- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

Could Nova’s (NVMI) ELIPSON Win Signal a Competitive Edge in Next-Generation Chip Manufacturing?

Reviewed by Sasha Jovanovic

- Nova recently announced that its ELIPSON materials metrology solution was selected as Tool of Record by a leading global foundry for advanced Gate-All-Around (GAA) manufacturing, with multiple ELIPSON tools already delivered for high-volume production processes.

- This achievement highlights increased industry adoption of Nova's non-destructive, nanoscale material characterization technology for next-generation semiconductor fabrication and further establishes Nova’s presence within advanced logic node production.

- We will examine how Nova’s ELIPSON selection by a major foundry may shift the company’s investment narrative and growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Nova Investment Narrative Recap

To be a Nova shareholder, you need to believe that accelerating semiconductor complexity and global investments in new manufacturing capacity will continue driving demand for advanced metrology solutions. The latest ELIPSON selection by a top foundry strengthens Nova's credibility as a technology leader and underpins its key catalyst, winning new “tool of record” status in advanced nodes, but also highlights an ongoing risk: revenue remains concentrated among a few major customers, so shifts in customer spending can still create near-term earnings volatility.

Nova’s earlier announcement that its METRION platform was selected by a major memory manufacturer for both R&D and high-volume production adds momentum to the ELIPSON win. Together, these events underline growing customer acceptance across logic and memory, helping reinforce the narrative that Nova’s new platforms can convert “lab-to-fab” and diversify revenue streams at a time of rapid technological change.

However, if even one of Nova’s key customers delays CapEx or shifts its roadmap...

Read the full narrative on Nova (it's free!)

Nova's outlook anticipates $1.1 billion in revenue and $293.1 million in earnings by 2028. Achieving this would require 9.8% annual revenue growth and a $58.2 million increase in earnings from the current $234.9 million level.

Uncover how Nova's forecasts yield a $306.67 fair value, in line with its current price.

Exploring Other Perspectives

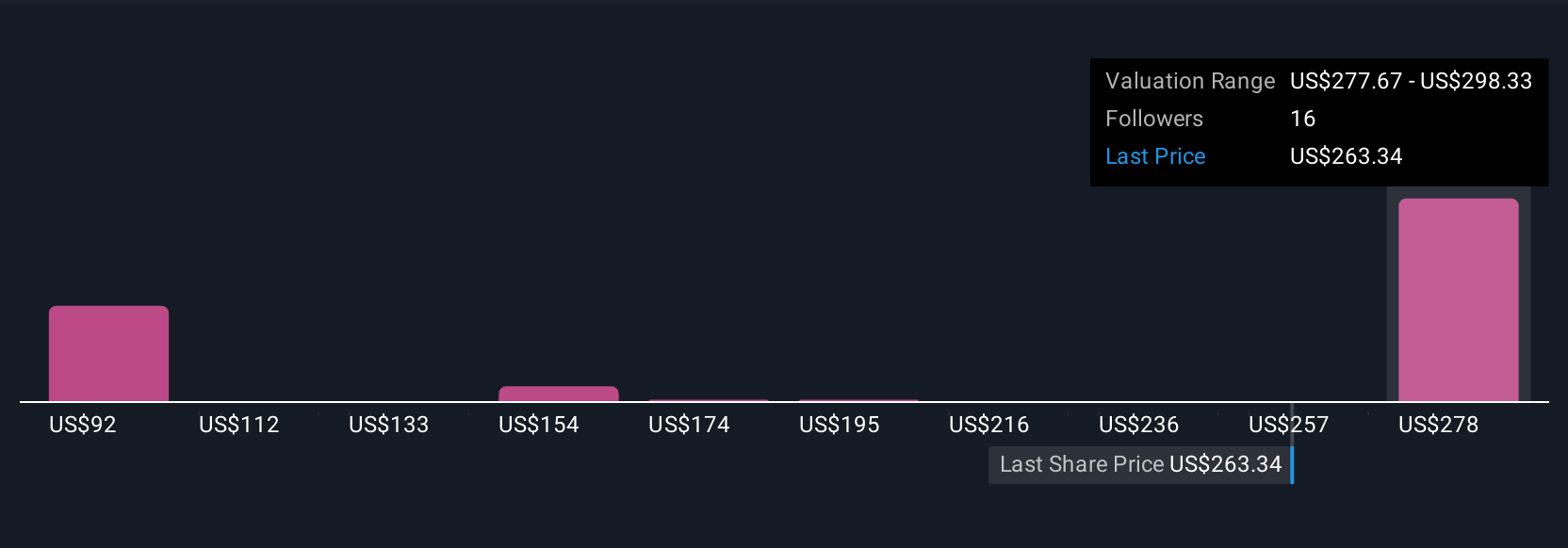

Private investors in the Simply Wall St Community estimated a wide range of fair values, from US$91 to US$307, across 6 perspectives. With customer concentration remaining a critical risk, comparing these diverse viewpoints can be essential for understanding potential outcomes for Nova’s performance.

Explore 6 other fair value estimates on Nova - why the stock might be worth as much as $306.67!

Build Your Own Nova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nova research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Nova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nova's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVMI

Nova

Engages in the design, development, production, and sells of process control systems used in the manufacture of semiconductors in Taiwan, the United States, China, Korea, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives