- United States

- /

- Banks

- /

- NasdaqCM:BCAL

US Undiscovered Gems Top Stocks for October 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with major indices like the S&P 500 and Nasdaq recently reaching new highs before a slight pullback, investors are navigating a complex landscape shaped by economic indicators and broader market sentiment. In this environment, identifying promising small-cap stocks requires careful consideration of their growth potential, resilience in volatile conditions, and alignment with emerging trends that can drive future performance.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

California BanCorp (BCAL)

Simply Wall St Value Rating: ★★★★★★

Overview: California BanCorp operates as the bank holding company for California Bank of Commerce, N.A., with a market capitalization of $557.35 million.

Operations: California BanCorp generates revenue primarily from its Commercial Banking segment, amounting to $157.67 million. The company's financial performance is influenced by its net profit margin, which reflects the efficiency of its operations and cost management strategies.

California BanCorp, with assets of US$4 billion and equity of US$547.6 million, stands out for its robust financial health. Total deposits reach US$3.3 billion against loans of US$3 billion, reflecting a solid balance sheet structure. The bank maintains an appropriate level of bad loans at 0.6% and has a sufficient allowance for these at 224%. Earnings growth over the past year was impressive at 94%, surpassing industry averages despite a one-off loss of US$16.3 million impacting recent results. With liabilities primarily funded through low-risk customer deposits, it offers a promising outlook in the banking sector.

- Click here to discover the nuances of California BanCorp with our detailed analytical health report.

NVE (NVEC)

Simply Wall St Value Rating: ★★★★★★

Overview: NVE Corporation specializes in developing and selling spintronics-based devices for information acquisition, storage, and transmission, with a market cap of $331.06 million.

Operations: The company generates revenue primarily from its electronic components and parts segment, totaling $25.20 million.

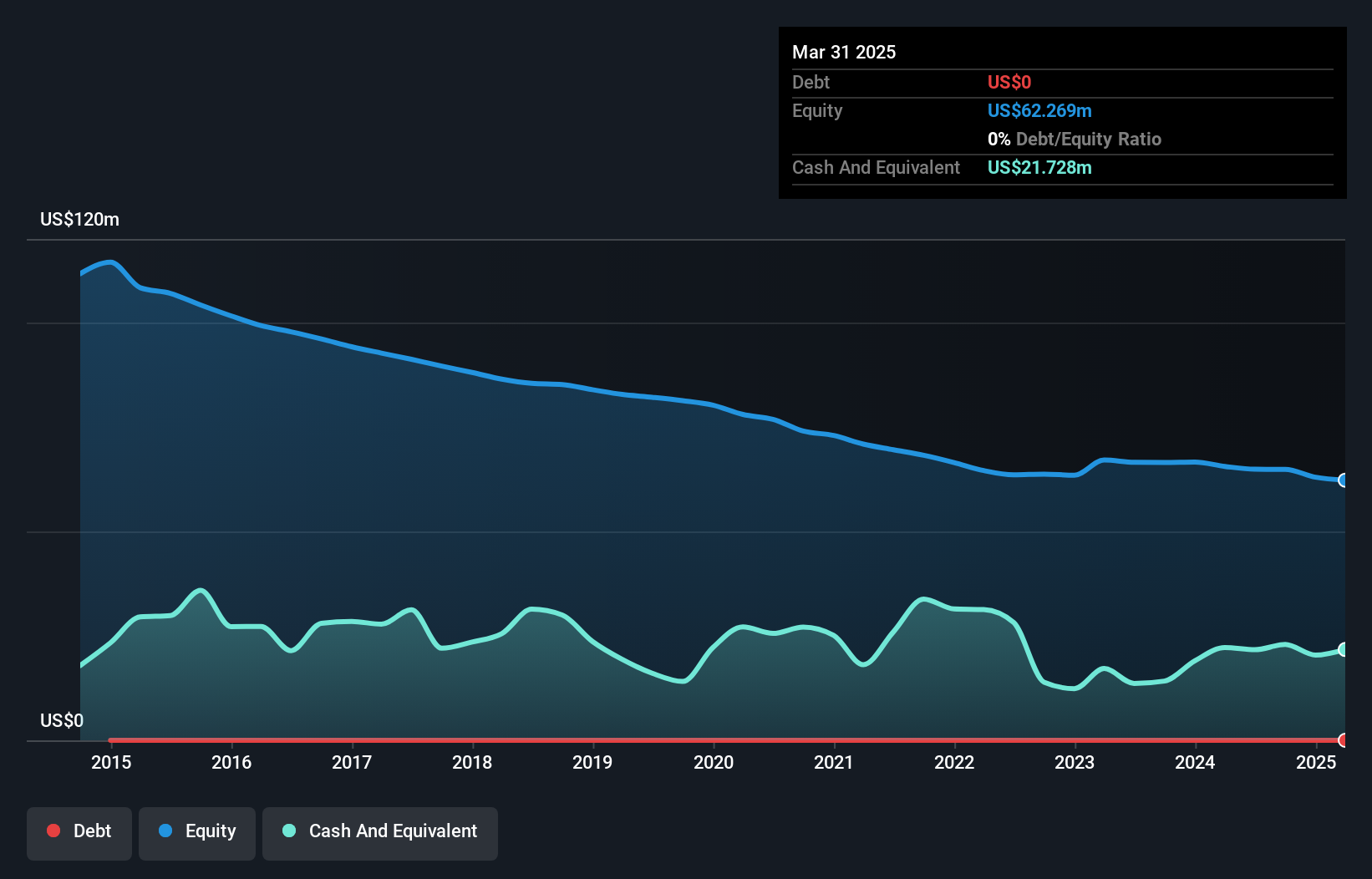

NVE Corporation, a nimble player in the semiconductor space, operates with no debt and boasts high-quality earnings. Despite recent challenges, including a 13.5% dip in earnings growth over the past year compared to an industry average of -0.7%, NVE remains profitable with robust free cash flow at US$19.87 million as of June 2023. The company's price-to-earnings ratio stands attractively at 22.8x against the industry’s 37x benchmark, hinting at potential value for investors seeking under-the-radar opportunities. Though revenue and net income have seen reductions recently, dividends remain steady at US$1 per share, reflecting management's commitment to shareholder returns amidst fluctuating market conditions.

- Click to explore a detailed breakdown of our findings in NVE's health report.

Assess NVE's past performance with our detailed historical performance reports.

SunCoke Energy (SXC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SunCoke Energy, Inc. is an independent producer of coke with operations in the Americas and Brazil, holding a market capitalization of approximately $713.73 million.

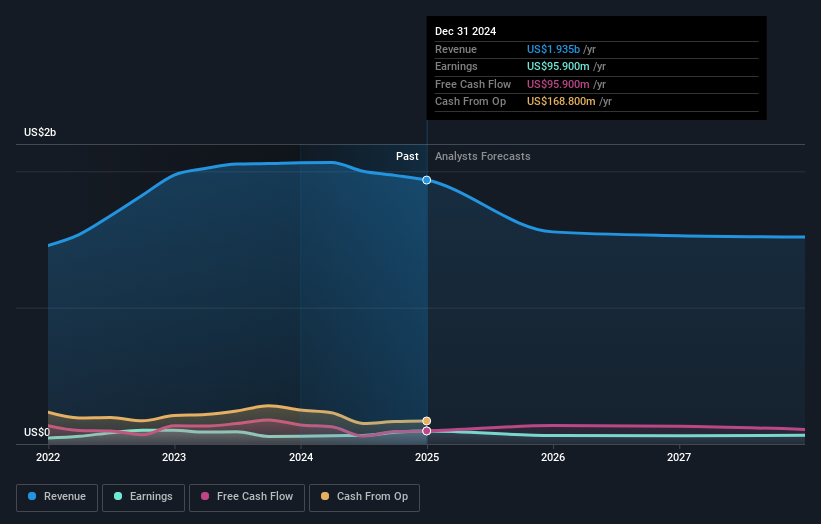

Operations: SunCoke Energy generates revenue primarily from its Domestic Coke segment, contributing $1.73 billion, and its Logistics segment, adding $102.30 million. The Brazil Coke segment also contributes $34.10 million to the total revenue stream.

SunCoke Energy, a notable player in the coke production industry with operations across the Americas and Brazil, has seen its debt-to-equity ratio improve significantly from 148.5% to 69.8% over five years. Despite trading at a substantial discount of 54.8% below its estimated fair value, SunCoke's net income for Q2 2025 was US$1.9 million, down from US$21.5 million a year prior, reflecting challenges in revenue generation amidst market shifts and integration hurdles post-acquisition of Phoenix Global. However, with earnings growth outpacing industry averages by 18%, SunCoke remains positioned for potential long-term gains despite current headwinds.

Turning Ideas Into Actions

- Access the full spectrum of 285 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BCAL

California BanCorp

Operates as the bank holding company for California Bank of Commerce, N.A.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives