- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Nvidia (NVDA): Exploring Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

Nvidia (NVDA) is once again in the spotlight as its share price has seen some short-term turbulence, catching the attention of investors. There is no major event driving the current move, but shifts like this often raise a familiar question among those thinking about buying, selling, or holding the stock. Is this a sign of changing sentiment toward a company that rarely stays out of the headlines for long?

Looking at the bigger picture, Nvidia's past year has been nothing short of a story in momentum. The stock is up 61% over the year, supported by consistent double-digit quarterly growth in both revenue and net income. Gains of 22% in the past 3 months show forward movement, although the recent month brought a pullback of just over 5%. Longer-term holders have seen impressive returns, but the latest slip might have some wondering if the run is losing steam or just resetting before another push higher.

After such a strong stretch, some are questioning whether the current dip is an opening for investors to buy a leader at a more reasonable price, or if the market is simply recalibrating its expectations for Nvidia’s next stage of growth.

Most Popular Narrative: 30% Overvalued

The leading narrative sees Nvidia as significantly overvalued relative to its intrinsic worth, driven by lofty revenue projections and dominant AI market expectations.

“Nvidia will hit $400b annual revenue in 5 years time. ~90% of revenue will come from data centre customers. This equates to $90b per quarter, or equivalent to 30,000 Blackwell racks (at ~$3m per rack). At 150kW per Blackwell rack, data centres will need to expand at 4.5gW per quarter to keep up. Global data centres are expected to increase wattage at 15% per year, which in 5 years time will be close to the 18gW annual increase required. AI (GPU) data centres have higher yields than other data centres, so some amount of use conversion is also expected.”

Did someone just predict a staggering leap in revenue fueled by game-changing infrastructure and industry shifts? There is a bold growth forecast in this narrative, one that rests on a few critical financial levers. Will Nvidia’s dominance and ambitious expansion turn these bullish targets into reality?

Result: Fair Value of $170.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, stronger competition or regulatory changes could quickly disrupt Nvidia’s projected dominance, introducing a layer of uncertainty to its ambitious growth outlook.

Find out about the key risks to this NVIDIA narrative.Another View: Discounted Cash Flow Model

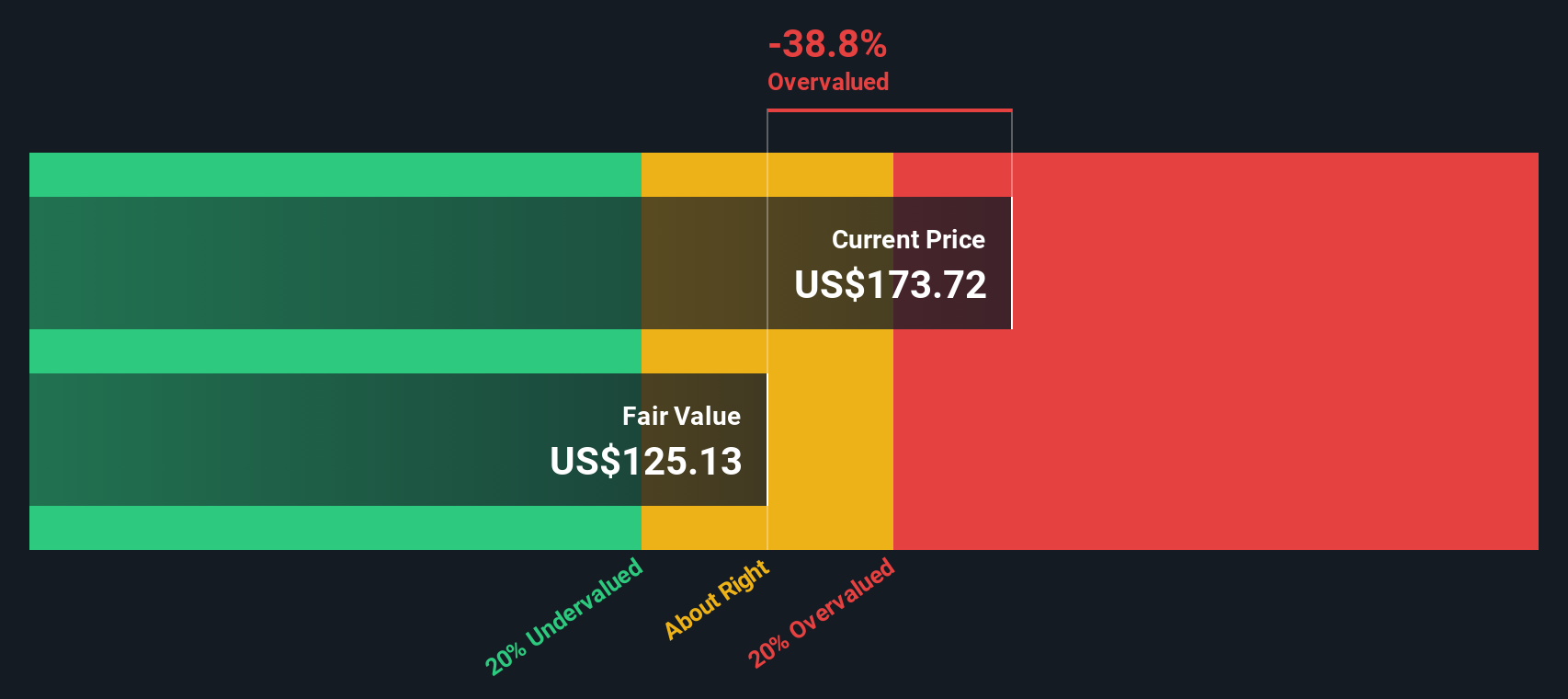

Taking a different approach, the SWS DCF model comes to a similar conclusion, indicating Nvidia is currently trading above its calculated fair value. Does this alignment across methods signal caution, or might the market know something these models do not?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NVIDIA Narrative

If you see the numbers differently or want to shape your own perspective, you can dive in and build your own view quickly. Do it your way

A great starting point for your NVIDIA research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss out on fresh opportunities that could take your investing to the next level. Try these handpicked screens to spot companies shaping the future.

- Tap into the powerful trends in digital money and explore trading businesses riding the wave of innovation with cryptocurrency and blockchain stocks.

- Unlock serious income potential by targeting companies offering attractive returns with dividend stocks with yields > 3%.

- Hunt for bargains among high-quality stocks selling below their cash flow value using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)