- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Unveils AI-Enhanced ePaper Touchpad for Innovative Laptop Experience

Reviewed by Simply Wall St

Intel (NasdaqGS:INTC) saw a 17% upward price movement over the last month, a striking performance that stands out amidst tech sector advancements. This gain aligns with significant developments, like the launch of a groundbreaking ePaper touchpad solution by E Ink Holdings in collaboration with Intel technologies. Additionally, strategic partnerships and leadership changes at Intel, coupled with broader tech sector optimism seen in Nasdaq gains, likely added to the positive sentiment. Market dynamics suggest that Intel's recent moves align well with investor focus on tech innovation and strategic repositioning, which could lend further confidence to the company's future endeavors.

Buy, Hold or Sell Intel? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

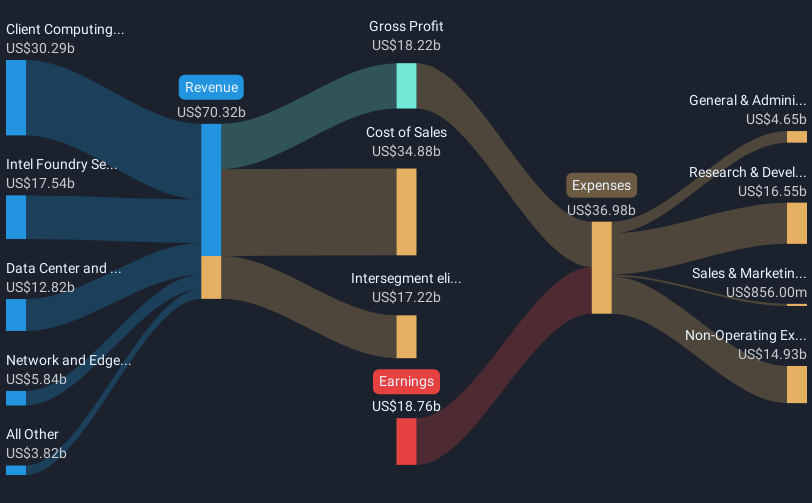

The recent collaboration between E Ink Holdings and Intel, combined with strategic partnerships and changes in leadership, holds the potential to impact Intel's ongoing transformation efforts positively. As Intel grapples with organizational complexity and seeks to enhance its innovation play in AI and foundry businesses, these developments could prove crucial in offsetting complexity risks and boosting investor confidence. Despite a 17% rise in its share price over the past month, Intel's longer-term performance remains concerning, with a total return, including dividends, of 25.99% decline over the last year. This performance, when compared to the broader industry, highlights the ongoing challenges Intel faces in achieving growth amid tech sector advancements.

Revenue and earnings forecasts could reflect optimism from recent strategic moves. However, broader market dynamics underline critical risks, such as reliance on older manufacturing nodes and geopolitical uncertainties. Analysts currently predict revenue growth of 2.5% annually, which is slower than the overall US market's 8.7% per year growth. Intel's focus on AI and structural transformation could influence future earnings, presenting a pathway for improvement, though benefits may take time to materialize. As the current share price of US$19.94 remains below the average analyst price target of US$21.29, this suggests Intel might still be perceived as undervalued relative to its fair value potential, presenting a mixed outlook for investors as they assess the company's transitional journey.

Evaluate Intel's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)