- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group (CRDO): Valuation Insights Following the Launch of ZeroFlap Optical Transceivers for AI Data Centers

Reviewed by Kshitija Bhandaru

Credo Technology Group Holding (CRDO) has introduced its new ZeroFlap optical transceiver portfolio, supporting network speeds up to 1.6T. These products were unveiled at the OCP Global Summit and drew attention from across the AI infrastructure space.

See our latest analysis for Credo Technology Group Holding.

Credo’s big OCP Summit debut comes on the heels of a remarkable run for shareholders. The company’s share price has soared 82.9% year-to-date, while its 1-year total shareholder return stands at an astounding 256.7%. Recent volatility, including a sharp 13.4% one-day drop, reflects shifting risk perceptions following additional equity offerings and ongoing insider sales. However, momentum over the past year puts Credo on the radar for investors looking at high-growth AI infrastructure plays.

If Credo’s surge has sparked your curiosity, this is the perfect moment to search for other leading-edge tech names with our See the full list for free.

Yet with Credo’s shares riding high after these transformative developments, the crucial question remains: is there still room for upside, or has the market already priced in all of the company’s rapid growth?

Most Popular Narrative: 17.4% Undervalued

With Credo trading at $129.75 and the most-followed narrative estimating a fair value over $150, the gap between the current price and consensus value has widened. This sets the context for an optimistic outlook, but with assumptions that are ripe for deeper scrutiny.

The industry-wide transition towards energy-efficient, high-speed interconnects (such as AECs) in data centers and hyperscale infrastructure aligns directly with Credo's product strengths and market leadership. This positioning could allow the company to benefit from secular shifts, improving operating leverage, and net margins.

Want to know what powers this bold valuation call? The most popular narrative is banking on a leap in revenue growth, a transformation in operating margins, and a future profit multiple that could rival the hottest names in tech. Ready to see how these financial targets stack up against reality? Uncover the critical drivers behind this fair value and decide if the story holds up.

Result: Fair Value of $157.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative faces risks if hyperscaler spending slows, or if increased competition and integration challenges reduce margins and growth expectations.

Find out about the key risks to this Credo Technology Group Holding narrative.

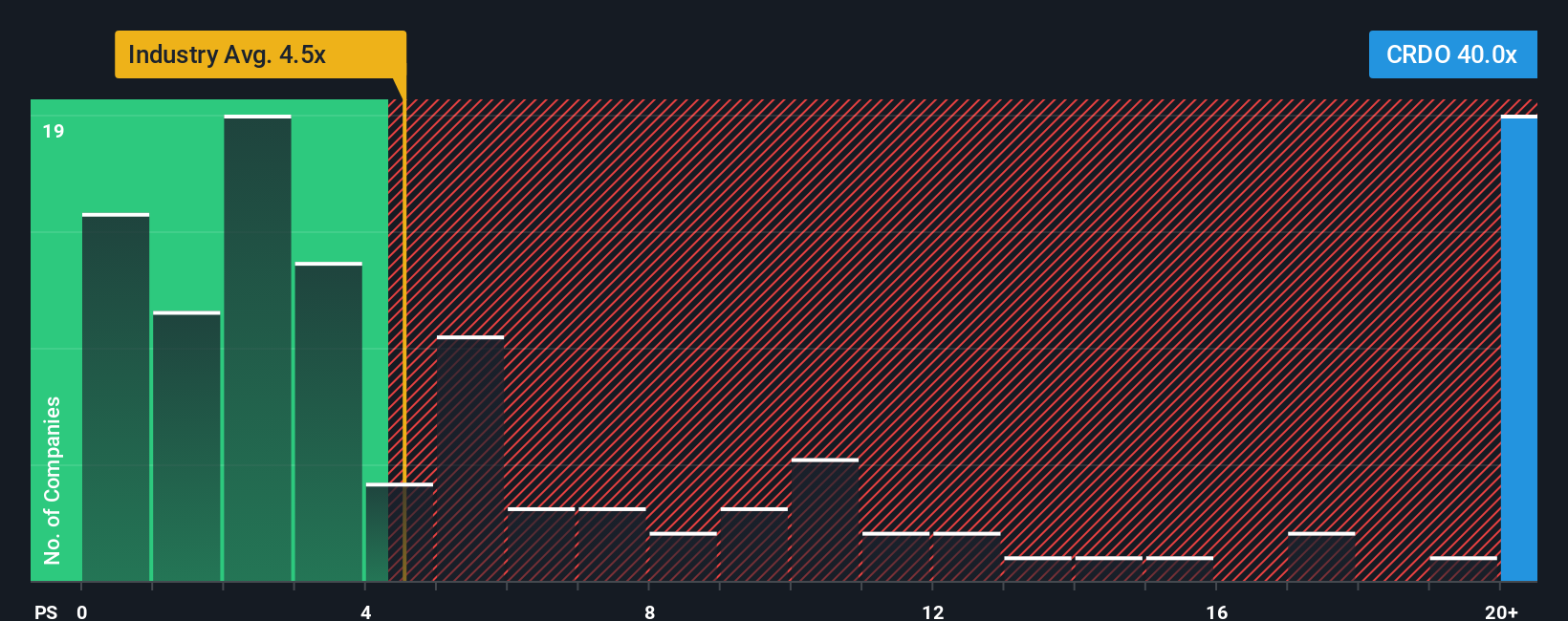

Another View: Market Multiples Tell a Cautionary Story

While the consensus narrative finds Credo shares undervalued based on future growth, a look at pricing through market multiples raises red flags. Credo currently trades at 37.4 times its sales, much higher than the peer average of 17.8 and the US semiconductor industry average of 5.2. The fair ratio suggests the market could eventually settle closer to 22.1 times sales, a level well below today's mark. This gap points to a risk that investors might be overpaying if business growth does not keep pace with expectations.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Credo Technology Group Holding Narrative

If you think the current story misses something or want to put your own perspective to the test, you can explore the numbers yourself and build a fresh view in just a few minutes. Do it your way

A great starting point for your Credo Technology Group Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for opportunity to find you. Sharpen your investing edge by searching for smart stock picks across different themes using our powerful screeners.

- Tap into fast-growing innovation by browsing these 25 AI penny stocks and get ahead of the curve with companies at the forefront of artificial intelligence.

- Amplify your portfolio’s earning power by checking out these 18 dividend stocks with yields > 3% with yields above 3% and robust financial strength.

- Stay ahead of the pack and evaluate these 881 undervalued stocks based on cash flows that show real value potential based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives