- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

3 Growth Companies With High Insider Ownership And 35% Revenue Growth

Reviewed by Simply Wall St

In a week marked by significant market volatility, with the Dow Jones and Nasdaq experiencing sharp declines following recent tariff announcements, investors are keenly observing growth companies that demonstrate resilience. Amidst this backdrop, stocks with high insider ownership and robust revenue growth can be particularly appealing as they may indicate strong confidence from those closest to the business and potential for sustained performance despite broader market turbulence.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.3% | 21.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.3% | 64.8% |

| Astera Labs (NasdaqGS:ALAB) | 15.8% | 61.4% |

| Red Cat Holdings (NasdaqCM:RCAT) | 19.4% | 122.6% |

| Niu Technologies (NasdaqGM:NIU) | 36.2% | 82.8% |

| Clene (NasdaqCM:CLNN) | 19.5% | 63.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.8% |

Let's dive into some prime choices out of the screener.

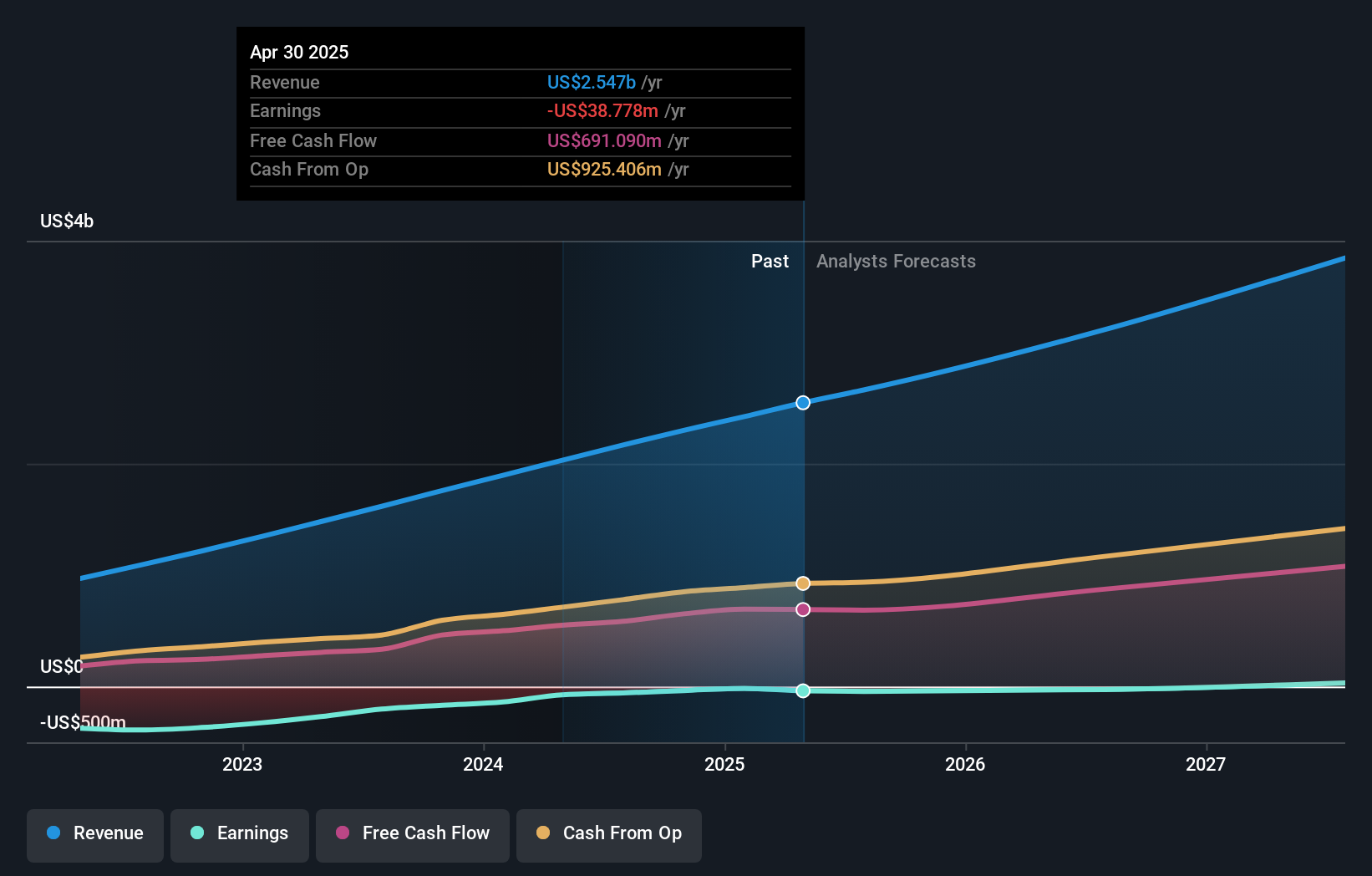

AAON (NasdaqGS:AAON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AAON, Inc. is involved in the engineering, manufacturing, marketing, and selling of air conditioning and heating equipment in the United States and Canada, with a market cap of approximately $6.69 billion.

Operations: The company's revenue segments include $865.05 million from AAON Oklahoma and $182.24 million from AAON Coil Products, alongside $198.72 million from Basx.

Insider Ownership: 17.6%

Revenue Growth Forecast: 14.2% p.a.

AAON is positioned for growth, with revenue and earnings expected to outpace the US market. Despite modest insider buying, the company maintains high insider ownership. Recent executive changes aim to leverage expertise in data center cooling, enhancing growth prospects. While recent earnings showed a dip in net income, AAON anticipates mid- to high-teens sales growth for 2025. Analysts predict a significant stock price increase of 36.5%, reflecting confidence in its future trajectory.

- Dive into the specifics of AAON here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that AAON is priced higher than what may be justified by its financials.

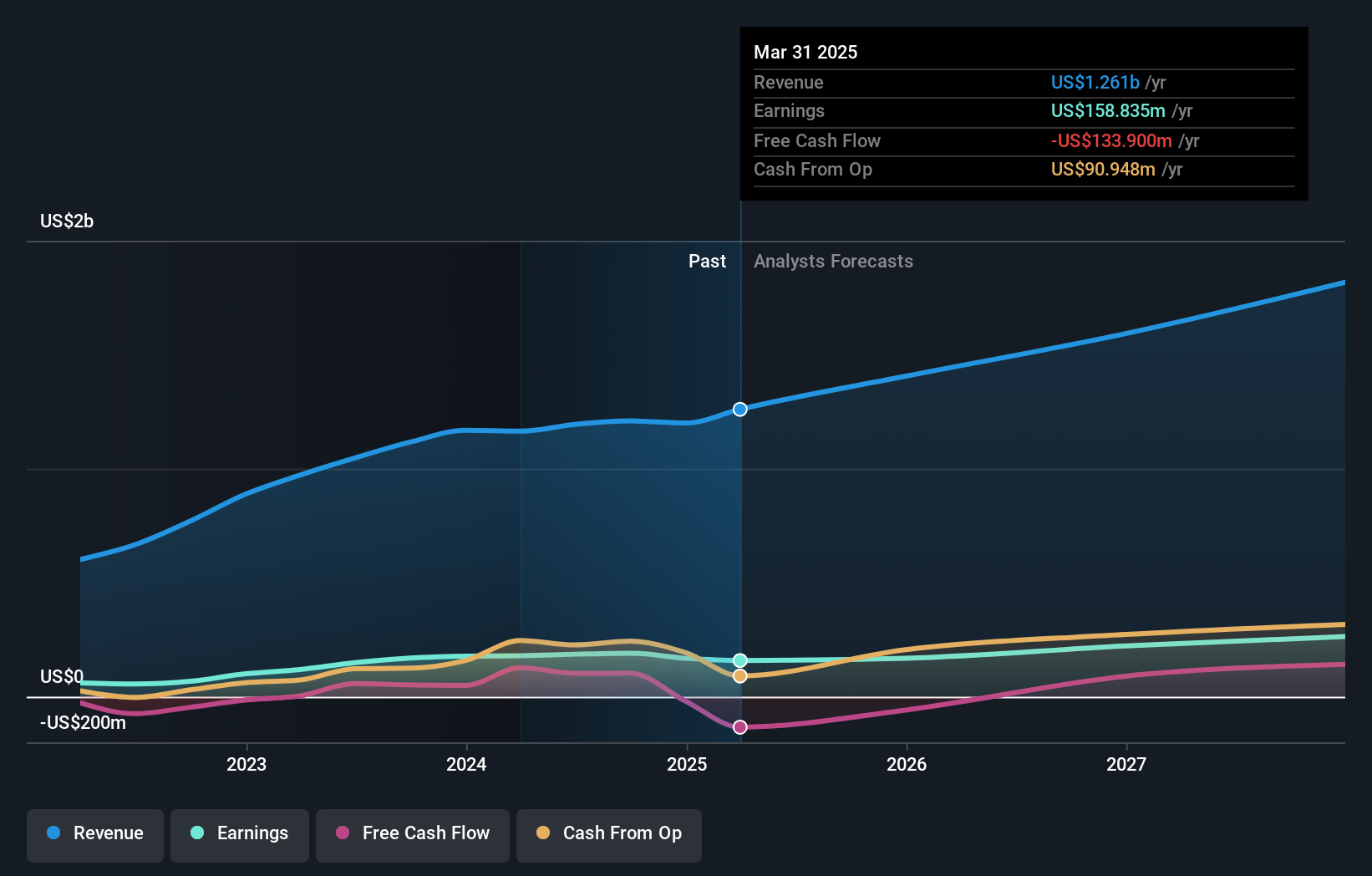

Credo Technology Group Holding (NasdaqGS:CRDO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Credo Technology Group Holding Ltd offers high-speed connectivity solutions for optical and electrical Ethernet applications across several regions, including the United States and Asia, with a market cap of approximately $7.35 billion.

Operations: The company's revenue is primarily derived from its Semiconductors segment, which generated $327.53 million.

Insider Ownership: 12.3%

Revenue Growth Forecast: 35.6% p.a.

Credo Technology Group Holding is poised for significant growth, with revenue and earnings expected to surpass the US market's pace. Despite notable insider selling recently, the company remains profitable and forecasts annual earnings growth of 64.8%. Recent product launches, such as the Lark optical DSP family, highlight its innovation in high-performance connectivity solutions. Executive changes aim to strengthen leadership amid strategic partnerships like WPG Americas Inc., enhancing Credo's position in data centers and telecommunications sectors.

- Navigate through the intricacies of Credo Technology Group Holding with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Credo Technology Group Holding's share price might be too optimistic.

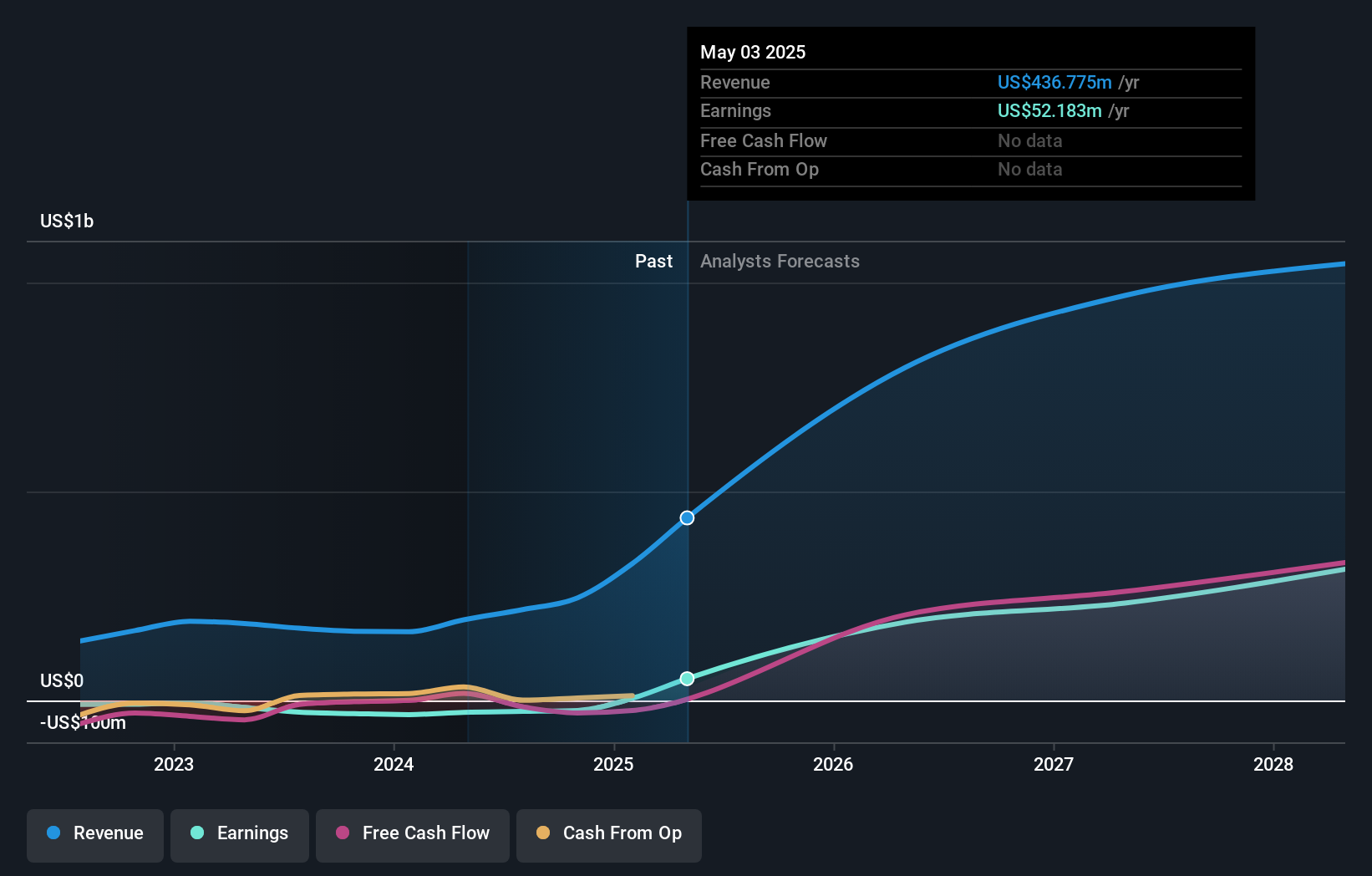

Zscaler (NasdaqGS:ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market cap of approximately $30.23 billion.

Operations: The company's revenue is primarily generated from the sales of subscription services to its cloud platform and related support services, totaling approximately $2.42 billion.

Insider Ownership: 19.6%

Revenue Growth Forecast: 16.5% p.a.

Zscaler's revenue is expected to grow 16.5% annually, outpacing the US market. Despite recent insider selling, the company anticipates becoming profitable in three years with a high return on equity forecast of 27.1%. Collaborations like the one with T-Mobile showcase its strategic expansion in zero trust security solutions. Recent executive appointments and conference presentations underscore Zscaler's focus on innovation and leadership in cloud security, driving potential growth and market presence.

- Click here to discover the nuances of Zscaler with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Zscaler's share price might be too pessimistic.

Make It Happen

- Gain an insight into the universe of 195 Fast Growing US Companies With High Insider Ownership by clicking here.

- Ready To Venture Into Other Investment Styles? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives