- United States

- /

- Semiconductors

- /

- NasdaqGS:SMTC

Could Semtech’s (SMTC) Unified Software Platform Redefine Its Edge in IoT Connectivity?

- On November 12, 2025, Semtech Corporation announced its Unified Software Platform (USP) for LoRa Plus devices, enabling advanced multi-protocol support on a single hardware platform and eliminating the need for separate hardware variants for different wireless protocols.

- This platform streamlines deployment and manufacturing for clients by allowing flexible protocol selection while protecting software investments across hardware generations.

- We'll explore how Semtech's multi-protocol USP platform may bolster its position in IoT and connectivity solutions within the broader investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Semtech Investment Narrative Recap

To be a Semtech shareholder today, one must have conviction in the company’s ability to sustain growth by expanding its presence across connectivity, IoT, and high-value data center markets, while managing margin pressures and volatility in cyclical end-markets. The new Unified Software Platform (USP) addresses demand for multi-protocol solutions in IoT, potentially reinforcing market leadership; however, its impact on near-term gross margin headwinds appears limited, as mix-driven earnings risk remains a concern following the recent impairment charge.

Among recent announcements, the launch of Gen 4 LoRa transceivers in September 2025 closely aligns with the USP rollout, as both initiatives advance the LoRa portfolio and highlight the company’s push to broaden its IoT addressable market. Pairing the USP’s multi-protocol support with dedicated, cost-optimized hardware may help accelerate IoT adoption, though it does not mitigate margin dilution, which remains an active risk for Semtech’s near-term profitability story.

Yet, while the technology addresses industry challenges, investors should be aware that near-term risks, particularly the ongoing margin pressure from mix shifts and profitability in newer segments, ...

Read the full narrative on Semtech (it's free!)

Semtech's narrative projects $1.3 billion revenue and $253.1 million earnings by 2028. This requires 8.5% yearly revenue growth and a $229.3 million increase in earnings from $23.8 million today.

Uncover how Semtech's forecasts yield a $71.86 fair value, in line with its current price.

Exploring Other Perspectives

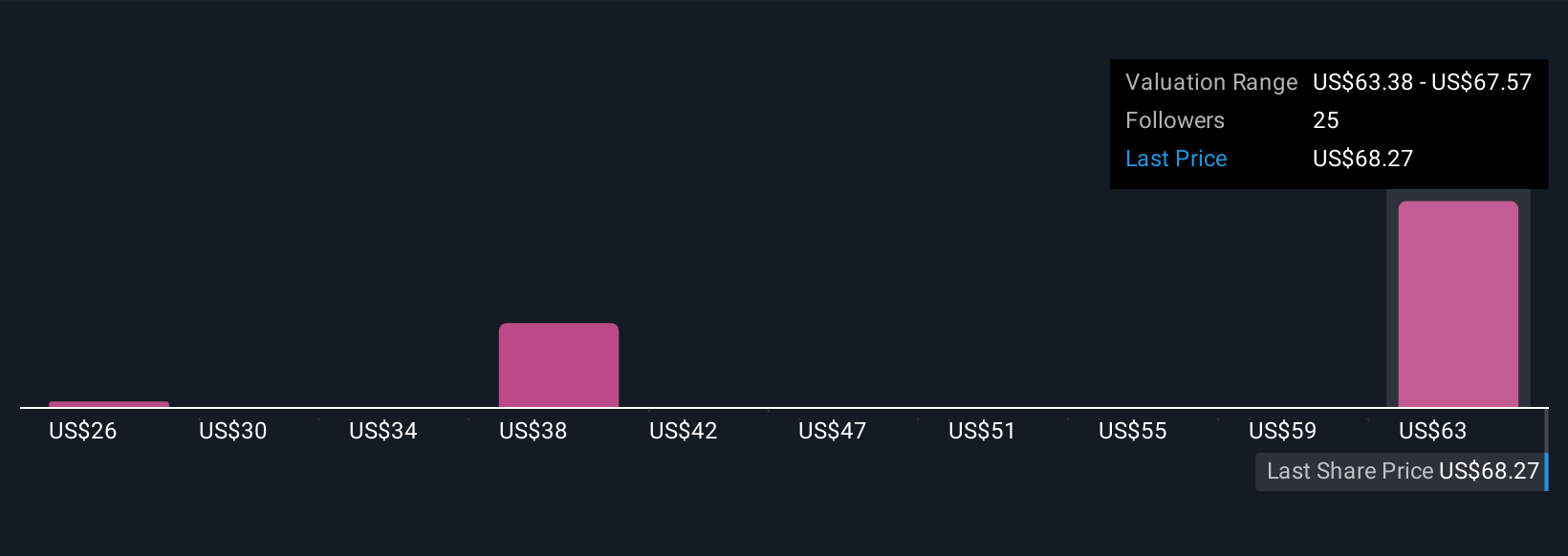

Five Simply Wall St Community fair value estimates for Semtech range from US$25.69 to US$71.86 per share, reflecting wide-ranging expectations. While some see upside, ongoing gross margin pressures remain a key risk to monitor as the business expands its IoT offerings.

Explore 5 other fair value estimates on Semtech - why the stock might be worth as much as $71.86!

Build Your Own Semtech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Semtech research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Semtech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Semtech's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMTC

Semtech

Provides semiconductor, Internet of Things systems, and cloud connectivity service solutions in the Asia- Pacific, North America, and Europe.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Wolters Kluwer - A Fundamental and Historical Valuation

METHODE ELECTRONICS (MEI): A Short Circuit or Just a Blown Fuse?

Titan Cement International S.A. (TITC.AT): Greece's Leading Cement and Building Materials Producer

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!