- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Marvell Technology (NasdaqGS:MRVL) Reaffirms Revenue Guidance For Fiscal 2026

Reviewed by Simply Wall St

Marvell Technology (NasdaqGS:MRVL) experienced a significant price move of 26%, influenced by several strategic developments. Key events include the announcement of its successful interoperability of the Structera portfolio with AMD and Intel platforms, demonstrating technological advancement and collaboration. This aligns with the upward trend in the market as tech stocks lead the rally. Additionally, the company's reaffirmation of its revenue guidance for Q1 of fiscal 2026 provided a boost in confidence. Executive changes and board announcements, while important, likely had a more subdued impact compared to broader market performance, which has been positive over the same period.

We've identified 1 warning sign for Marvell Technology that you should be aware of.

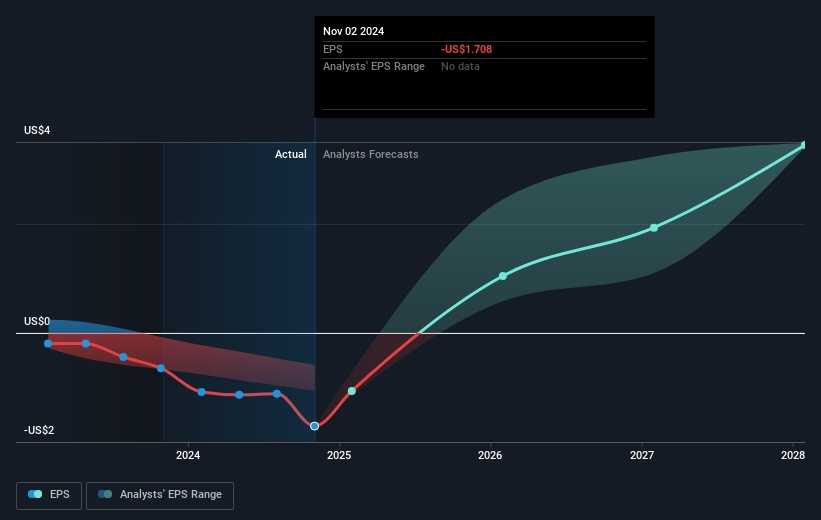

The interoperability achievement announced with AMD and Intel has the potential to significantly impact Marvell Technology's growth narrative. By successfully integrating its Structera portfolio with major industry players, Marvell is positioning itself to capitalize on expanding AI demands and reinforcing its semiconductor technology capabilities. This aligns with analysts’ forecasts expecting a substantial revenue growth driven by high-performance product adoption. The advancement in data center solutions, alongside new technologies like the 3-nanometer DSP, supports expectations of boosted revenue streams and improved profit margins.

Over the past five years, Marvell's total shareholder return was an impressive 132.65%, contrasting with its underperformance relative to the U.S. Semiconductor industry in the past year, which saw a return of 21%. Similarly, it underperformed compared to the U.S. market's one-year return of 10.6%. This long-term growth underscores the company's potential despite short-term challenges.

The reaffirmation of revenue guidance for Q1 of fiscal 2026 is a confidence booster, potentially enhancing earnings projections. However, with a current share price of US$61.22, the analysts’ consensus price target of US$103.36 reflects a potential upside of 40.8%. This creates an interesting scenario for investors to consider how effectively the strategic advancements might materialize in reshaping Marvell's financial prospects and meet or surpass these optimistic forecasts.

Understand Marvell Technology's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Marvell Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives