- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Sees 18% Price Move As Lip-Bu Tan Appointed CEO

Reviewed by Simply Wall St

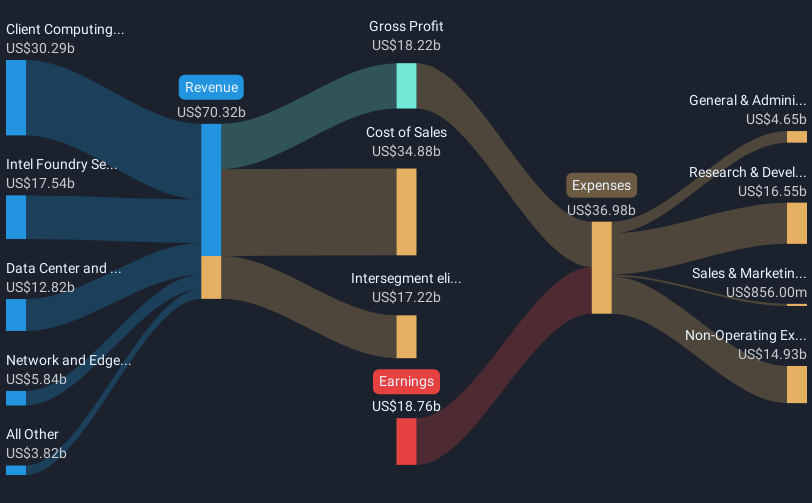

Intel (NasdaqGS:INTC) experienced a significant stock price increase of 18% over the last quarter amid several key developments. The appointment of Lip-Bu Tan as the new CEO on March 18, 2025, brought renewed optimism, given his extensive experience in the semiconductor sector. Additionally, the launch of the Intel Xeon 6700P and 6500P series processors on February 24, with enhanced AI and performance capabilities, bolstered investor confidence. The company's potential business restructuring through discussions with Silver Lake Technology Management to sell a majority stake in its programmable chips unit also drew attention. Concurrently, the broader tech sector saw a rally, with major indexes like the Nasdaq Composite rising from earlier declines, influenced partly by gains in companies such as Nvidia and Palantir. Despite the overall market experiencing a 2% decline in recent weeks, Intel's specific advancements and changes facilitated its positive share price movement.

Evaluate Intel's historical performance by accessing our past performance report.

The last 5 years have seen Intel grapple with challenges that contributed to its total shareholder return of 40.80% decline, contrasting against the rising tides in the semiconductor sector. A key factor was the suspension of dividends from Q4 2024, a decision made to enhance liquidity amid persisting financial difficulties, such as Q4 2024's net loss of US$126 million, a stark contrast to the US$2.67 billion net income a year before. Intel's struggles were further underscored by a strategic pivot in its business model, highlighted by exclusive discussions in 2025 to divest a majority stake in its programmable chips unit.

The company's value proposition remained below market expectations, as shown by analyst target prices. Despite these hurdles, Intel continued to release innovative products such as the new Xeon processors launched in early 2025, focusing on enhanced AI capabilities and future growth. Yet its 1-year performance lagged behind the broader US market, which rose 9.5%, and its own industry, which grew 16.5%, reflecting ongoing competitive and operational challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Intel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives