- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group Holding (NasdaqGS:CRDO) Surges 69% In A Month

Reviewed by Simply Wall St

Credo Technology Group Holding (NasdaqGS:CRDO) recently experienced a significant price move of 69% over the past month. While specific news for Credo Technology hasn't been highlighted as a major catalyst in this period, the market as a whole saw a rise of 1.6% in the last week, with a 12% increase over the past 12 months, suggesting that broader market trends might contribute to its significant upside. Despite the notable surge in Credo's share price, no specific period events were noted to counter this broader market positivity. Overall, Credo's performance considerably outpaced the general market trends.

We've spotted 2 risks for Credo Technology Group Holding you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Credo Technology Group Holding's recent significant price move, with substantial gains over the past month, does not appear to stem from specific internal developments. However, it aligns with a broader market upswing of 1.6% last week and a 12% spike over the past year. Despite the lack of direct news regarding Credo as a catalyst, the company's share performance shows resilience and an upward trajectory that far exceeds the general market trends. Understanding this in the context of Credo's three-year total return of very large percent highlights long-term growth potential, despite shorter-term uncertainties.

Over this longer period, Credo's shares have delivered very large percent total returns, including share price appreciation and dividends, indicating robust investor confidence. The company's recent performance also contrasts sharply with the US Semiconductor industry's one-year return of 19.7%, illustrating the company's exceptional market position and growing acceptance of its products. Such gains could impact revenue projections, providing positive momentum as the firm expands its PCIe and optical DSP businesses.

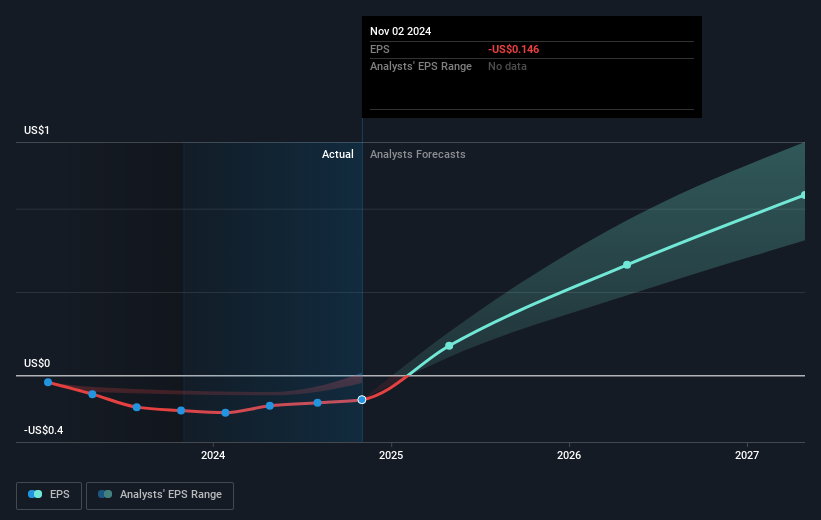

Analysts predict that Credo's revenue and earnings will grow significantly due to the expansion of its product lines, reflecting potential for sustained growth. Yet, the current share price of US$43.21 remains a marked discount to the consensus price target of approximately US$66.55, reinforcing a positive outlook. The ongoing strategic initiatives could eventually support a re-rating towards this target, contingent on continued earnings and revenue growth, along with successful diversification of the customer base.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives