- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Falls 14% This Week Amid Unveiling Of AI Data Platform

Reviewed by Simply Wall St

NVIDIA (NasdaqGS:NVDA) experienced a price decline of 14% over the past week. This movement coincides with substantial recent announcements and partnerships, such as their collaboration with Quantum Machines to advance quantum computing. Additionally, NVIDIA's unveiling of the DGX SuperPOD and AI Data Platform highlights their focus on driving technological innovation. However, this period also saw a significant market drop, with the Nasdaq entering bear market territory due to global tariff tensions impacting stocks broadly. NVIDIA's stock was not immune to the broader market downturn that saw the S&P 500 and Nasdaq falling sharply, affecting technology stocks overall.

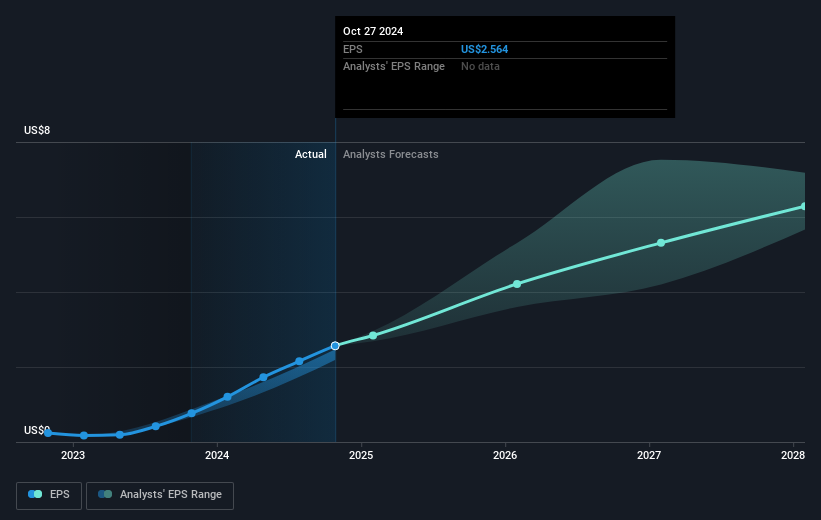

NVIDIA's recent collaboration with Quantum Machines and the unveiling of the DGX SuperPOD and AI Data Platform are pivotal, potentially bolstering its technological footprint. Such partnerships and product announcements could enhance NVIDIA's revenue and earnings forecasts by expanding its market presence in quantum computing and AI innovation. The announcement underscores NVIDIA's commitment to staying at the forefront of technological advancements, which might drive future earnings, although regulatory challenges and market uncertainties remain influential.

Over the past five years, NVIDIA's total shareholder return, including both share price appreciation and dividends, reached more than 1339%, indicating a very large return. This return significantly outpaces the broader market and supports the narrative of NVIDIA's strong brand and performance in the tech sector.

In the context of the current price movements, NVIDIA's shares, trading at US$110.15, are below the analyst consensus price target of US$171.01. This suggests an upside potential of 35.6% based on anticipated future earnings growth and other assumptions by analysts. Despite a recent short-term decline, the long-term perspective provided by the total returns could suggest resilience in the company's strategic initiatives across AI and data centers, contingent upon overcoming existing challenges in the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives