- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Texas Instruments (NasdaqGS:TXN) Announces US$60 Billion Investment in American Semiconductor Manufacturing

Reviewed by Simply Wall St

Texas Instruments (NasdaqGS:TXN) recently announced a substantial $60 billion investment to build seven semiconductor fabs in the U.S., aiming to strengthen domestic manufacturing and collaborate with companies like Ford, Medtronic, and NVIDIA. Over the last quarter, the company's stock price increased by 9%. This aligns closely with broader market trends, as both Texas Instruments and market indices have posted similar gains. This expansion and strategic collaborations could have added upward momentum in line with broader sector movements. The company's performance during such economic conditions underscored its resilience and potential for future growth.

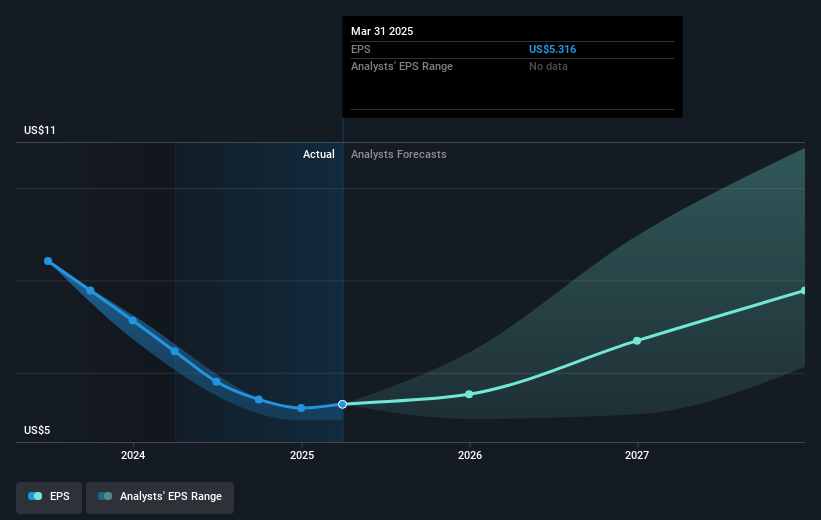

The recent announcement of Texas Instruments' US$60 billion investment to build semiconductor fabs in the U.S. alongside collaborations with industry leaders such as Ford, Medtronic, and NVIDIA could potentially bolster its revenue and earnings forecasts. Such investments are likely to enhance production capabilities and fortify the company's market position amidst recovering industrial and automotive demand. This strategic move may also catalyze revenue growth, though the pressure from geopolitical challenges and tariffs remains a risk to margins and profitability.

Over a five-year period, Texas Instruments' total shareholder return, including dividends, was 79.59%. This significant growth reflects the company's capacity to generate value, though it underperformed the U.S. market, which experienced a 9.8% return over the past year. Relative to the semiconductor industry, Texas Instruments' performance aligned more closely, reflecting a movement consistent with its peers in the previous year.

The current share price movement, reflecting a 9% increase over the last quarter, suggests positive market sentiment related to the company's expansion plans. However, the share price remains at a discount to the consensus analyst price target of US$180.76, with a noted share price discount of around 8.6%. This indicates the potential for further price adjustments as the company's plans materialize and market conditions evolve.

Learn about Texas Instruments' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)