- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

Can NXP Semiconductors' (NXPI) Thought Leadership in AI Events Bolster Its Competitive Edge?

Reviewed by Sasha Jovanovic

- NXP Semiconductors participated in two key industry events in early October, presenting at AutoSens Europe 2025 in Barcelona and the 17th Annual Silicon Valley C-Level Technology Leadership Summit in California with senior executives sharing insights on evolving automotive and semiconductor trends.

- These appearances coincide with a period of renewed investor interest in the AI sector and come ahead of NXP's anticipated third-quarter earnings release later this month, highlighting the company's role in automotive innovation and its connection to broader market optimism around artificial intelligence-driven demand.

- We'll examine how NXP's thought leadership at major conferences may influence its investment narrative amid anticipation for AI sector growth.

Find companies with promising cash flow potential yet trading below their fair value.

NXP Semiconductors Investment Narrative Recap

Being a shareholder in NXP Semiconductors means believing in the long-term demand for automotive and industrial semiconductors, especially as new vehicle platforms and edge AI drive growth. While recent AI sector optimism and NXP’s conference appearances may strengthen the investment narrative, analysts expect a slight earnings decline in Q3, with end-market recovery and competitive pressures in China remaining the most important short-term catalyst and risk, respectively. These latest events do not materially change that assessment.

Of NXP’s recent announcements, the upcoming third-quarter earnings release on October 27 stands out, as it will provide concrete data on the pace of automotive recovery and validate whether improving investor sentiment around AI translates to better results. The numbers will give insight into both margin trends and the company’s ability to capitalize on direct demand following inventory normalization in Western markets.

However, investors should be aware that amid these positives, competitive pressures in the Chinese automotive market remain...

Read the full narrative on NXP Semiconductors (it's free!)

NXP Semiconductors' narrative projects $15.5 billion revenue and $3.5 billion earnings by 2028. This requires 8.7% yearly revenue growth and a $1.4 billion earnings increase from $2.1 billion today.

Uncover how NXP Semiconductors' forecasts yield a $258.19 fair value, a 26% upside to its current price.

Exploring Other Perspectives

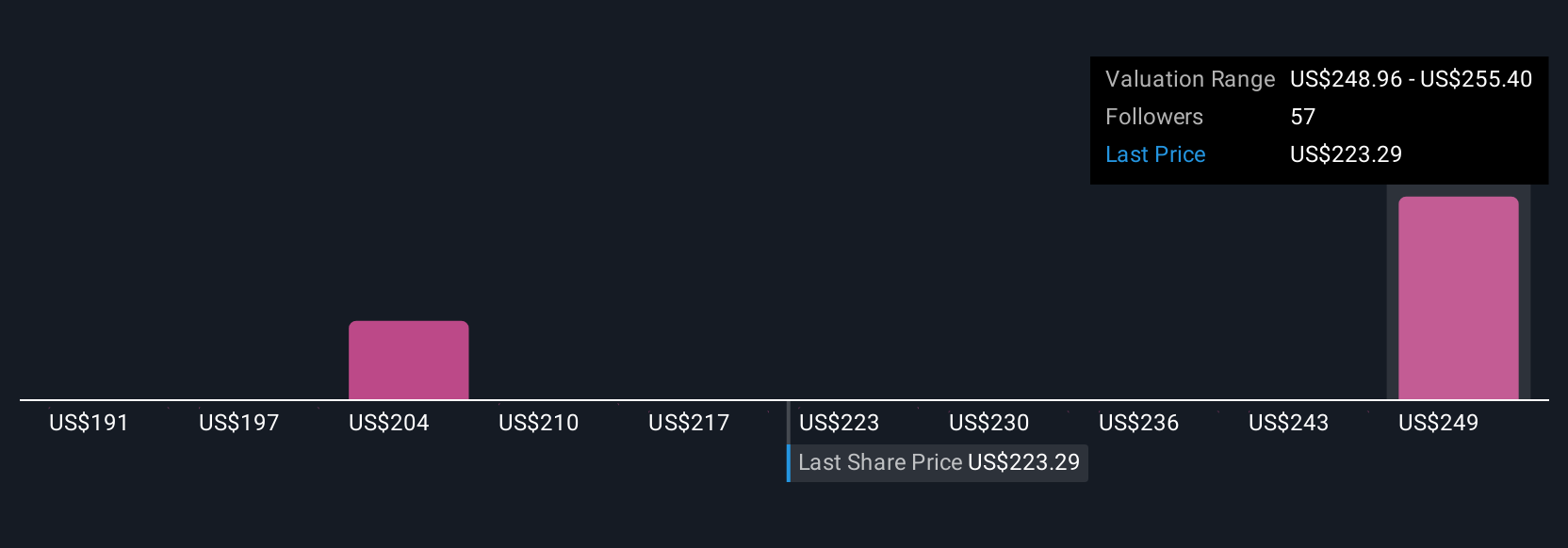

Simply Wall St Community members posted 11 fair value estimates for NXP, spanning from US$187.08 to US$294.09 per share. Despite this broad spread of opinions, the key question remains whether inventory normalization in automotive can support the sustained revenue growth expected by many in the market.

Explore 11 other fair value estimates on NXP Semiconductors - why the stock might be worth 9% less than the current price!

Build Your Own NXP Semiconductors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NXP Semiconductors research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NXP Semiconductors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NXP Semiconductors' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives