- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group Holding (NasdaqGS:CRDO) Stock Dips 24% Despite US$135M Q3 Revenue Rise

Reviewed by Simply Wall St

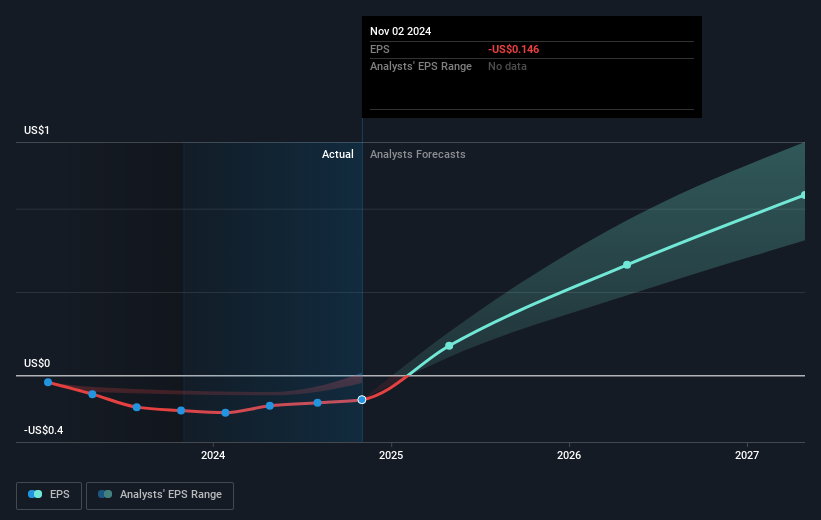

Credo Technology Group Holding (NasdaqGS:CRDO) experienced a 24% decline in share price over the past week, a significant move amid a mixed earnings season and market turmoil. While the company reported robust Q3 financials on March 4, showing a revenue increase to $135 million from $53 million year-over-year, broader market headwinds influenced its stock performance. The tech sector faced pressures as tariff concerns caused a broader sell-off, with the Nasdaq Composite down 1.1% due to persistent trade policy jitters. Despite Credo's successful product announcements, including the PCIe 5.0 retimer compliance, investor sentiment was likely overshadowed by negative macroeconomic factors affecting tech stocks. The company's projection for Q4 revenue between $155 million and $165 million and a favorable GAAP gross margin outlook did little to alleviate concerns. Overall, Credo's stock move reflects both specific achievements and broader market volatility impacting tech equities.

Unlock comprehensive insights into our analysis of Credo Technology Group Holding stock here.

Over the past three years, Credo Technology Group Holding has delivered a total return of 184.25%, distinguishing itself amidst volatile market conditions. This long-term performance reflects a mix of company-specific achievements and industry trends. In the past year alone, Credo outpaced both the US Market and the US Semiconductor industry, which saw returns of 13.1% and 10.1%, respectively. This success was partially driven by the company's marked revenue growth; for instance, the Q3 FY2025 results highlighted a net income boost to US$29.36 million from a modest US$0.43 million year-on-year. Furthermore, Credo secured significant partnerships, such as with Net One Systems in November 2024, which facilitated greater distribution channels.

Credo's product innovation played a crucial role in its stock performance. The introduction of advanced technologies like the Toucan PCIe 5.0 Retimer and 800G HiWire ZeroFlap AECs, launched between September 2024 and March 2025, signaled the company's commitment to maintaining a competitive edge. Lastly, despite insider selling over the past quarter, Credo's overall trajectory suggests a robust adaptation in the rapidly evolving tech sector, balancing challenges with strategic growth initiatives.

- Analyze Credo Technology Group Holding's fair value against its market price in our detailed valuation report—access it here.

- Discover the key vulnerabilities in Credo Technology Group Holding's business with our detailed risk assessment.

- Shareholder in Credo Technology Group Holding? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.