- United States

- /

- Semiconductors

- /

- NasdaqGS:LSCC

Does Lattice’s PQC-Enabled FPGA Launch Change the Bull Case for Lattice Semiconductor (LSCC)?

Reviewed by Sasha Jovanovic

- In October 2025, Lattice Semiconductor introduced the Lattice MachXO5-NX TDQ family, the industry's first secure control FPGAs with full post-quantum cryptography (PQC) support, which have already shipped to key communications and computing customers.

- This launch addresses growing concerns about quantum computing's potential to undermine existing security standards and marks a major innovation for hardware security in computing, industrial, and automotive sectors.

- We'll explore how Lattice's breakthrough in PQC-compliant FPGAs may impact its position within the broader AI and edge computing landscape.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 39 companies in the world exploring or producing it. Find the list for free.

Lattice Semiconductor Investment Narrative Recap

To back Lattice Semiconductor as a shareholder, you need to believe the company can capture ongoing growth from AI and edge computing by winning more design slots for its power-efficient FPGAs, even as competition and revenue volatility increase. The debut of the MachXO5-NX TDQ family with CNSA 2.0-compliant post-quantum cryptography support underscores Lattice’s bid to stay at the forefront of hardware security, but the short-term catalyst of inventory normalization in industrial and automotive segments is unlikely to be materially impacted by this release. The biggest risk remains concentrated competition and potential margin pressure from larger rivals or disruptive alternatives.

Among recent news, Lattice’s August expansion of high I/O density options for its Certus-NX and MachXO5-NX FPGA lines is particularly relevant, as it enhanced the appeal of these devices for AI, industrial, and automotive applications. Coupled with the new PQC-compliant FPGAs, these product rollouts reinforce the company’s push to win more designs as next-generation industrial and automotive systems migrate to secure, low-power computing.

But despite headlines about breakthrough innovation, investors should pay close attention to rising competition from much larger FPGA vendors and...

Read the full narrative on Lattice Semiconductor (it's free!)

Lattice Semiconductor's narrative projects $764.9 million revenue and $187.0 million earnings by 2028. This requires 16.1% yearly revenue growth and a $155.4 million earnings increase from $31.6 million today.

Uncover how Lattice Semiconductor's forecasts yield a $68.31 fair value, a 4% downside to its current price.

Exploring Other Perspectives

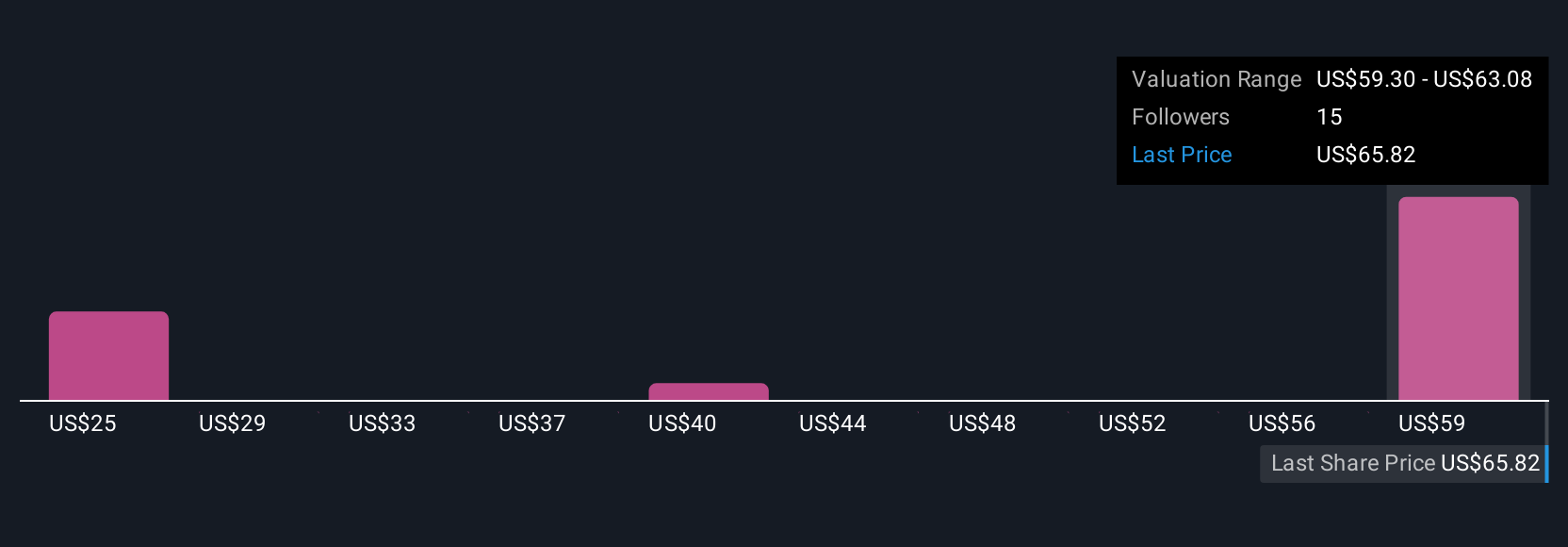

Simply Wall St Community fair value estimates for Lattice run from US$25.45 to US$68.31, reflecting just four varied viewpoints. While many see upside in the AI-driven catalysts, the persistent risk of margin pressure and market share loss underscores why opinions across the community can differ so widely.

Explore 4 other fair value estimates on Lattice Semiconductor - why the stock might be worth less than half the current price!

Build Your Own Lattice Semiconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lattice Semiconductor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Lattice Semiconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lattice Semiconductor's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LSCC

Lattice Semiconductor

Develops and sells semiconductor, silicon-based and silicon-enabling, evaluation boards, and development hardware products in Asia, Europe, and the Americas.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives