- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Enphase Energy (NasdaqGM:ENPH) Sees 24% Weekly Price Drop

Reviewed by Simply Wall St

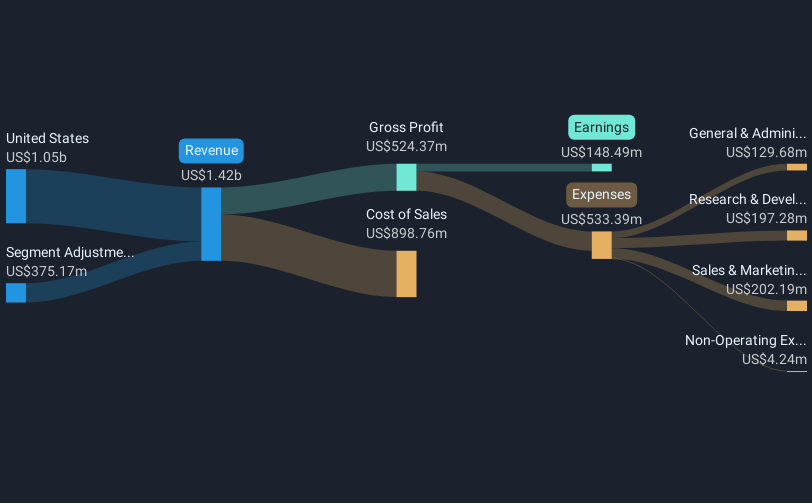

Enphase Energy (NasdaqGM:ENPH) recently introduced its IQ Energy Management system in France, leveraging AI to optimize household energy savings, and launched the IQ Balcony Solar System in Germany and Belgium for easier access to solar power. However, despite these product expansions, the share price saw a 24% decline last week. This was likely influenced by broader market conditions, which saw tech shares decline amid revived trade concerns, as well as global market volatility rather than specific recent company developments. These factors added downward pressure to the company stock reflecting wider market trends.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The introduction of Enphase Energy's IQ Energy Management system in France and the IQ Balcony Solar System in Germany and Belgium could positively influence the company's European market presence. These expansions align with the narrative of leveraging AI and diversifying product offerings to potentially drive revenue growth and customer satisfaction. Although short-term share price dropped by 24%, these developments could bolster long-term earnings potential if they achieve the anticipated market penetration and customer retention.

Over the five-year period, Enphase's total shareholder return, including dividends, declined by 31.89%. In contrast, the company underperformed the U.S. market and the semiconductor industry, with technology shares generally seeing better returns over the past year. This underperformance highlights the challenges Enphase faces amid broader market pressures despite growth initiatives.

As for revenue and earnings forecasts, expanding the product portfolio internationally might mitigate some revenue pressures and align with analyst expectations of a 9.1% annual revenue growth. Analysts' consensus price target of US$59.24 reflects a 25.9% potential upside from the current share price of US$43.87, assuming the company achieves its forecasted earnings. However, existing market volatility and internal challenges, such as tariff impacts and interest rate increases, remain critical factors in realizing these forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)