- United States

- /

- Semiconductors

- /

- NasdaqGS:KLIC

Does Strong Quarterly Orders and Peer Momentum Reinforce the Bull Case for Kulicke and Soffa (KLIC)?

Reviewed by Sasha Jovanovic

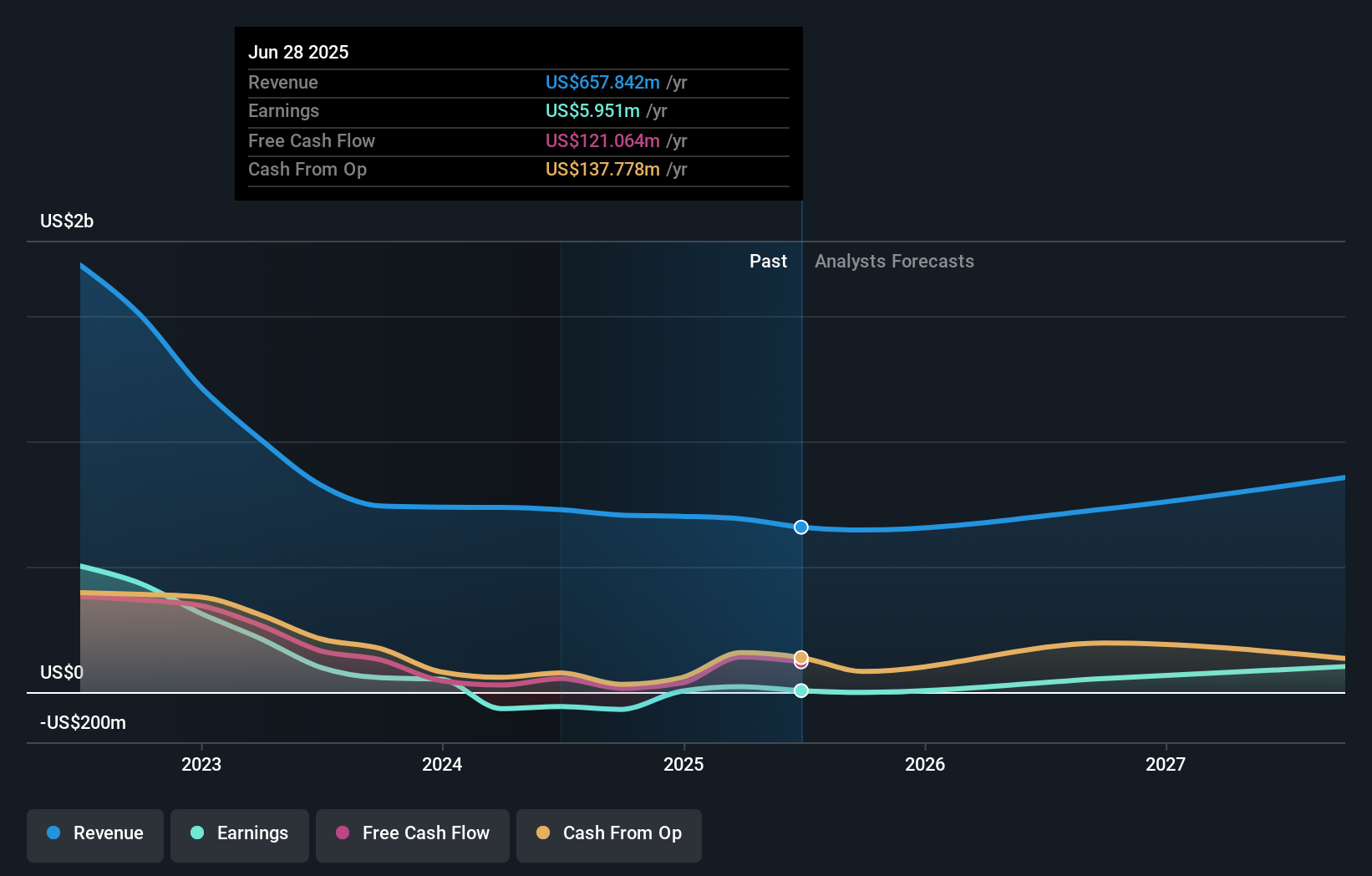

- Kulicke and Soffa recently reported quarterly revenues that exceeded analysts’ expectations and pointed to positive market feedback and rising order momentum.

- This performance, alongside robust results from key peers Amkor Technologies and Lam Research, reflects continued strength in the semiconductor equipment sector.

- We'll explore how stronger order trends and favorable industry dynamics shape Kulicke and Soffa's investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Kulicke and Soffa Industries' Investment Narrative?

At its core, owning Kulicke and Soffa means believing in the ongoing demand for semiconductor manufacturing equipment and the company's ability to translate new product launches, like ACELON™ and advanced packaging solutions, into growth. The latest earnings beat and rising order momentum provide a degree of short-term confidence, suggesting that recent product innovations and customer demand may be gaining traction faster than the prior quarter's results implied. While the news is encouraging, the full impact on upcoming catalysts, such as further order acceleration or margin improvement, will hinge on whether this positive momentum sustains through the year. Key risks like recent insider selling, ongoing industry volatility after the broader tech sell-off, and lower-than-expected returns on equity remain relevant, although the earnings surprise could soften concerns about immediate downside. Overall, this news improves the short-term outlook but does not erase scrutiny around profit consistency, dividend coverage, or the company’s premium valuation. However, the risk of profit volatility is something every investor needs to fully understand.

Kulicke and Soffa Industries' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on Kulicke and Soffa Industries - why the stock might be worth as much as 41% more than the current price!

Build Your Own Kulicke and Soffa Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kulicke and Soffa Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kulicke and Soffa Industries' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kulicke and Soffa Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLIC

Kulicke and Soffa Industries

Designs, manufactures, and sells capital equipment and consumables in China, the United States, Taiwan, Malaysia, Japan, the Philippines, Korea, Hong Kong, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion