- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group Holding (NASDAQ:CRDO) Is In A Strong Position To Grow Its Business

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether Credo Technology Group Holding (NASDAQ:CRDO) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Credo Technology Group Holding

When Might Credo Technology Group Holding Run Out Of Money?

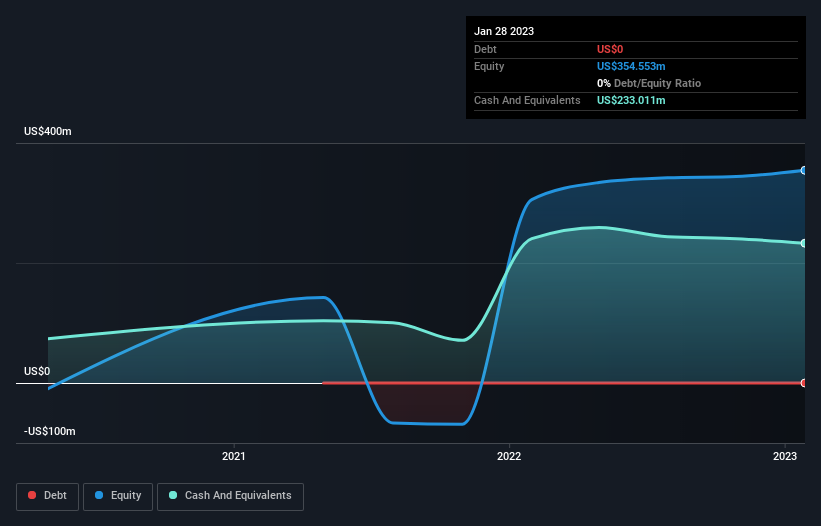

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In January 2023, Credo Technology Group Holding had US$233m in cash, and was debt-free. In the last year, its cash burn was US$38m. So it had a cash runway of about 6.2 years from January 2023. Importantly, though, analysts think that Credo Technology Group Holding will reach cashflow breakeven before then. If that happens, then the length of its cash runway, today, would become a moot point. You can see how its cash balance has changed over time in the image below.

How Well Is Credo Technology Group Holding Growing?

We reckon the fact that Credo Technology Group Holding managed to shrink its cash burn by 28% over the last year is rather encouraging. But it was the operating revenue growth of 114% that really shone. We think it is growing rather well, upon reflection. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Credo Technology Group Holding Raise Cash?

There's no doubt Credo Technology Group Holding seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Credo Technology Group Holding has a market capitalisation of US$1.2b and burnt through US$38m last year, which is 3.1% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

How Risky Is Credo Technology Group Holding's Cash Burn Situation?

As you can probably tell by now, we're not too worried about Credo Technology Group Holding's cash burn. For example, we think its revenue growth suggests that the company is on a good path. And even though its cash burn reduction wasn't quite as impressive, it was still a positive. It's clearly very positive to see that analysts are forecasting the company will break even fairly soon. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 3 warning signs for Credo Technology Group Holding that potential shareholders should take into account before putting money into a stock.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with excellent balance sheet.