- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Reports Earnings Loss Yet Shares Climb 20%

Reviewed by Simply Wall St

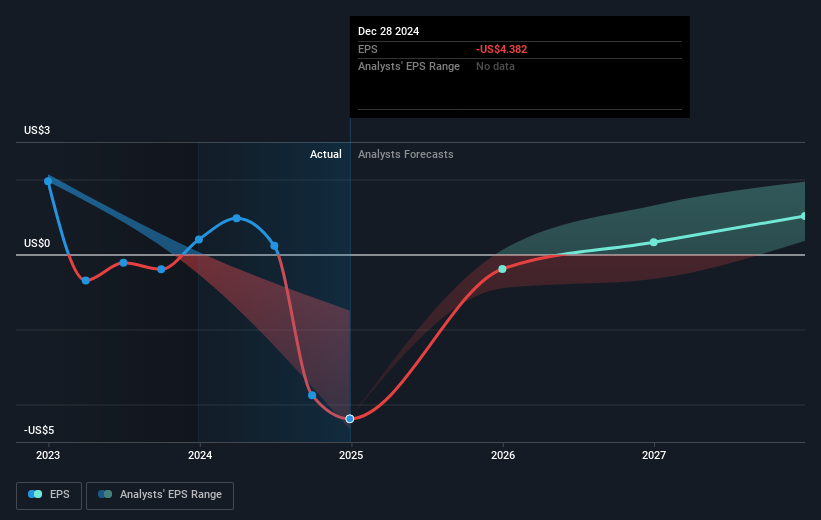

Intel (NasdaqGS:INTC) saw exclusive discussions regarding the potential sale of its programmable chips unit, igniting interest among investors. Despite reporting a disappointing earnings season with a substantial net loss for the fourth quarter of 2024 and gloomy guidance for Q1 2025, Intel's share price rose 20% over the last month. These discussions, coupled with speculative excitement around potential M&A, likely played a significant role in influencing investor sentiment positively. This rise contrasts with general market trends, as major indices experienced volatility, with the Dow Jones declining 1.5% and the S&P 500 slipping 0.9% after hitting record highs. Amidst broader market declines and mixed earnings from industry giants like Walmart, Intel’s movements suggest a unique blend of corporate actions and investor reactions. The company's performance, while facing financial challenges, highlights the stock's resilient behavior within a fluctuating market landscape.

Take a closer look at Intel's potential here.

Over the past three years, Intel's total shareholder return has been less than favorable, experiencing a 38.36% decline. This performance stands in stark contrast to the vibrant US semiconductor industry and broader markets, where Intel has notably underperformed in the last year. Several factors have influenced this trajectory. Notably, errors in strategic execution became evident with Intel's decision in August 2024 to suspend dividends to preserve liquidity for significant investments. Additionally, the retirement of CEO Pat Gelsinger in December 2024 amid challenging market conditions likely contributed to investor uncertainty.

In terms of strategic corporate moves, the company focused on refining its automotive product portfolio, highlighted by a January 2025 announcement targeting the electric and software-defined vehicle markets. However, despite these efforts, ongoing earnings challenges have overshadowed such advancements, as illustrated by recent earnings guidance foreseeing continued losses in Q1 2025. The company’s valuation contrasts with its own estimated fair value, suggesting potential long-term recovery considerations.

- Analyze Intel's fair value against its market price in our detailed valuation report—access it here.

- Discover the key vulnerabilities in Intel's business with our detailed risk assessment.

- Got skin in the game with Intel? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives