- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group (CRDO) Valuation in Focus After Strong Earnings Reversal and Upbeat Outlook

Reviewed by Simply Wall St

Credo Technology Group Holding (CRDO) just laid out an impressive earnings report for the first quarter, putting to rest last year’s loss with both surging revenue and a swing to profitability. Revenue soared to $223 million from about $60 million a year ago, and net income flipped from negative to a $63 million gain. In addition, management’s upbeat revenue and margin guidance for next quarter has caught the market’s eye, adding fuel to the conversation around Credo’s long-term prospects.

Not surprisingly, the stock’s momentum is hard to miss. Shares have climbed almost five-fold over the past year, and gains have only accelerated over the past three months. A recent resolution of a patent dispute also lowered legal overhang, further improving sentiment. This series of catalysts has many wondering if Credo’s story has shifted from turnaround to high-growth contender.

As expectations reset, the big question is whether the current price reflects ongoing growth ahead or if there is still more upside to uncover. Could now be a buying opportunity, or has the market already priced in these stellar results?

Most Popular Narrative: 34.7% Overvalued

The prevailing narrative views Credo Technology Group Holding as significantly overvalued based on consensus projections for future earnings and margin expansion.

While anticipated multi-year architecture upgrades and the shift toward 200G SerDes, PCIe Gen 6/7, and 1.6T solutions suggest ongoing market expansion, these trends are well-known and already reflected in high revenue and margin expectations. Any delay in industry adoption cycles or slower-than-expected protocol transitions could negatively impact future top-line growth and net margins.

Can you handle the truth about what is driving this rich valuation? Think you know the core assumptions behind these ambitious forecasts? Find out what analysts believe is powering this story and discover the one factor that could make or break its price target. The numbers may surprise you.

Result: Fair Value of $109.5 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued AI data growth and stronger customer diversification could bolster Credo’s sales trajectory. This could challenge the consensus view on its valuation.

Find out about the key risks to this Credo Technology Group Holding narrative.Another View: SWS DCF Model Puts a Brake on Optimism

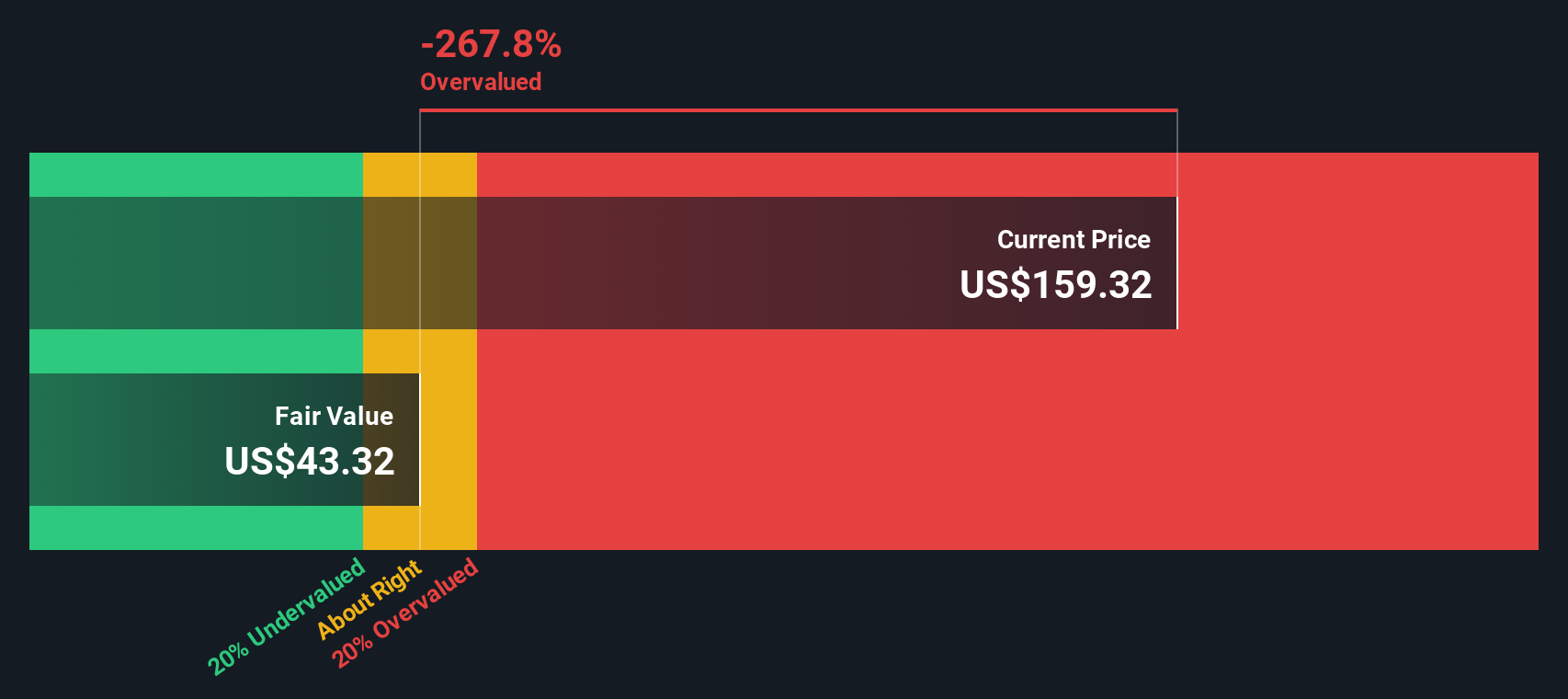

While many are watching revenue growth and industry multiples, our SWS DCF model offers a starkly different perspective. It currently suggests the stock is actually overvalued, casting doubt on the upbeat projections seen elsewhere. Which story will the market ultimately believe?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Credo Technology Group Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Credo Technology Group Holding Narrative

If you see things differently or want to dig into the numbers firsthand, you can build your own story in just a few minutes. Do it your way

A great starting point for your Credo Technology Group Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit your options to just one company? Uncover fresh opportunities right now and make your watchlist stand out with high-potential stocks suited to your goals.

- Unlock standout opportunities in undervalued companies and seize potential bargains by starting your search with undervalued stocks based on cash flows in just a few clicks.

- Explore the future of healthcare by scoping out advanced medical innovators using the power of healthcare AI stocks for smarter investment choices.

- Fuel your portfolio with the latest AI breakthroughs and identify fast-rising tech leaders through AI penny stocks before they make headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)