- United States

- /

- Semiconductors

- /

- NasdaqGS:SMTC

Has Semtech’s 163% Three Year Surge Left Limited Upside at Today’s Price?

Reviewed by Bailey Pemberton

- If you are wondering whether Semtech at around $72.89 is still worth a closer look, or if the big money has already been made, you are in the right place to work out what the current price really implies.

- The stock has pulled back about 8.4% over the last week, but it is still up 7.8% over 30 days and 17.4% year to date, with a 163.1% gain over 3 years that naturally raises questions about what comes next.

- Recent moves have been driven by growing investor attention on Semtech's role in connectivity and high performance analog solutions, alongside renewed interest in semiconductor names tied to long term digital infrastructure themes. At the same time, sentiment has been swinging as the market reassesses which chip companies may be able to turn structural demand into durable cash flows rather than just cyclical spikes.

- Right now Semtech scores just 1/6 on our valuation checks, which suggests the market may already be pricing in a lot of optimism. In the sections that follow, we walk through different valuation approaches and then finish with a more holistic way to judge whether the current price really makes sense.

Semtech scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Semtech Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today, to reflect risk and the time value of money.

For Semtech, the latest twelve month Free Cash Flow is about $129.1 Million. Analysts expect this to grow steadily, with Simply Wall St using a 2 Stage Free Cash Flow to Equity model that blends analyst forecasts for the next few years with extrapolated growth thereafter. Under this approach, projected Free Cash Flow reaches roughly $503.4 Million by 2035, reflecting strong anticipated expansion in cash generation over the coming decade.

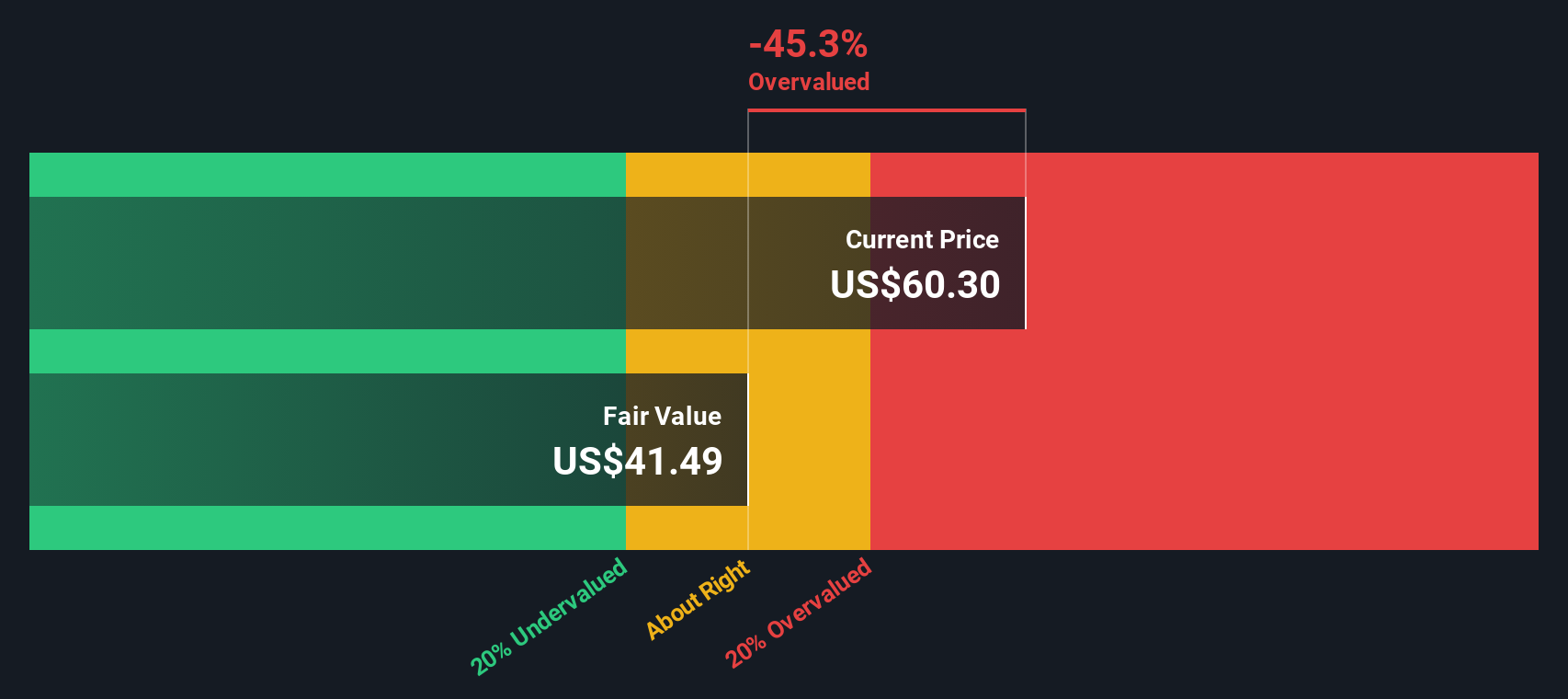

When all these future cash flows are discounted back to today in $, the model arrives at an estimated intrinsic value of about $47.16 per share. Compared to the recent share price around $72.89, this implies Semtech is roughly 54.6% overvalued on a pure cash flow basis. This suggests expectations embedded in the stock are already very optimistic.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Semtech may be overvalued by 54.6%. Discover 907 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Semtech Price vs Sales

