- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

Nova Ltd. (NASDAQ:NVMI) Shares May Have Slumped 28% But Getting In Cheap Is Still Unlikely

Nova Ltd. (NASDAQ:NVMI) shares have had a horrible month, losing 28% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 46% in the last year.

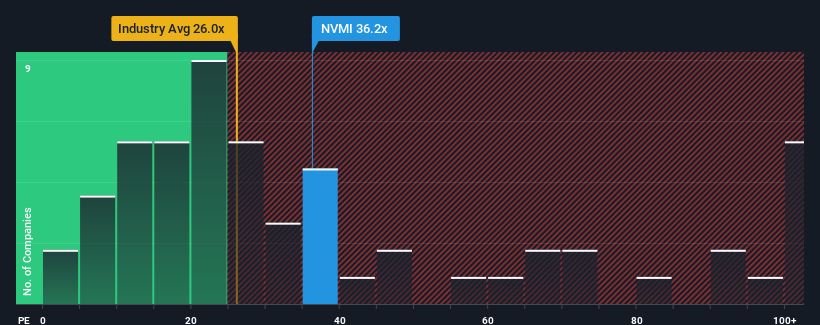

Even after such a large drop in price, Nova's price-to-earnings (or "P/E") ratio of 36.2x might still make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 17x and even P/E's below 10x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Nova's negative earnings growth of late has neither been better nor worse than most other companies. One possibility is that the P/E is high because investors think the company can turn things around and break free from the broader downward trend in earnings. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Nova

Is There Enough Growth For Nova?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Nova's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 2.2% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 150% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 9.7% per year as estimated by the six analysts watching the company. That's shaping up to be similar to the 10% per year growth forecast for the broader market.

In light of this, it's curious that Nova's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

Even after such a strong price drop, Nova's P/E still exceeds the rest of the market significantly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Nova currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Nova with six simple checks.

If these risks are making you reconsider your opinion on Nova, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Nova, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVMI

Nova

Designs, develops, produces, and sells process control systems used in the manufacture of semiconductors in Israel, Taiwan, the United States, China, Korea, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives