- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Accelerates AI Innovations In SMEs And Smart Cities

Reviewed by Simply Wall St

Recent developments at NVIDIA (NasdaqGS:NVDA) include Pri0r1ty Ai Ltd. joining the NVIDIA Connect Program, which offers access to AI acceleration tools, and Peachtree Corners integrating NVIDIA technologies for smart city enhancements. Despite these positive strides in AI, NVIDIA's stock saw an 8.61% decline last week, coinciding with broader market volatility and concerns over chip export restrictions to China. The Nasdaq Composite, within the same week, saw modest gains as NVIDIA and other tech stocks faced pressures from U.S.-China trade tensions, exemplifying how external factors can weigh on company-specific positive news.

The recent developments surrounding NVIDIA's initiatives with Pri0r1ty Ai Ltd. and the smart city integration by Peachtree Corners highlight the company's ongoing efforts to bolster its AI footprint. However, broader market challenges, especially concerning chip export restrictions to China, are influential factors affecting NVIDIA's stock performance. Despite last week's 8.61% decline, investor focus remains on the company's strategic partnerships, such as those with Toyota and Uber, which may drive significant growth in AI and automotive sectors.

Over the past five years, NVIDIA has achieved a total return of very large, showcasing its strong market presence and operational success. More recently, the company has also surpassed the 4.6% return of the US market over the past year, demonstrating robust performance relative to its peers. This historical context emphasizes the resilience of NVIDIA's business model amidst fluctuating market dynamics.

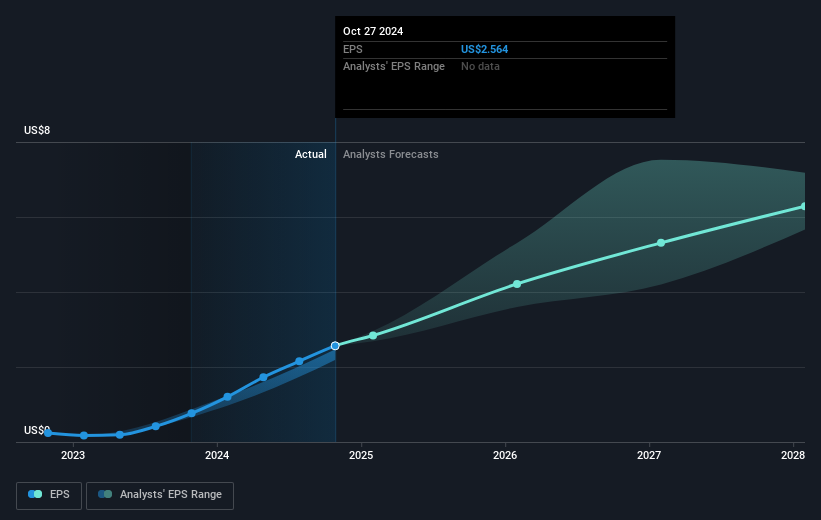

The recent news may impact revenue and earnings forecasts positively. The expansion in AI, facilitated by partnerships and technological advancements, points toward potential enhancement in NVIDIA's revenue streams, particularly in data centers and gaming segments. Analysts predict an annual revenue growth rate of 20.2%, with earnings projected to grow to US$159.1 billion by April 2028, although there are varying expectations.

In terms of valuation, NVIDIA's current share price stands at US$96.3, representing a significant discount to the consensus analyst price target of US$169.47, suggesting potential upside if forecasts materialize as anticipated. As NVIDIA continues to address regulatory challenges and capitalize on AI opportunities, its strategic moves will likely play a crucial role in guiding future performance.

Learn about NVIDIA's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade NVIDIA, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives