- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NASDAQ:NVDA) is Starting to Look Pricey if Forecasts don't begin to Rise

NVIDIA Corporation's ( NASDAQ:NVDA ) share price has been on a tear over the last few weeks. The stock price has risen 36% since the minor correction at the end of September, compared to the S&P500’s 8.3% gain and the Philadelphia Semiconductor Sector which has gained 12.5%. These gains come on top of 1,000% of gains over the last five years.

The buying appears primarily to have been motivated by increased hype around the Metaverse, including Facebook’s (NASDAQ:FB) - now Metaverse Platforms' - plans to invest heavily in building its corner of the Metaverse.

Besides potential Metaverse spending, the rebound in cryptocurrency prices and new product launches have also provided a tailwind for the share price. But there always comes a time when a stock is too expensive which impacts future returns.

We decided to have a look at how Nvidia's share price stacks up againt future growth forecasts.

Check out our latest analysis for NVIDIA

NVIDIA’s P/E ratio

P/E ratios have limited value when it comes to providing an absolute value for a share, but can help us understand how a company is valued compared to other company’s and a company’s own trading history.

NVIDIA’s price-to-earnings (or "P/E") ratio of 91.2x is now more than 5 times that of the average US stock which has a ratio of 17.8x. It’s also more than three times the average P/E ratio for the semiconductor industry which is 28.5x.

Prior to 2020, Nvidia’s P/E ratio ranged between 18 and 60x,so the current ratio is high by historical standards too.

Check out our latest analysis for NVIDIA

Keen to find out how analysts think NVIDIA's future stacks up against the industry? In that case, our free report is a great place to start .

Is There Enough Growth For NVIDIA?

There's an inherent assumption that a company should far outperform the market for P/E ratios like NVIDIA's to be considered reasonable. Nvidia’s EPS are expected to increase by at least 70% for the year to January 2022. Sustainable growth at this level would certainly justify a P/E ratio well ahead of the market.

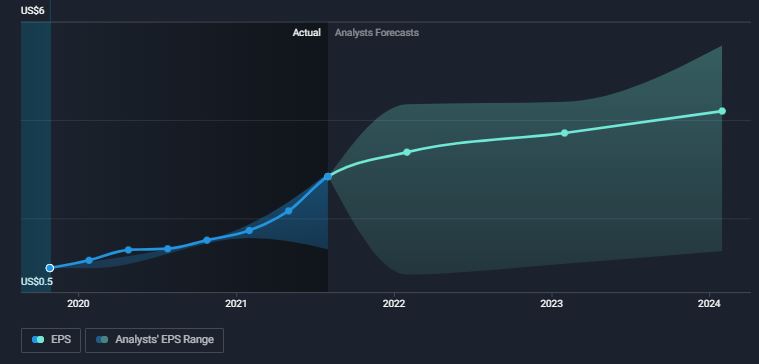

However, this growth will also set a high base for the following years. The following graph reflects analysts forecasts for the next few years, including a dramatic deceleration beginning next year.

The graph also reflects a very wide range of estimates with some analysts actually expecting EPS to fall quite soon. However, even if we include only the most optimistic forecasts, growth is expected to flatten off next year. This table reflects the highest estimates, along with the growth rate and forward P/E implied by a $260 share price.

| Year End | Highest EPS Estimate | YoY EPS Growth | Fwd P/E @$260 |

| 1/31/2022 | 4.32 | 145% | 60.2 |

| 1/31/2023 | 4.37 | 1% | 59.5 |

| 1/31/2024 | 5.51 | 26% | 47.2 |

The Key Takeaway

Nvidia is a market leader and a key supplier to many, if not most, of the fastest growing industries in the world - including automation, visualization, virtual and augmented reality, artificial intelligence, and blockchain technology. The company is also closely tied to making the metaverse a reality . So, it’s likely that a share like this will always trade at a premium to other stocks.

On the other hand, upside may be limited if growth is well below the broader market in the next few years. Nvidia will also need to make ongoing investments in the next few years to maintain its leadership position, and these will impact EPS regardless of revenue growth.

Clearly these forecasts may also rise, as they have done over the last year. We would suggest keeping an eye on these forecasts, particularly after the 3rd quarter results are released on 17th November. You can keep track of these estimates by referring back to our free analysis of Nvidia.

Of course, you might also be able to find a better stock than NVIDIA . So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)