- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Lam Research (NasdaqGS:LRCX) Reports Strong Q3 Growth and Provides Upbeat Revenue Guidance

Reviewed by Simply Wall St

Lam Research (NasdaqGS:LRCX) recently reported impressive third-quarter earnings with significant increases in sales and net income. Over the past week, its stock saw a 5% rise, aligning closely with the broader market moves led by gains in the semiconductor sector. The company's strong guidance for the upcoming quarter, with expected revenue growth and earnings per share, supported investor sentiment. Meanwhile, the tech rally driven by positive earnings reports and optimism around tariff discussions bolstered tech stocks, including chipmakers like Lam Research. These developments collectively reinforced the company's share price movement amidst broader market trends.

Buy, Hold or Sell Lam Research? View our complete analysis and fair value estimate and you decide.

Recent developments in the semiconductor sector, including Lam Research's third-quarter earnings report and subsequent stock rise, could bolster the company's long-term growth narrative. This aligns with Lam's focus on advanced technologies and infrastructure investments to enhance competitiveness amid an estimated US$100 billion rise in wafer fabrication equipment spending. However, such positive sentiment must consider risks like export controls and reliance on NAND upgrades, which could impact revenue stability.

Over a five-year period, Lam's total shareholder return reached 177.25%, indicating robust longer-term growth. This is marked by strategic R&D investments, operational improvements, and technological advancements. In contrast, the company's one-year performance lagged behind the US market and semiconductor industry, which recorded 5.9% and 5.1% returns, respectively. Such discrepancies highlight the necessity of evaluating both short-term fluctuations and broader industry trends.

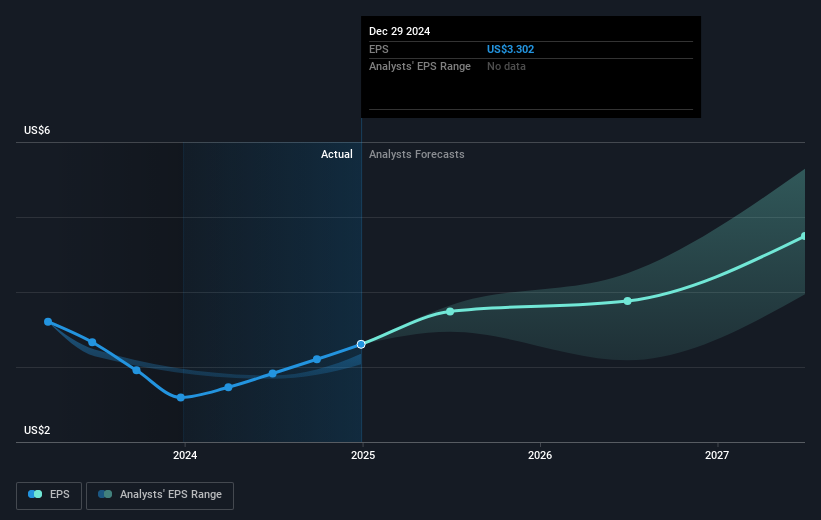

Lam's positive earnings report and future guidance may uplift revenue and earnings forecasts, driven by increased demand for semiconductor equipment and technological innovations. Analysts predict revenue growth of 9.3% annually over the next three years, while earnings could reach US$6.1 billion by April 2028. Despite current pricing challenges, Lam's shares suggest a trading discount compared to the consensus analyst price target of US$92.64. With a current share price of US$63.48, the target indicates a significant premium, emphasizing potential market confidence in Lam's growth trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives