- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group Holding (NasdaqGS:CRDO) Climbs 15% As Revenue Hits US$72 Million

Reviewed by Simply Wall St

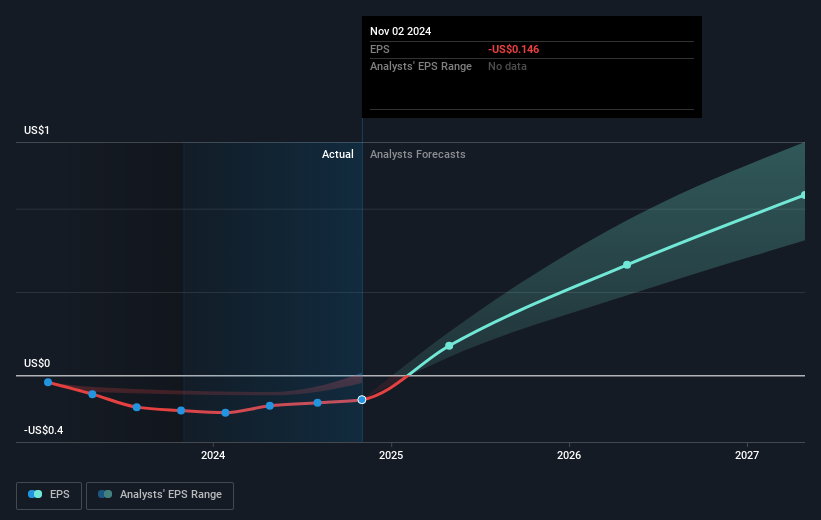

Credo Technology Group Holding (NasdaqGS:CRDO) experienced a 15.44% price increase in the last quarter, a period that featured several significant developments. The company's earnings guidance for the third quarter of fiscal 2025, projecting revenues between $115 million and $125 million, could have played a crucial role. Additionally, their earnings announcement showed improved financial performance, with second-quarter revenue rising to $72.03 million and net losses shrinking by nearly $2.4 million compared to the previous year. This financial progress aligns with broader market trends, where the tech-heavy Nasdaq witnessed fluctuations due to varying sentiments about inflation and interest rates. Despite a 5.5% monthly decline for the Nasdaq, other key tech stocks showed resilience, perhaps reflecting investor optimism in certain technology sectors. The overall market context, including fluctuating inflation data impacting the tech sector, might have added context for investors assessing Credo's prospects and contributing to its positive stock performance.

Get an in-depth perspective on Credo Technology Group Holding's performance by reading our analysis here.

Over the past three years, Credo Technology Group Holding has delivered a total shareholder return of 252.36%. During this period, the company's annual growth significantly outpaced the US Semiconductor industry, which saw a return of 19.3% over the past year. Key events contributing to this performance include launching innovative products like the Toucan and Magpie Retimers, which were introduced in October 2024 to enhance performance in applications such as generative AI infrastructure. Additionally, collaboration with Net One Systems, announced in November 2024, expanded the distribution of Credo’s products in Japan, boosting their market presence.

The company also saw improvements in financial performance, with consistent revenue growth amid financial restructuring. Noteworthy was the raise of $175 million through a follow-on equity offering completed in December 2023, which was instrumental in supporting further expansion. Concurrently, executive changes, such as appointing a new Chief Legal Officer in August 2024, reflected internal adjustments aimed at strengthening governance and future-proofing the company's trajectory.

- Discover whether Credo Technology Group Holding is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Uncover the uncertainties that could impact Credo Technology Group Holding's future growth—read our risk evaluation here.

- Is Credo Technology Group Holding part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives