- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Marvell Technology (MRVL) Strengthens Leadership Team With Key Executive Promotions

Reviewed by Simply Wall St

On July 15, 2025, Marvell Technology (MRVL) announced significant executive promotions with Chris Koopmans becoming President and COO and Sandeep Bharathi appointed as President of the Data Center Group. These leadership changes might have positively influenced investor sentiment, contributing to a 39% rise in the company's stock over the last quarter. This upward move aligns with generally strong corporate earnings and economic resilience; however, broader market factors and partnerships with Ferric and NVIDIA for AI advancements have possibly bolstered this trend further, contrasting the flatness seen in Netflix and Amex.

The recent executive promotions at Marvell Technology could play a positive role in shaping the company's growth narrative, especially in the AI and data center sectors. By enhancing leadership with experienced executives like Chris Koopmans and Sandeep Bharathi, Marvell might strengthen its strategic focus on AI technologies and custom silicon programs, potentially accelerating revenue and earnings growth. The 39% rise in stock price over the past quarter aligns with investor optimism, but the true test will be in delivery against these elevated expectations.

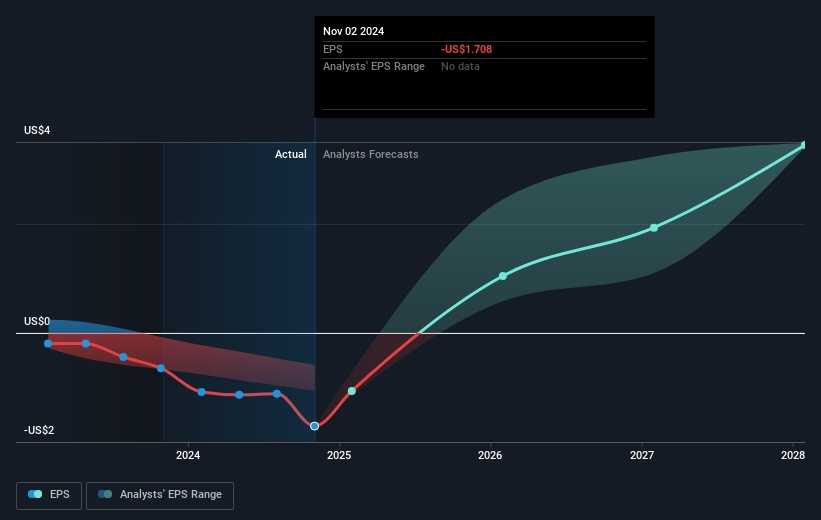

Over a five-year period, Marvell's total shareholder return, including dividends, was 108.22%. This performance contrasts with the more recent underperformance against both the US Semiconductor industry and the broader US market over the past year. Marvell's share appreciation suggests strong long-term value creation, but the company still faces challenges to match the market's pace.

The impacts of leadership changes could influence projected revenue and earnings positively, expecting to exceed AI sector targets, although potential risks remain due to heavy reliance on the data center market. Currently, with the stock trading at US$72.01, analysts set a consensus price target of approximately US$90.27, reflecting a price movement that suggests room for appreciation. Achieving this target requires confidence in Marvell's capacity to execute its growth strategies, underscoring the importance of the company's ongoing technological advancements and market positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives