- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Climbs 8% With New Xeon 6 Processors Launch

Reviewed by Simply Wall St

Intel (NasdaqGS:INTC) witnessed a notable share price increase of 7.57% last month, following significant developments in its product lineup and strategic partnerships. The company launched its Xeon 6 processors, including the Xeon 6700P and 6500P series, which feature doubled memory bandwidth and enhanced AI acceleration capabilities, catering to data centers and network operations. The announcement of a partnership with Wind River to support Intel's Xeon 6 SoCs within its Studio Operator platform underscored Intel’s push into high-performance computing for cloud and edge workloads. Additionally, news emerged of Silver Lake's exclusive negotiations to acquire a majority stake in Intel's programmable chips unit, potentially reshaping its business strategy. Despite broader market declines, including a 4% drop in the tech-heavy Nasdaq Composite influenced by economic concerns and tariffs, Intel's strategic moves and product advancements may have helped bolster investor confidence, leading to robust performance in contrast to the broader industry's slump.

Take a closer look at Intel's potential here.

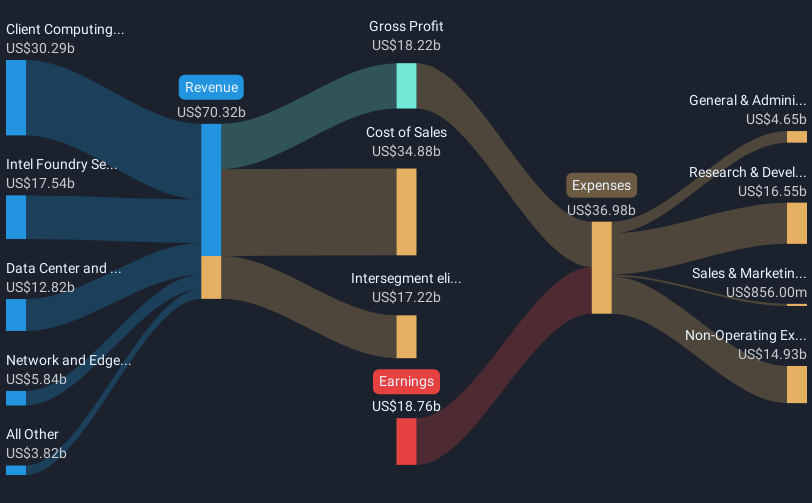

Over the last five years, Intel's total shareholder return was down 48.60%, reflecting challenges such as declining earnings and increased net losses, particularly evident in recent reports where sales fell from US$54.23 billion to US$53.10 billion, and the company recorded a net loss of US$18.76 billion. Additionally, despite introducing advanced products like Xeon processors and engaging in strategic partnerships, Intel struggled to outperform the US market and semiconductor industry, both of which achieved positive annual returns. Leadership transitions, such as the retirement of CEO Pat Gelsinger, also marked significant shifts within the company.

Moreover, M&A talks were initiated, including discussions with Silver Lake over Intel’s programmable chips unit, signaling possible structural change. Meanwhile, no shares were repurchased late in 2024, despite a substantial buyback program since 2005. Despite these efforts, Intel's trajectory has been influenced by a combination of internal challenges and external market conditions impacting its long-term performance.

- See how Intel measures up with our analysis of its intrinsic value versus market price.

- Analyze the downside risks for Intel and understand their potential impact—click to learn more.

- Got skin in the game with Intel? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with moderate growth potential.