- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Three Stocks That May Be Priced Below Their Estimated Value In May 2025

Reviewed by Simply Wall St

In the last week, the United States market has remained flat, yet it has shown an 8.0% increase over the past year with earnings expected to grow by 14% annually. In this environment, identifying stocks that may be priced below their estimated value can offer potential opportunities for investors seeking to capitalize on these favorable growth forecasts.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $56.71 | $111.26 | 49% |

| KBR (NYSE:KBR) | $55.20 | $108.72 | 49.2% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.30 | $18.49 | 49.7% |

| HealthEquity (NasdaqGS:HQY) | $90.40 | $179.14 | 49.5% |

| Arrow Financial (NasdaqGS:AROW) | $26.13 | $51.19 | 49% |

| Verra Mobility (NasdaqCM:VRRM) | $24.19 | $48.21 | 49.8% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | $424.99 | $822.82 | 48.3% |

| Mobileye Global (NasdaqGS:MBLY) | $16.30 | $31.64 | 48.5% |

| Nutanix (NasdaqGS:NTNX) | $75.10 | $145.13 | 48.3% |

| Pursuit Attractions and Hospitality (NYSE:PRSU) | $28.92 | $57.16 | 49.4% |

Let's review some notable picks from our screened stocks.

LPL Financial Holdings (NasdaqGS:LPLA)

Overview: LPL Financial Holdings Inc. offers a comprehensive platform of brokerage and investment advisory services to independent financial advisors and those at institutions across the United States, with a market cap of approximately $28.82 billion.

Operations: The company generates revenue primarily from its brokerage segment, which accounts for $12.92 billion.

Estimated Discount To Fair Value: 31.4%

LPL Financial Holdings appears undervalued based on discounted cash flow analysis, trading at US$360.42, significantly below its estimated fair value of US$525.54. Recent earnings reports show revenue growth from US$2.83 billion to US$3.67 billion year-over-year and an increase in net income, reflecting robust financial performance. However, the company's debt coverage by operating cash flow is a concern despite strong earnings quality and a high forecasted return on equity of 38.7%.

- Our expertly prepared growth report on LPL Financial Holdings implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of LPL Financial Holdings.

Lyft (NasdaqGS:LYFT)

Overview: Lyft, Inc. operates a peer-to-peer marketplace for on-demand ridesharing services in the United States and Canada, with a market cap of approximately $7 billion.

Operations: Lyft generates revenue primarily from its Internet Information Providers segment, which amounted to $5.96 billion.

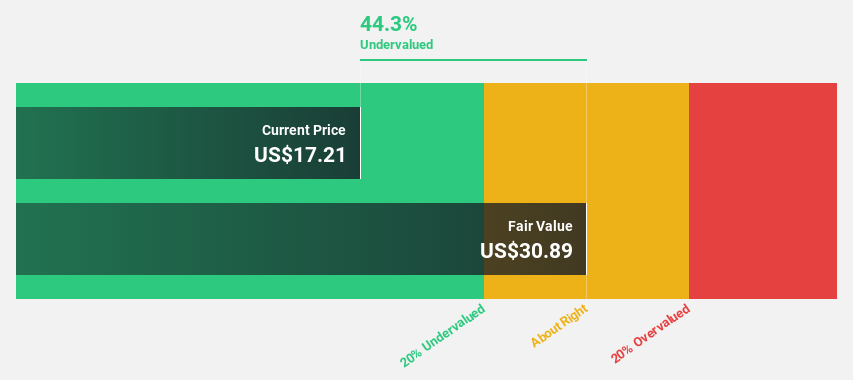

Estimated Discount To Fair Value: 40.6%

Lyft is trading at US$16.65, significantly below its estimated fair value of US$28.04, indicating it may be undervalued based on cash flows. The company recently became profitable with a net income of US$2.57 million in Q1 2025 and earnings projected to grow substantially over the next three years. Despite slower revenue growth forecasts, Lyft's increased share repurchase authorization to US$750 million suggests a strategic focus on enhancing shareholder value amidst governance challenges highlighted by Engine Capital Management.

- In light of our recent growth report, it seems possible that Lyft's financial performance will exceed current levels.

- Dive into the specifics of Lyft here with our thorough financial health report.

NVIDIA (NasdaqGS:NVDA)

Overview: NVIDIA Corporation is a computing infrastructure company that offers graphics, compute, and networking solutions globally, with a market cap of approximately $2.84 trillion.

Operations: The company's revenue is derived from its Graphics segment, which generated $14.30 billion, and its Compute & Networking segment, which contributed $116.19 billion.

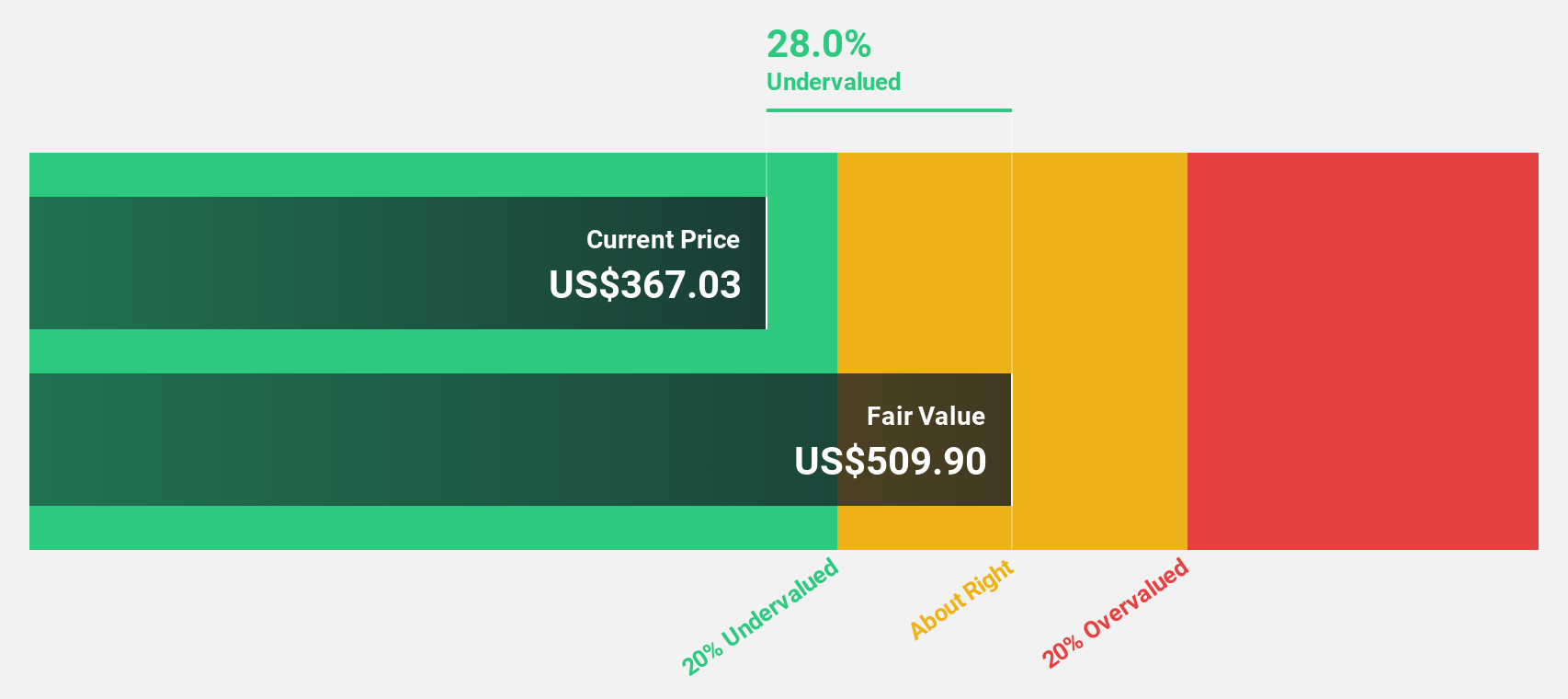

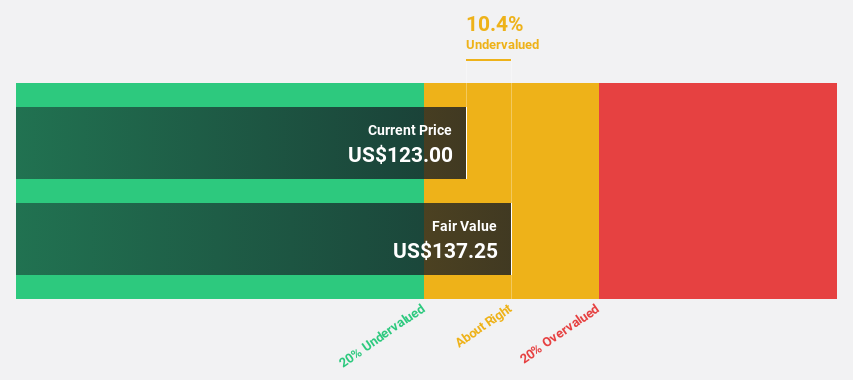

Estimated Discount To Fair Value: 15%

NVIDIA, priced at US$116.65, trades below its fair value estimate of US$137.18, reflecting potential undervaluation based on cash flows. Earnings are forecast to grow significantly over the next three years with a high return on equity expected. However, recent insider selling could be a concern. The expanded partnership with ServiceNow aims to enhance AI capabilities and operational efficiencies across enterprises, potentially boosting NVIDIA's strategic positioning in AI-driven markets amidst these financial dynamics.

- The analysis detailed in our NVIDIA growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of NVIDIA stock in this financial health report.

Seize The Opportunity

- Discover the full array of 172 Undervalued US Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives