- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Considers NEX Business Sale Amid New GPU and AI Releases

Reviewed by Simply Wall St

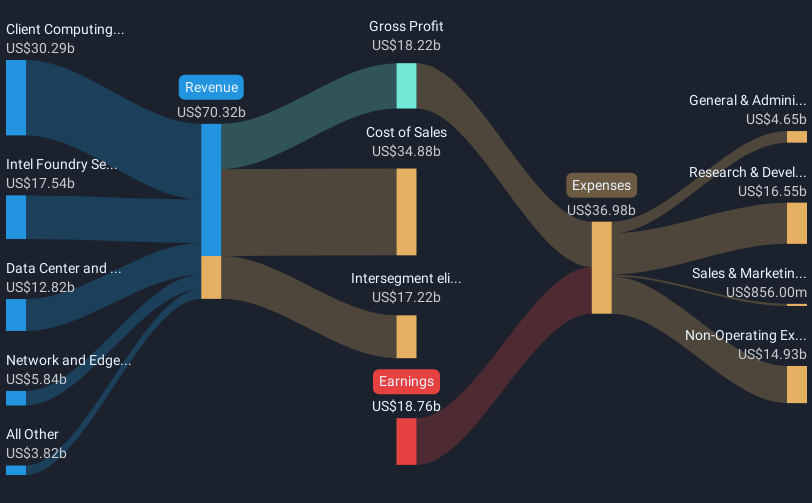

Intel (NasdaqGS:INTC) has recently been in the spotlight with its exploration of divesting the Network and Edge businesses and the launch of the Intel Arc Pro B-Series GPUs. These moves underscore a strategic focus on core business areas such as PC and data center chips. In the broader market, the S&P 500 experienced a period of consecutive gains, which broadly influenced tech stocks. Intel's 12.94% price increase over the past month aligns with general market trends, suggesting that the strategic announcements and product launches likely bolstered its share price amidst broader positive market sentiment.

Buy, Hold or Sell Intel? View our complete analysis and fair value estimate and you decide.

Intel's recent strategic moves, including the divestment of its Network and Edge businesses and the launch of the Arc Pro B-Series GPUs, underscore a focus on core operations. These initiatives could streamline operations potentially impacting future revenue and earnings positively. Nonetheless, the complexity of such transformations may introduce short-term challenges in achieving immediate financial gains. Over the last year, Intel's total shareholder return, including dividends, was a 32.97% decline. This long-term return starkly contrasts recent positive share price movements, suggesting that while current strategies may be promising, their full impact will need time to realize.

Comparing Intel's performance to the broader market and industry over the past year, Intel underperformed both the US Semiconductor industry, which returned 19.7%, and the US Market, which returned 11.7%. This relative underperformance highlights the challenges Intel faces in achieving growth amidst structural changes and competitive pressures.

While the broader market gains and strategic announcements contributed to Intel's recent share price increase of 12.94% over the month, the price remains below the consensus analyst target of US$21.34. This suggests a cautious investor outlook, balanced between optimism around operational shifts and skepticism about immediate gains in financial performance. The fair valuation range, influenced by bearish analyst expectations, places potential revenue at US$51.6 billion in 2028 with earnings of US$3.4 billion, indicating a need for Intel to execute its strategic plans effectively to achieve consensus price targets.

Learn about Intel's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives