- United States

- /

- Basic Materials

- /

- NYSE:SUM

US Exchange: 3 Stocks That Investors Might Be Undervaluing

Reviewed by Simply Wall St

As major U.S. stock indexes navigate a mix of corporate earnings reports and fresh economic data, investors are closely monitoring the market for signs of stability amid fluctuating indices and economic indicators. In this environment, identifying undervalued stocks can be crucial for investors seeking opportunities that may not yet be fully recognized by the market, offering potential value in a landscape where careful analysis is key.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bank of Marin Bancorp (NasdaqCM:BMRC) | $22.90 | $44.35 | 48.4% |

| California Resources (NYSE:CRC) | $52.09 | $104.09 | 50% |

| Atlanticus Holdings (NasdaqGS:ATLC) | $37.65 | $72.49 | 48.1% |

| Vita Coco Company (NasdaqGS:COCO) | $30.78 | $60.61 | 49.2% |

| Range Resources (NYSE:RRC) | $31.00 | $60.06 | 48.4% |

| WEX (NYSE:WEX) | $173.16 | $346.09 | 50% |

| Vitesse Energy (NYSE:VTS) | $24.94 | $49.27 | 49.4% |

| ChromaDex (NasdaqCM:CDXC) | $3.62 | $7.15 | 49.4% |

| Reddit (NYSE:RDDT) | $81.74 | $161.24 | 49.3% |

| Rapid7 (NasdaqGM:RPD) | $41.60 | $81.38 | 48.9% |

Here's a peek at a few of the choices from the screener.

DoorDash (NasdaqGS:DASH)

Overview: DoorDash, Inc. operates a commerce platform facilitating connections between merchants, consumers, and independent contractors both in the United States and internationally, with a market cap of approximately $63.12 billion.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, generating $9.61 billion.

Estimated Discount To Fair Value: 29.9%

DoorDash is trading at US$155.2, significantly below its estimated fair value of US$221.46, suggesting potential undervaluation based on discounted cash flows. Despite recent insider selling and shareholder dilution over the past year, DoorDash's revenue growth forecast of 13.6% annually surpasses the broader U.S. market rate of 8.9%. Additionally, DoorDash's strategic partnerships with companies like Wegmans and Mattress Firm could bolster future cash flows as it aims for profitability within three years.

- Insights from our recent growth report point to a promising forecast for DoorDash's business outlook.

- Click here to discover the nuances of DoorDash with our detailed financial health report.

GlobalFoundries (NasdaqGS:GFS)

Overview: GlobalFoundries Inc. is a semiconductor foundry that offers a variety of mainstream wafer fabrication services and technologies globally, with a market cap of approximately $22.20 billion.

Operations: The company generates revenue of $6.89 billion from its semiconductor segment.

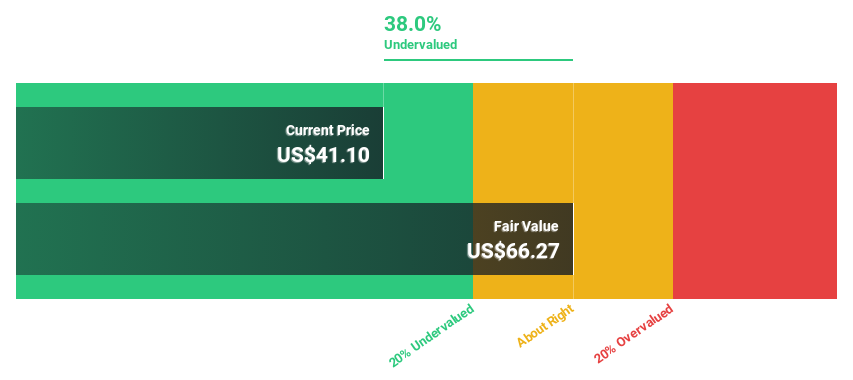

Estimated Discount To Fair Value: 38%

GlobalFoundries is trading at US$40.72, which is significantly below its estimated fair value of US$65.69, highlighting potential undervaluation based on discounted cash flows. Despite a decline in profit margins from 19.1% to 11.8%, earnings are expected to grow by 23% annually over the next three years, outpacing the U.S. market's growth rate of 15.1%. Strategic partnerships with Finwave Semiconductor and Efficient could enhance future cash flows and operational efficiencies.

- The growth report we've compiled suggests that GlobalFoundries' future prospects could be on the up.

- Get an in-depth perspective on GlobalFoundries' balance sheet by reading our health report here.

Summit Materials (NYSE:SUM)

Overview: Summit Materials, Inc. is a vertically integrated construction materials company operating in the United States and Canada with a market cap of approximately $8.01 billion.

Operations: The company's revenue is segmented into East ($942.03 million), West ($1.66 billion), and Cement ($773.26 million).

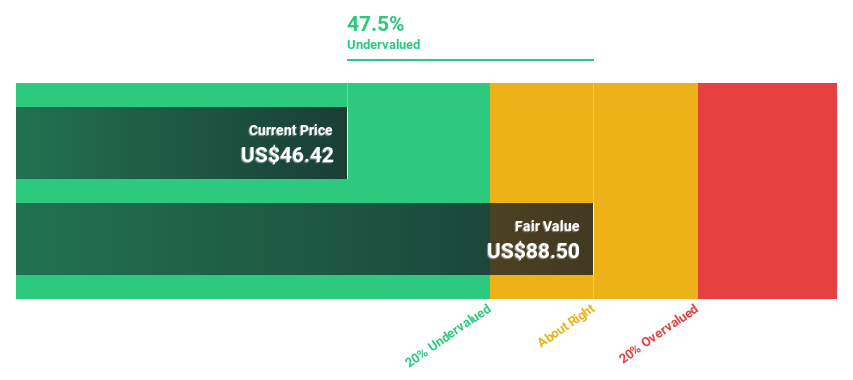

Estimated Discount To Fair Value: 47.9%

Summit Materials is trading at US$46.01, considerably below its estimated fair value of US$88.35, suggesting potential undervaluation based on discounted cash flows. Despite recent executive changes and a low forecasted return on equity of 8%, the company anticipates significant earnings growth of 23.7% annually over the next three years, surpassing the U.S. market average of 15.1%. However, interest payments are not well covered by earnings and shareholder dilution occurred last year.

- Our comprehensive growth report raises the possibility that Summit Materials is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Summit Materials.

Seize The Opportunity

- Explore the 195 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Summit Materials, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SUM

Summit Materials

Operates as a vertically integrated construction materials company in the United States and Canada.

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives