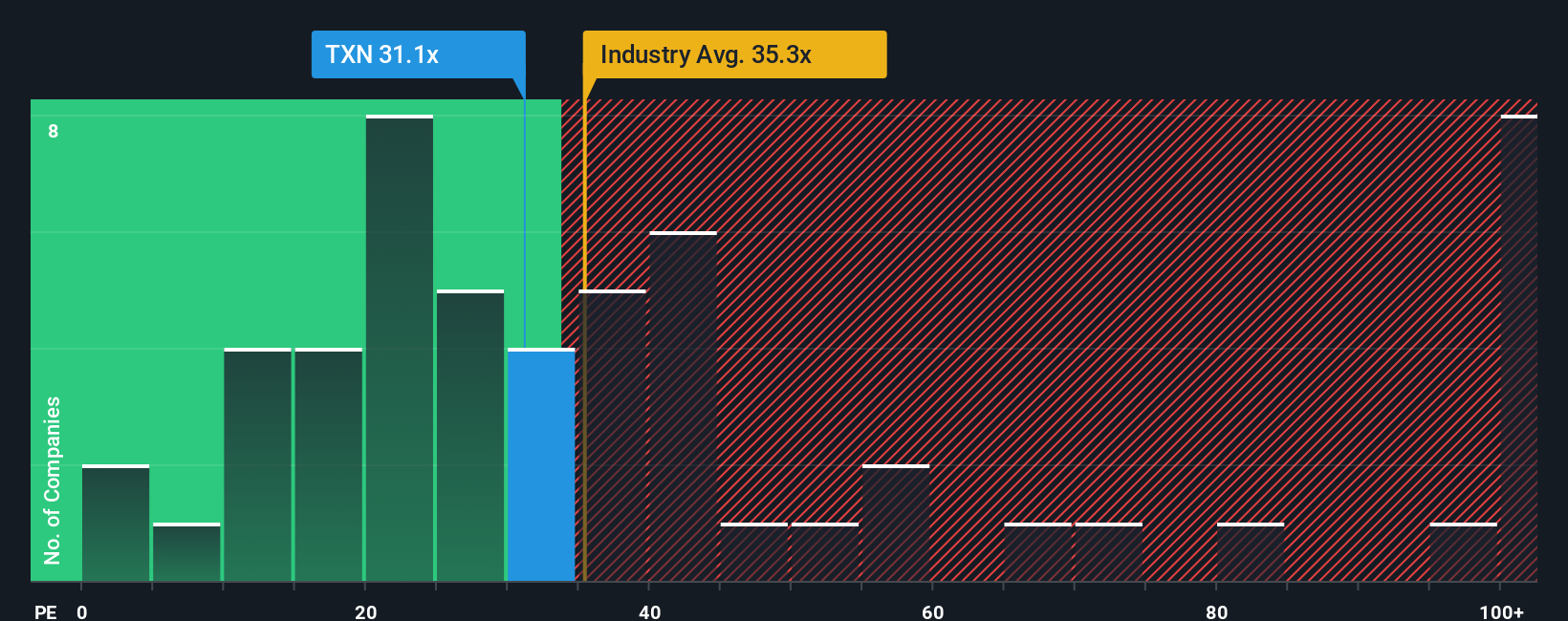

While the narrative based fair value suggests Texas Instruments is modestly undervalued, the price to earnings lens tells a different story. At 32.2 times earnings, the stock trades well above its own fair ratio of 28.9 times, even if it still looks cheaper than industry and peer averages.

This gap hints that investors may already be paying up for quality and stability, leaving less room for error if margins or growth disappoint from here. Is the premium simply the cost of safety, or a sign that expectations have drifted ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Texas Instruments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Texas Instruments Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized view in just minutes: Do it your way.

A great starting point for your Texas Instruments research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at Texas Instruments, you may miss out on other compelling setups, so let Simply Wall Street’s powerful screener surface fresh opportunities for you.

- Capture potential mispricings by targeting quality companies trading below intrinsic value through these 908 undervalued stocks based on cash flows and position yourself ahead of a possible sentiment reset.

- Capitalize on innovation trends by zeroing in on early stage innovators in artificial intelligence via these 26 AI penny stocks before the crowd fully catches on.

- Strengthen your income strategy by focusing on established payers in these 13 dividend stocks with yields > 3% and lock in yields that could support returns when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)