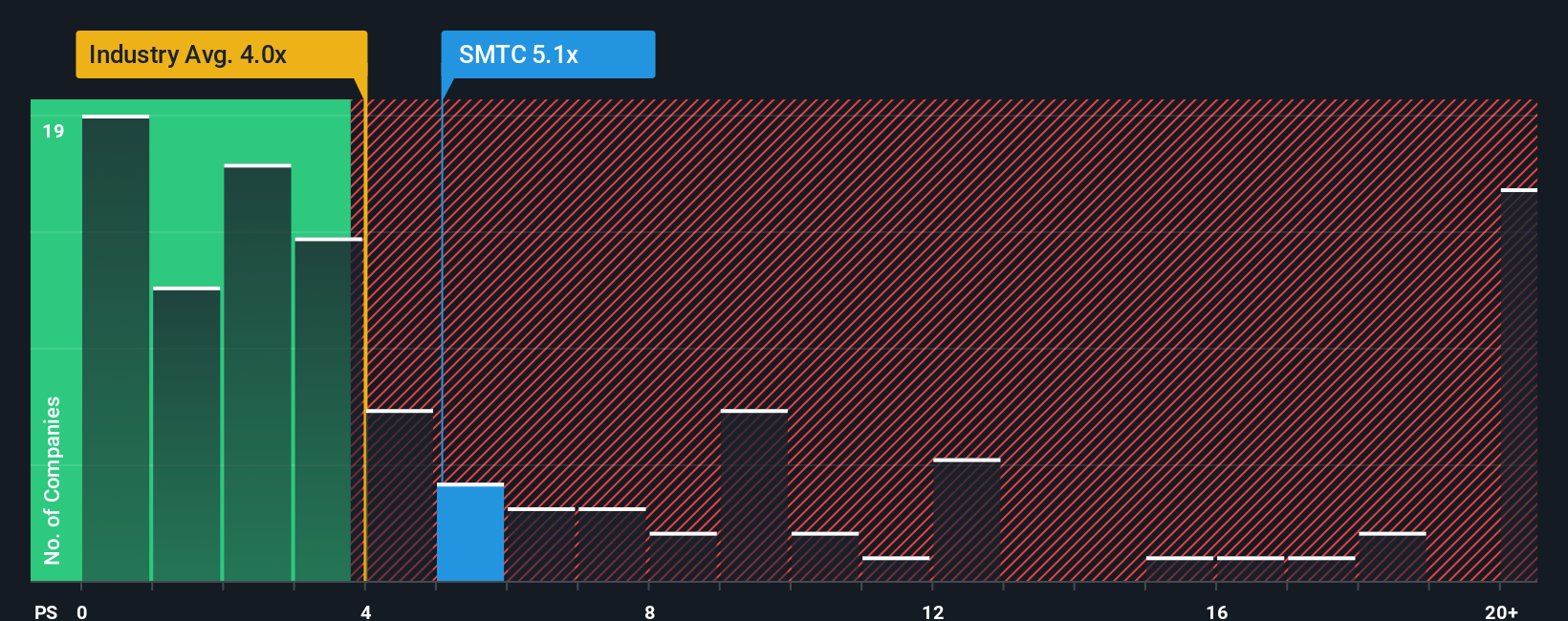

For companies that are still normalising profitability but already generating meaningful revenue, the price to sales ratio is often a useful yardstick. It sidesteps short term earnings volatility and focuses on how much investors are paying for each dollar of sales, which is especially relevant for semiconductor names investing heavily for growth.

In general, higher expected growth and lower perceived risk justify a higher normal price to sales multiple, while slower growth or higher uncertainty usually warrant a discount. Semtech currently trades on about 6.57x sales, slightly above the Semiconductor industry average of roughly 5.41x and broadly in line with a peer group average around 6.59x.

Simply Wall St’s proprietary Fair Ratio for Semtech is 6.42x. This represents the price to sales multiple the company might reasonably deserve once you factor in its growth outlook, profitability profile, market cap, risk characteristics and industry positioning. Because this Fair Ratio is tailored to Semtech’s own fundamentals, it provides a more nuanced benchmark than a simple comparison with peers or the wider industry. With the current 6.57x multiple sitting only marginally above the 6.42x Fair Ratio, the shares appear priced close to fair value on this measure.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Semtech Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page. It lets you turn your view of Semtech’s story into concrete numbers by connecting your assumptions about future revenue, earnings and margins to a fair value estimate. You can then compare that fair value with today’s price to decide whether you think the stock is a buy, hold or sell. Your view is automatically updated as new earnings or news arrives. For example, one investor might build a bullish Semtech Narrative that leans into accelerating data center and IoT demand, stronger margins and a fair value closer to $80 per share. Another might create a more cautious Narrative that stresses integration risks, margin pressure and a fair value nearer $53. By setting up or exploring these Narratives you can quickly see which story you agree with and what that implies for your next move.

Do you think there's more to the story for Semtech? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMTC

Semtech

Provides semiconductor, Internet of Things systems, and cloud connectivity service solutions in the Asia- Pacific, North America, and Europe.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)