- United States

- /

- Auto Components

- /

- NasdaqGS:MBLY

3 Stocks Estimated To Be Up To 48.5% Below Intrinsic Value

Reviewed by Simply Wall St

The United States stock market has experienced a significant surge, with major indices like the Dow Jones Industrial Average and the Nasdaq Composite climbing sharply following an easing of trade tensions between the U.S. and China. As investors navigate these buoyant market conditions, identifying undervalued stocks becomes crucial for those looking to capitalize on potential growth opportunities that may arise from current economic developments.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $56.71 | $111.26 | 49% |

| KBR (NYSE:KBR) | $55.20 | $108.72 | 49.2% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.30 | $18.49 | 49.7% |

| HealthEquity (NasdaqGS:HQY) | $90.40 | $179.14 | 49.5% |

| Arrow Financial (NasdaqGS:AROW) | $26.13 | $51.19 | 49% |

| Verra Mobility (NasdaqCM:VRRM) | $24.19 | $48.21 | 49.8% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | $424.99 | $822.82 | 48.3% |

| Mobileye Global (NasdaqGS:MBLY) | $16.30 | $31.64 | 48.5% |

| Nutanix (NasdaqGS:NTNX) | $75.10 | $145.13 | 48.3% |

| Pursuit Attractions and Hospitality (NYSE:PRSU) | $28.92 | $57.16 | 49.4% |

Let's review some notable picks from our screened stocks.

Mobileye Global (NasdaqGS:MBLY)

Overview: Mobileye Global Inc. develops and deploys advanced driver assistance systems and autonomous driving technologies worldwide, with a market cap of approximately $13.24 billion.

Operations: The company's revenue primarily comes from its advanced driver assistance systems and autonomous driving technologies, totaling $1.81 billion.

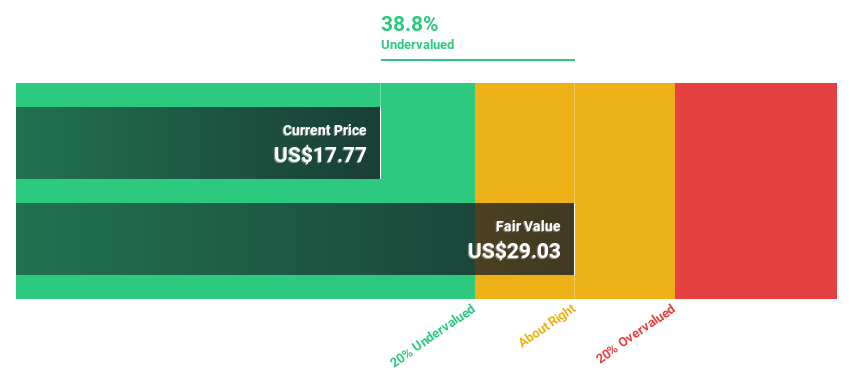

Estimated Discount To Fair Value: 48.5%

Mobileye Global is trading at US$16.30, significantly below its estimated fair value of US$31.64, suggesting it might be undervalued based on cash flows. The company's revenue growth forecast of 16.8% annually outpaces the broader U.S. market's 8.4%. Despite recent executive resignations, strategic alliances like the one with Volkswagen for advanced driver assistance systems could bolster future prospects as Mobileye aims to become profitable within three years.

- Upon reviewing our latest growth report, Mobileye Global's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Mobileye Global.

ON Semiconductor (NasdaqGS:ON)

Overview: ON Semiconductor Corporation offers intelligent sensing and power solutions globally, with a market cap of approximately $17.12 billion.

Operations: The company's revenue is derived from three main segments: Power Solutions Group ($3.12 billion), Intelligent Sensing Group ($1.07 billion), and Analog & Mixed-Signal Group ($2.48 billion).

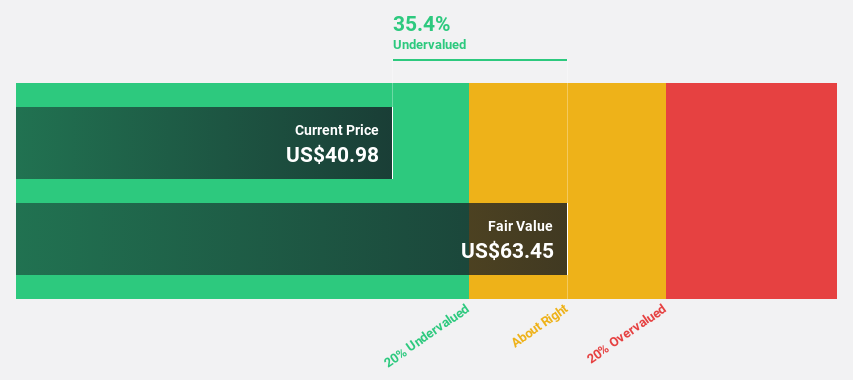

Estimated Discount To Fair Value: 35.4%

ON Semiconductor, trading at US$40.98, is significantly below its estimated fair value of US$63.45, indicating potential undervaluation based on cash flows. Despite a recent net loss of US$486.1 million for Q1 2025 and declining profit margins compared to last year, the company forecasts substantial earnings growth of 33.8% annually over the next three years, outpacing the U.S. market's average growth rate and highlighting its strong future profit potential amidst slower revenue growth projections.

- The growth report we've compiled suggests that ON Semiconductor's future prospects could be on the up.

- Navigate through the intricacies of ON Semiconductor with our comprehensive financial health report here.

Renasant (NYSE:RNST)

Overview: Renasant Corporation is a bank holding company for Renasant Bank, offering financial, wealth management, fiduciary, and insurance services to retail and commercial clients, with a market cap of approximately $3.22 billion.

Operations: Renasant's revenue is primarily driven by its Community Banks segment, generating $708.08 million, complemented by $27.37 million from Wealth Management services.

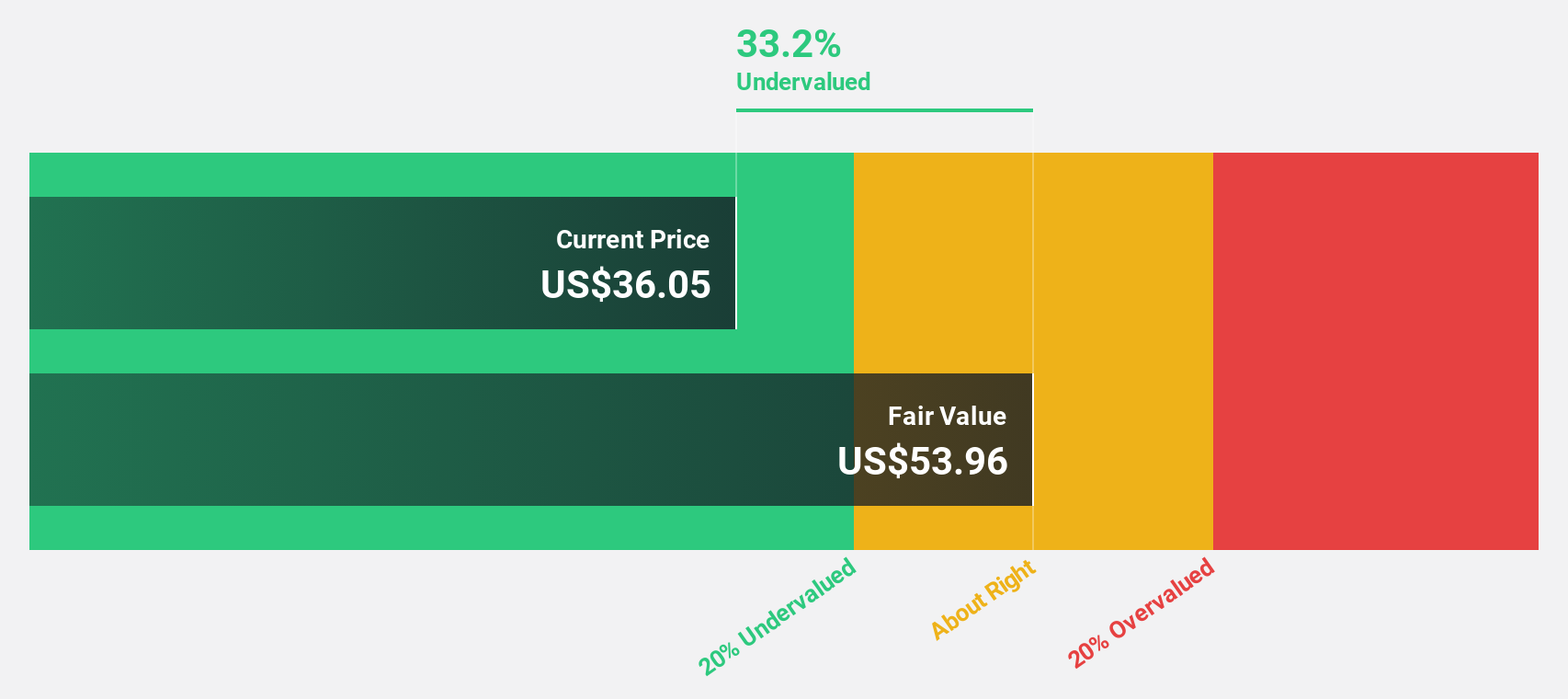

Estimated Discount To Fair Value: 39.8%

Renasant, trading at US$33.9, is valued significantly below its estimated fair value of US$56.28, suggesting an undervaluation based on cash flows. With projected annual earnings growth of 32.41% and revenue growth of 23.7%, both surpassing U.S. market averages, the company shows strong future potential despite recent shareholder dilution and no share buybacks in Q1 2025. Leadership changes with Kevin D. Chapman as CEO may influence strategic direction positively.

- Our earnings growth report unveils the potential for significant increases in Renasant's future results.

- Get an in-depth perspective on Renasant's balance sheet by reading our health report here.

Summing It All Up

- Delve into our full catalog of 172 Undervalued US Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MBLY

Mobileye Global

Develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives