- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Powers Cerence's Next-Gen Automotive AI with MediaTek Partnership

Reviewed by Simply Wall St

NVIDIA (NasdaqGS:NVDA) advanced 1.20% last week. The company remains in focus with the recent expansion of its partnership with Cerence Inc. to enhance automotive user experiences through new AI capabilities. This development coincides with the recent rally in the broader tech market led by chipmakers, as evidenced by gains in other semiconductor stocks like Broadcom. Overall, an optimistic atmosphere in the tech sector, propelled by strong earnings reports and positive market sentiment, particularly in chip stocks, provided a supportive background, aligning NVIDIA’s move with broader market trends.

The recent expansion of NVIDIA's partnership with Cerence Inc. enhances the company's AI capabilities in the automotive sector, aligning with its broader strategy of growth through AI model scaling and the Blackwell architecture. This development could bolster NVIDIA's revenue from the automotive sector as it integrates AI solutions, further supported by its collaborations with Toyota and Uber. With an emphasis on enhancing automotive user experiences, NVIDIA could capitalize on growing demand in both the automotive and data center markets, potentially improving earnings.

Over the past five years, NVIDIA's total shareholder return, including share price and dividends, was very large, reflecting its significant market presence and innovation in sectors such as gaming, data centers, and AI. This performance compares favorably to the broader market and the US Semiconductor industry over the recent year, where NVIDIA exceeded the industry's return, demonstrating its relative strength amidst challenges such as U.S. regulatory issues and export controls with China.

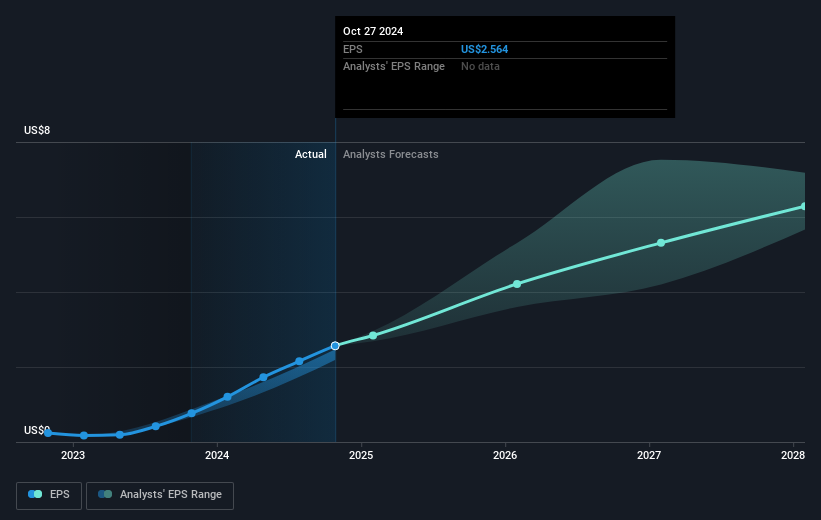

In terms of pricing, NVIDIA's current share price at US$98.89 is positioned well below the consensus analyst price target of US$164.74, representing a 40% potential upside. The news of expanded partnerships might influence revenue and earnings forecasts positively, potentially easing some uncertainties while supporting NVIDIA's valuation trajectory. As per analyst projections, NVIDIA is anticipated to achieve earnings of $158.2 billion by 2028, contingent on strategic expansions and efficient management of manufacturing scales. However, investors are urged to evaluate these projections considering market conditions and inherent risks.

Unlock comprehensive insights into our analysis of NVIDIA stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade NVIDIA, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives