- United States

- /

- Semiconductors

- /

- NasdaqCM:INDI

Bullish: Analysts Just Made A Huge Upgrade To Their indie Semiconductor, Inc. (NASDAQ:INDI) Forecasts

Celebrations may be in order for indie Semiconductor, Inc. (NASDAQ:INDI) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. The stock price has risen 5.7% to US$9.89 over the past week, suggesting investors are becoming more optimistic. It will be interesting to see if this latest upgrade is enough to kickstart further buying interest in the stock.

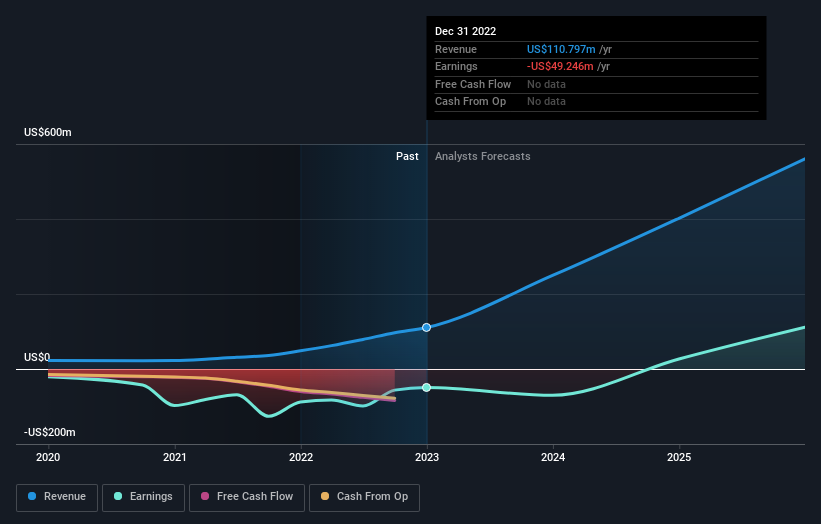

Following the upgrade, the latest consensus from indie Semiconductor's six analysts is for revenues of US$249m in 2023, which would reflect a substantial 125% improvement in sales compared to the last 12 months. Per-share losses are expected to see a sharp uptick, reaching US$0.45. However, before this estimates update, the consensus had been expecting revenues of US$223m and US$0.72 per share in losses. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to this year's revenue estimates, while at the same time reducing their loss estimates.

Check out our latest analysis for indie Semiconductor

It will come as no surprise to learn that the analysts have increased their price target for indie Semiconductor 14% to US$15.33 on the back of these upgrades. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values indie Semiconductor at US$20.00 per share, while the most bearish prices it at US$12.00. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The analysts are definitely expecting indie Semiconductor's growth to accelerate, with the forecast 125% annualised growth to the end of 2023 ranking favourably alongside historical growth of 62% per annum over the past three years. Compare this with other companies in the same industry, which are forecast to grow their revenue 8.2% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that indie Semiconductor is expected to grow much faster than its industry.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses this year, perhaps suggesting indie Semiconductor is moving incrementally towards profitability. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at indie Semiconductor.

It's great to see the analysts upgrading their estimates, but the biggest highlight to us is that the business is expected to become profitable in the foreseeable future. For more information, you can click through to our free platform to learn more about these forecasts.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if indie Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:INDI

indie Semiconductor

Provides automotive semiconductors and software solutions for advanced driver assistance systems, driver automation, in-cabin, connected car, and electrification applications.

High growth potential with excellent balance sheet.