- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Lam Research (NasdaqGS:LRCX) Sinks 13% In A Week As Trade War Fears Grip Semiconductor Stocks

Reviewed by Simply Wall St

Lam Research (NasdaqGS:LRCX) saw its share price decline by 13% over the past week, a period that coincided with significant market turmoil prompted by tariffs announced by the Trump administration. The broader market also experienced significant drops, with the Nasdaq Composite entering bear market territory. As fears of a global trade war intensified, semiconductor stocks, including Lam Research, were particularly hard hit, likely contributed by investor anxiety over potential impacts on global supply chains. The overall market decline of 6% underscored widespread uncertainty, affecting tech stocks across the board, amplifying pressure on companies like Lam Research.

Buy, Hold or Sell Lam Research? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

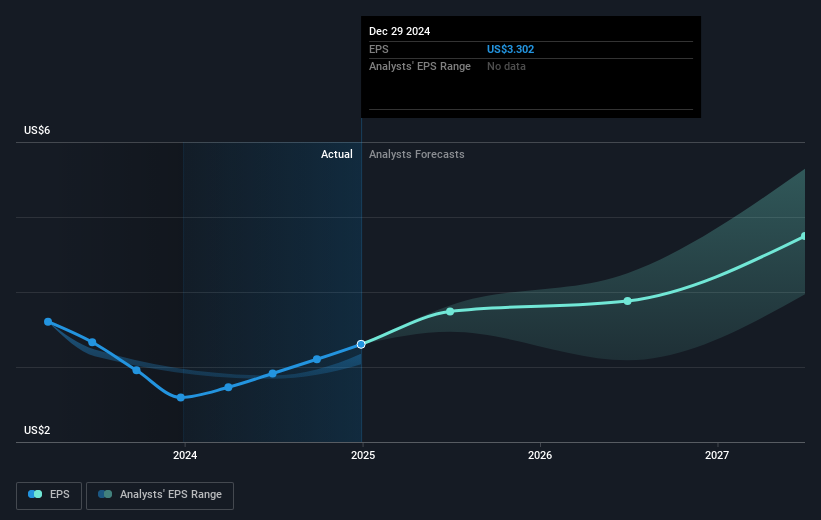

Over the past five years, Lam Research has delivered a total shareholder return of 167.83%, reflecting significant growth that far outpaces market challenges. Key innovations, such as the launch of the ALTUS® Halo and Akara®, have positioned Lam as a leader in advanced semiconductor manufacturing, addressing industry demands for precision and scalability. This period also saw the company enhance its financial performance, with revenues increasing, exemplified by Q1 and Q2 2025 results reporting over US$4 billion each quarter. These financial milestones underscore Lam's resilient execution of growth initiatives.

Lam's concentrated R&D investments and technological advancements, coupled with share repurchases totalling millions, underscore its commitment to shareholder value. The completion of a US$650 million buyback program and significant dividend increases have further bolstered returns. Despite industry challenges, including export controls and customer spending limitations, Lam's comprehensive strategies in technology and finance have firmly sustained its competitive edge over the long term.

Assess Lam Research's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lam Research, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives