- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

A Fresh Look at ON Semiconductor's Valuation After New U.S. Tariff Plans Announced

Reviewed by Simply Wall St

ON Semiconductor (ON) just found itself at the center of the headlines, thanks to President Donald Trump’s announcement of substantial new tariffs on imported semiconductors. The twist is that companies with U.S.-based manufacturing or plans to invest domestically are exempt. This carve-out brings ON Semiconductor’s operational model sharply into focus. For investors, this is more than just a policy update as it raises immediate questions about ON’s cost structure and future pricing power if these tariffs become reality.

The stock has already been through a volatile run this year. After a tough twelve months that saw shares fall nearly 29%, ON Semiconductor has bounced by just over 3% in the past month. Major swings like these suggest the market is wrestling with shifting expectations, especially as the chip sector digests ongoing trade uncertainties and ON works to find its footing amid evolving global supply chains.

Given recent turbulence and this new policy blow, is ON Semiconductor now a bargain hiding in plain sight, or has the market already factored in all these future risks and rewards?

Most Popular Narrative: 14.8% Undervalued

According to the most widely followed narrative, ON Semiconductor is currently undervalued by nearly 15%. The valuation relies on major industry shifts and strategic positioning that analysts believe can drive future earnings and margins substantially higher.

"The company's strategic investments in silicon carbide (SiC), wide bandgap technologies, and advanced power management solutions for both automotive and AI data centers position it at the forefront of key structural growth markets. As these high-value products ramp, they are expected to enhance margins and drive long-term earnings growth."

What is fueling this optimistic outlook? There is a bold roadmap betting on stacked recurring revenues, significant increases in profits, and a future multiple that suggests premium status among peers. Want to see which standout assumptions about ON’s financial trajectory justify that striking fair value? The narrative’s summary is packed with projections that are drawing a lot of attention.

Result: Fair Value of $57.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent manufacturing underutilization and increased competition in EV and AI silicon carbide could easily derail this bullish outlook for ON Semiconductor.

Find out about the key risks to this ON Semiconductor narrative.Another View: What About the Market Multiple?

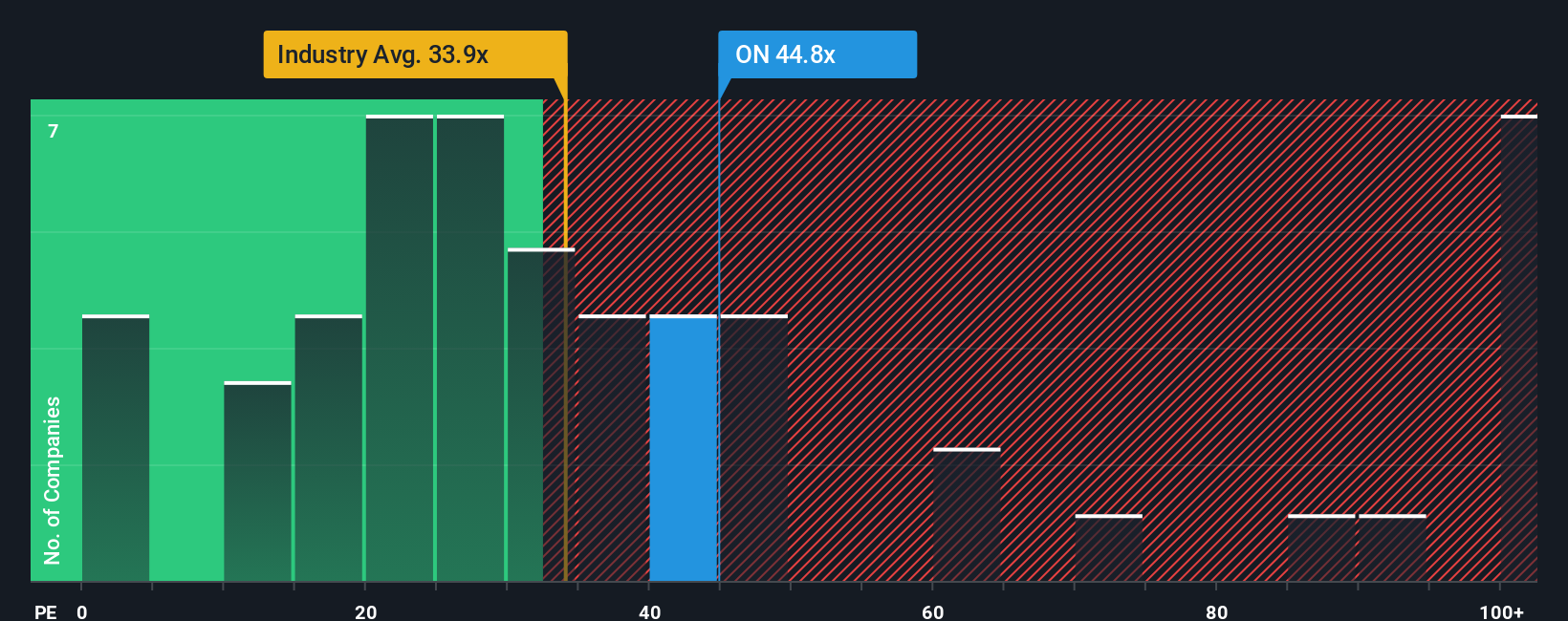

Looking from a different angle, the market's leading comparison ratio tells a different story. According to this method, ON Semiconductor appears a bit expensive compared to its industry. So, is the premium justified by growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ON Semiconductor Narrative

If you’re not convinced by these perspectives or want to test your own assumptions, you can dive into the numbers and craft a narrative yourself in just a few minutes. Do it your way.

A great starting point for your ON Semiconductor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t limit yourself to just one stock when there are standout opportunities waiting to be uncovered. Sharpen your strategy with these handpicked ideas before the rest of the market catches on.

- Spot undervalued gems with real growth potential when you check out undervalued stocks based on cash flows.

- Unlock the future of medicine by tapping into breakthroughs from pioneering innovators in healthcare AI stocks.

- Shape your portfolio with tomorrow’s technology by sifting through companies driving advances in quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in Hong Kong, Singapore, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)