- United States

- /

- Trade Distributors

- /

- NasdaqGS:XMTR

3 Stocks That Might Be Undervalued By Up To 49.2%

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 4.4%, while overall remaining flat over the past year, with earnings expected to grow by 13% annually. In this environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential growth opportunities that may not yet be reflected in current stock prices.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | $39.64 | $78.07 | 49.2% |

| CareTrust REIT (NYSE:CTRE) | $28.06 | $54.41 | 48.4% |

| TowneBank (NasdaqGS:TOWN) | $31.29 | $62.34 | 49.8% |

| First National (NasdaqCM:FXNC) | $18.50 | $36.91 | 49.9% |

| Moog (NYSE:MOG.A) | $159.89 | $318.48 | 49.8% |

| First Bancorp (NasdaqGS:FBNC) | $37.05 | $72.67 | 49% |

| Ready Capital (NYSE:RC) | $4.37 | $8.65 | 49.5% |

| Washington Trust Bancorp (NasdaqGS:WASH) | $26.24 | $51.49 | 49% |

| Atlassian (NasdaqGS:TEAM) | $192.84 | $380.19 | 49.3% |

| Comstock Resources (NYSE:CRK) | $18.64 | $36.18 | 48.5% |

Let's uncover some gems from our specialized screener.

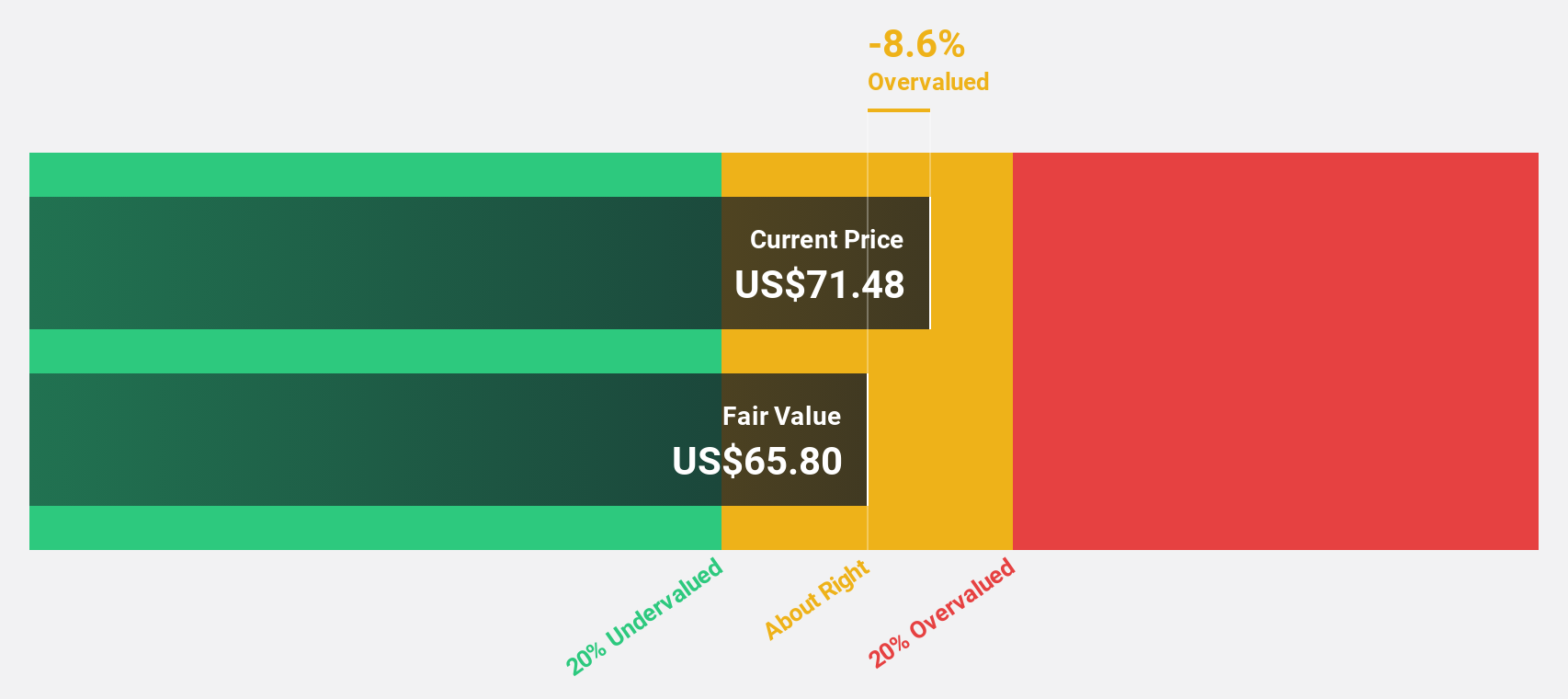

Microchip Technology (NasdaqGS:MCHP)

Overview: Microchip Technology Incorporated develops, manufactures, and sells smart, connected, and secure embedded control solutions across the Americas, Europe, and Asia with a market cap of approximately $20.74 billion.

Operations: The company's revenue segments include Semiconductor Products, generating $4.65 billion, and Technology Licensing, contributing $110.70 million.

Estimated Discount To Fair Value: 23.5%

Microchip Technology is trading at US$39.43, significantly below its estimated fair value of US$51.51, indicating it may be undervalued based on discounted cash flow analysis. Despite forecasted slower revenue growth than the market, Microchip's earnings are expected to grow substantially faster than the U.S. market over the next three years. However, its dividend yield of 4.62% is not well covered by earnings or free cash flows, and recent financial results show a net loss and lower profit margins compared to last year.

- In light of our recent growth report, it seems possible that Microchip Technology's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Microchip Technology.

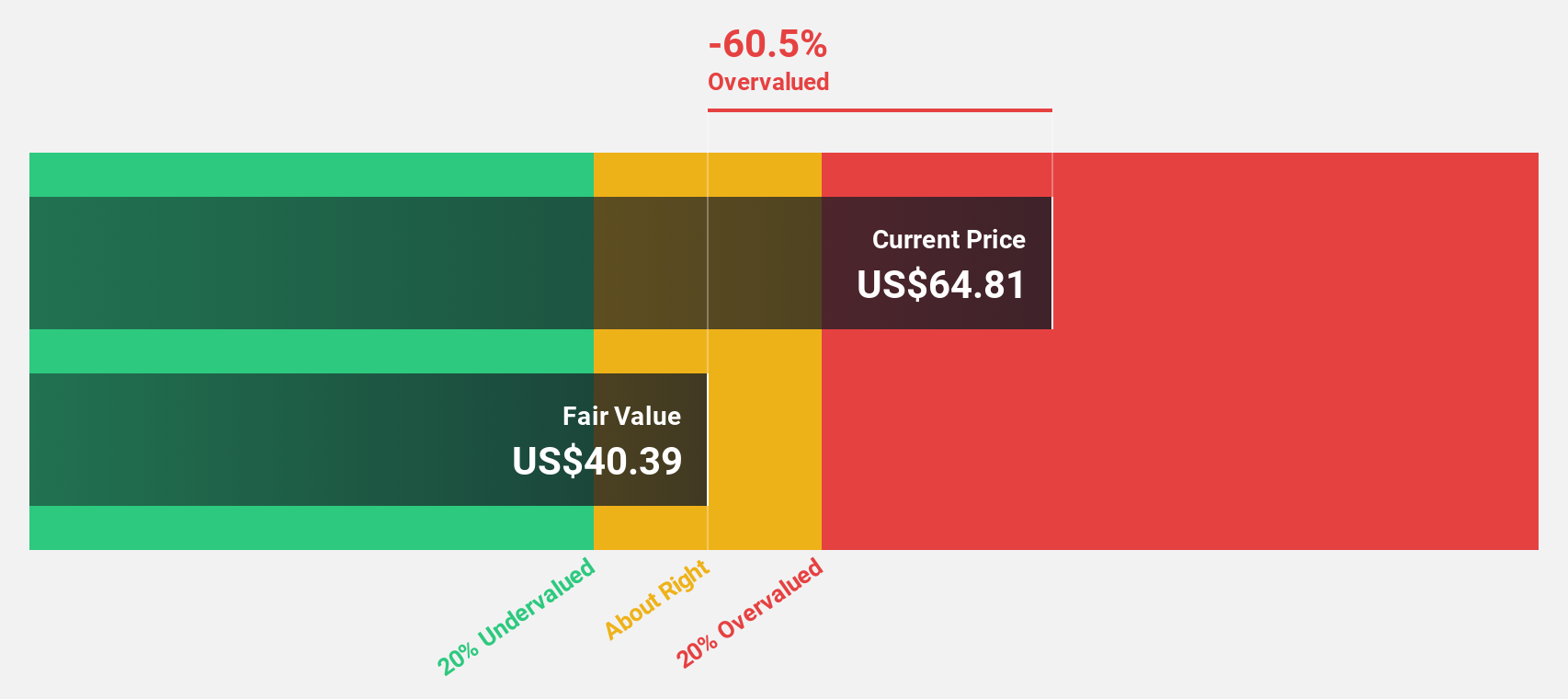

NBT Bancorp (NasdaqGS:NBTB)

Overview: NBT Bancorp Inc. is a financial holding company offering commercial banking, retail banking, and wealth management services, with a market cap of approximately $1.88 billion.

Operations: The company generates revenue primarily from its Community Banking Industry segment, totaling approximately $557.34 million.

Estimated Discount To Fair Value: 49.2%

NBT Bancorp is trading at US$39.64, well below its estimated fair value of US$78.07, highlighting potential undervaluation based on cash flows. The company's earnings grew by 18.4% last year and are forecasted to increase significantly at 24.3% annually, outpacing the broader U.S. market's growth rate of 13.3%. Despite this positive outlook, insider selling has been significant recently, which could be a point of concern for investors considering its prospects.

- Insights from our recent growth report point to a promising forecast for NBT Bancorp's business outlook.

- Click to explore a detailed breakdown of our findings in NBT Bancorp's balance sheet health report.

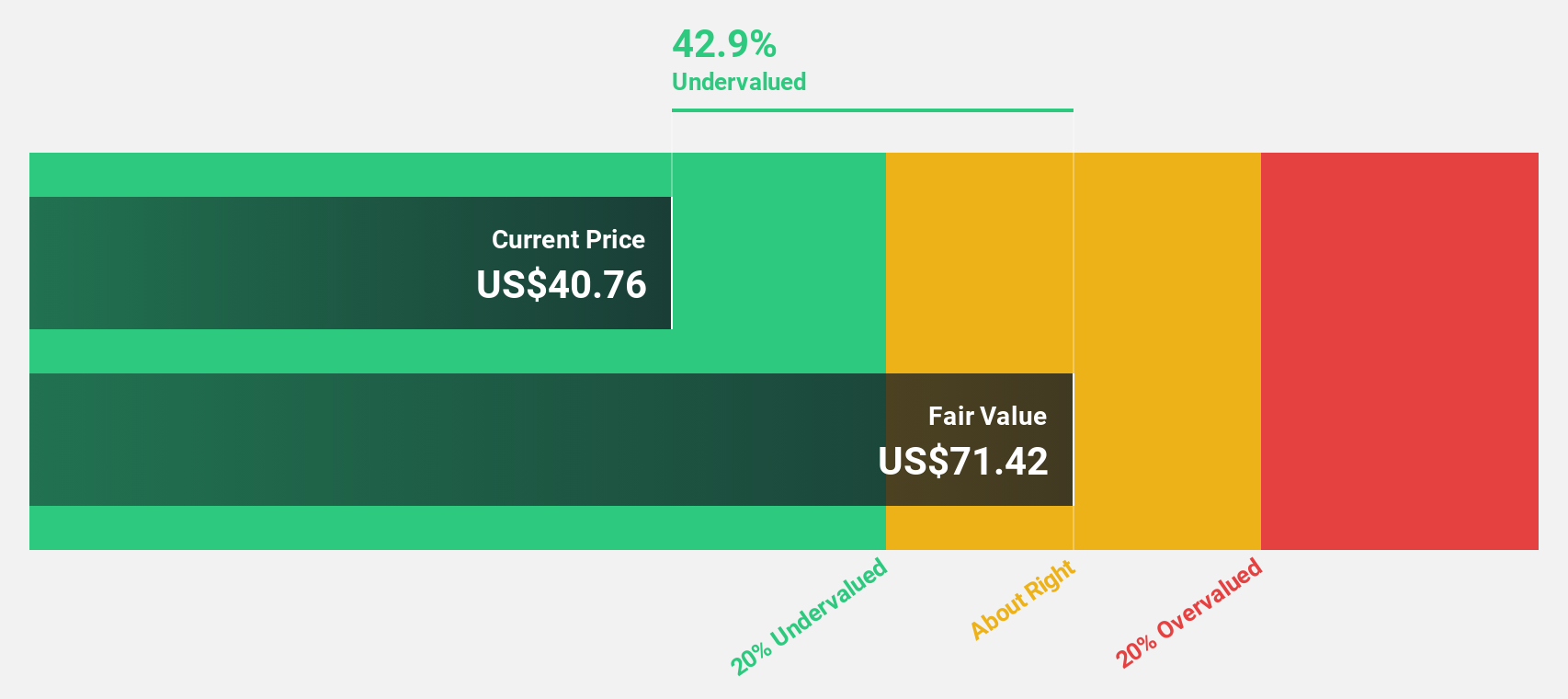

Xometry (NasdaqGS:XMTR)

Overview: Xometry, Inc. operates an AI-powered online manufacturing marketplace both in the United States and internationally, with a market cap of approximately $1.11 billion.

Operations: The company generates revenue of $545.53 million from its Internet Software & Services segment.

Estimated Discount To Fair Value: 42.9%

Xometry, Inc. is trading at US$22.18, significantly below its estimated fair value of US$38.85, suggesting it may be undervalued based on cash flows. The company anticipates becoming profitable within three years and expects revenue to grow by 14.5% annually, surpassing the U.S. market's growth rate of 8.2%. However, recent executive changes and a switch in auditors might introduce some uncertainty for investors evaluating its potential trajectory.

- Our comprehensive growth report raises the possibility that Xometry is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Xometry stock in this financial health report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 168 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XMTR

Xometry

Operates an artificial intelligence (AI) powered online manufacturing marketplace in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion