- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

NXP Semiconductors (NXPI): Exploring Valuation After Trade War Fears Ease and Shares Rebound

Reviewed by Kshitija Bhandaru

After a turbulent stretch driven by tariff threats and supply chain concerns, NXP Semiconductors (NasdaqGS:NXPI) saw its stock bounce back as the United States softened its tone on trade with China.

See our latest analysis for NXP Semiconductors.

After a rollercoaster week driven by shifting trade rhetoric, NXP Semiconductors' share price staged a robust recovery as trade war concerns cooled and investors grew more optimistic about the sector’s near-term outlook. While the recent one-day share price jump of 5.5% signals renewed momentum, the year’s total shareholder return is still down 9.3%, which serves as a reminder of the volatility that has persisted despite promising growth over the past three and five years.

If you’re curious where else positive momentum is emerging in tech, consider it a perfect moment to discover See the full list for free.

This back-and-forth leaves investors facing a key question. Given the recent volatility and improving sentiment, is NXP Semiconductors undervalued right now, or has the market already priced in all of its potential growth?

Most Popular Narrative: 16% Undervalued

NXP Semiconductors' most widely followed narrative sets a fair value of $258.19, a considerable premium versus the latest close of $216.70. With a fair value noticeably above the market price, this perspective frames NXP as offering solid upside driven by sector catalysts.

A major catalyst is the normalization of automotive Tier 1 inventory levels in Western markets, which is ending after several quarters of being a growth headwind. As NXP can now ship directly to natural end demand, instead of customers burning through old inventory, this transition is expected to drive higher automotive revenues and better earnings visibility through the next several quarters.

Want a glimpse at the aggressive growth thesis behind this optimistic target? The narrative hinges on a blend of sector-defining trends, strategic wins, and striking financial projections. Consider margin expansion, market share gains, and a forward multiple that diverges from industry norms. Which levers drive this bullish fair value? Tap into the full breakdown to see how it all adds up.

Result: Fair Value of $258.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if demand recovery stalls or if competition in China intensifies, NXP's growth outlook and margin expansion could quickly come under pressure.

Find out about the key risks to this NXP Semiconductors narrative.

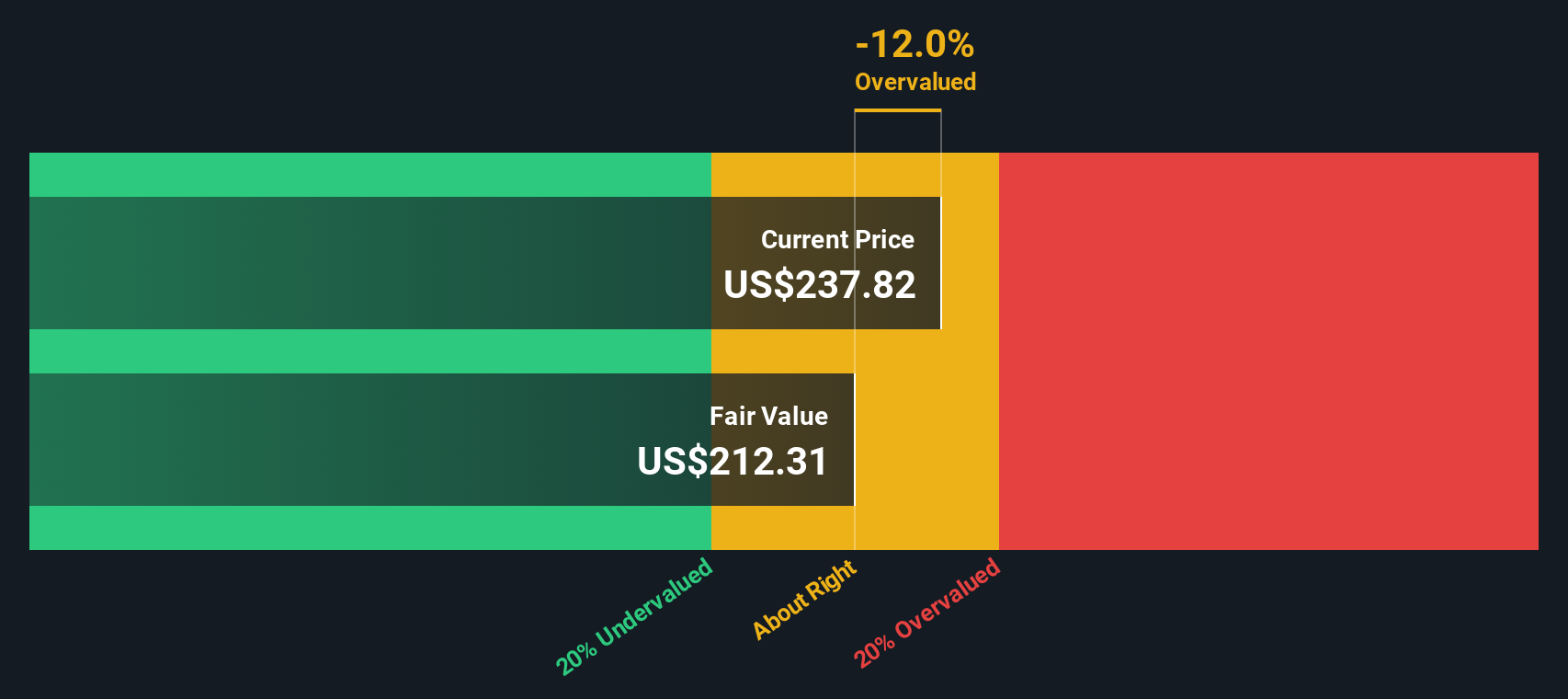

Another View: SWS DCF Model Suggests Slight Overvaluation

Looking at NXP Semiconductors using our DCF model, the share price of $216.70 is currently above our estimated fair value of $209.19. This approach suggests the company may be slightly overvalued at the moment, which introduces a different kind of risk for investors compared to the more optimistic analyst forecasts. Which method should carry more weight in your research?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NXP Semiconductors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NXP Semiconductors Narrative

If these perspectives do not quite fit your view, why not dive into the numbers yourself? In just a few minutes, you can build your own take on NXP Semiconductors. Do it your way

A great starting point for your NXP Semiconductors research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Want to give yourself a real investing edge? Skip the noise and use screener picks trusted by experienced investors, before the rest of the market catches on.

- Accelerate your search for tomorrow's breakout names by targeting these 3579 penny stocks with strong financials primed for rapid growth and bold financial health.

- Supercharge your portfolio with innovation by focusing on these 25 AI penny stocks making waves in artificial intelligence breakthroughs and industry disruption.

- Maximize value and limit downside by handpicking from these 891 undervalued stocks based on cash flows, where companies are trading for less than their projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives