- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

Assessing ON Semiconductor (ON) Valuation After Its Recent Share Price Rebound

Reviewed by Simply Wall St

Why ON Semiconductor stock is back on investors radar

ON Semiconductor (ON) has quietly put together a solid run, with the stock up roughly 16% over the past month even though it is still down for the year.

See our latest analysis for ON Semiconductor.

That recent 15.6% 1 month share price return has started to chip away at ON Semiconductor’s 9.3% year to date share price decline. However, the 1 year total shareholder return of negative 16.6% shows sentiment is only tentatively improving.

If this rebound has you thinking about where else momentum and earnings power might be lining up, it is worth scanning high growth tech and AI stocks for other potential semiconductor and chip adjacent opportunities.

With shares still below last year’s levels despite solid revenue and profit growth, investors face a key question: is ON Semiconductor quietly undervalued after a tough stretch, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 5% Undervalued

With ON Semiconductor last closing at $55.97 against a narrative fair value of $58.70, the story leans modestly positive on future upside potential.

The analysts have a consensus price target of $57.533 for ON Semiconductor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $40.0.

Curious how relatively modest revenue growth assumptions can still support a step change in profitability and valuation multiples over time? The narrative focuses on sharply improving margins, a powerful earnings ramp and a future earnings multiple that looks very different from today. Want to see exactly how those pieces add up to that fair value target? Read on and unpack the full set of projections behind this call.

Result: Fair Value of $58.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent manufacturing underutilization and intensifying competition in EV silicon carbide and image sensing could delay the expected margin expansion and earnings ramp.

Find out about the key risks to this ON Semiconductor narrative.

Another View on Valuation

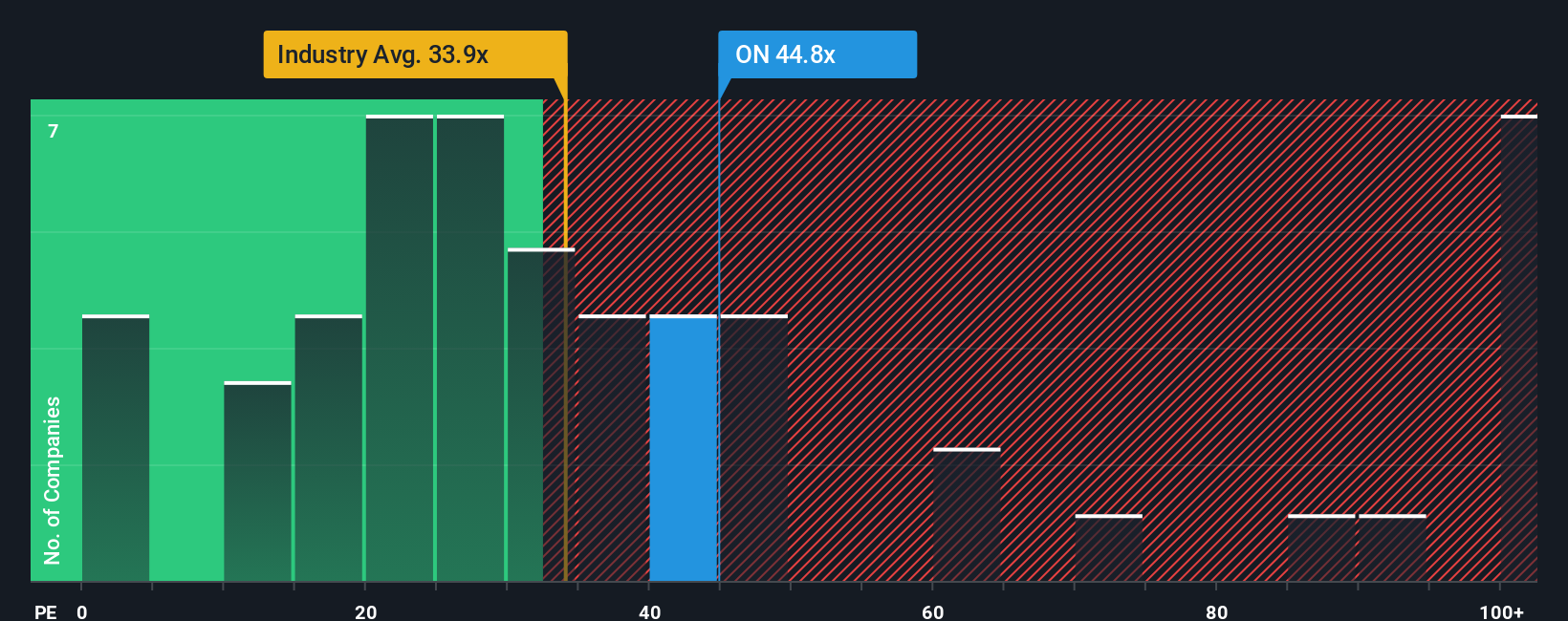

While the narrative suggests modest upside, the current price to earnings ratio of 70.6x looks demanding next to the US Semiconductor industry at 38x, peers at 36.1x, and even the 58x fair ratio our models point to. That premium narrows the margin of safety, so what exactly is the market paying up for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ON Semiconductor Narrative

If you are not fully convinced by this view or simply prefer to dig into the numbers yourself, you can quickly build a custom story in just a few minutes: Do it your way.

A great starting point for your ON Semiconductor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put the momentum from ON Semiconductor to work by scanning targeted stock ideas that could sharpen your next investing move.

- Capture early-stage potential by reviewing these 3605 penny stocks with strong financials that already back their stories with solid fundamentals and financial resilience.

- Ride structural growth trends by focusing on these 30 healthcare AI stocks using data, automation and diagnostics to reshape how medicine is delivered.

- Strengthen your income stream by assessing these 12 dividend stocks with yields > 3% that may help support long term returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in Hong Kong, Singapore, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion