- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (NasdaqGS:AVGO) Unveils World's First 102.4 Terabits/sec Ethernet Switch

Reviewed by Simply Wall St

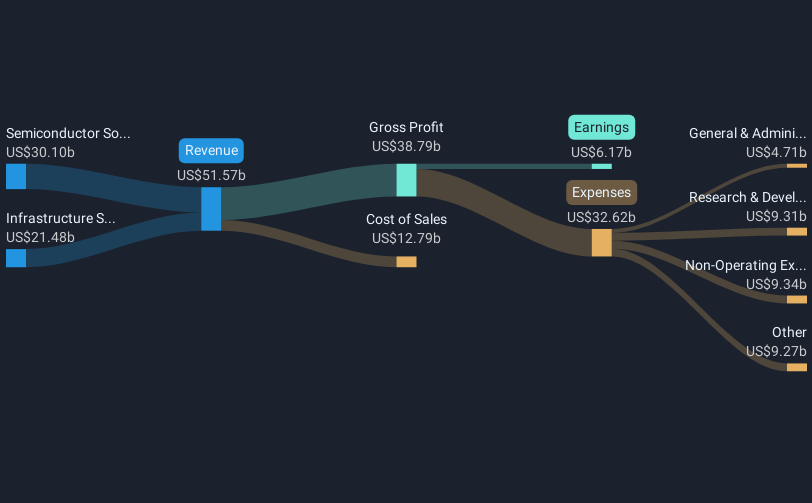

Broadcom (NasdaqGS:AVGO) has officially begun shipping the Tomahawk 6 switch series, marking a significant milestone in AI-optimized network infrastructure. This development aligns with the company's recent impressive quarterly performance, where it recorded a 34% price increase. This upsurge was further bolstered by its robust Q1 earnings report, showing substantial revenue and net income growth. The introduction of new AI-powered features in CloudHealth and advancements in co-packaged optics also contributed to Broadcom's positive momentum. While the market saw a general upward trend, Broadcom’s focused innovations in AI and network technologies likely amplified its stronger position.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent launch of Broadcom's Tomahawk 6 switch series represents a meaningful development within its AI-optimized network solutions. These advancements may reinforce the company's strategic focus on AI technology, potentially propelling future revenue streams and profit margins. By intensifying efforts in AI R&D and forming significant hyperscale partnerships, Broadcom aims to enhance its technological leadership, setting the stage for improved long-term financial performance.

Over the past five years, Broadcom's shares have experienced a very large total return, indicating strong value generation for shareholders. Comparatively, in the more recent one-year period, Broadcom's stock outperformed the US Semiconductor industry, which saw an 11.6% increase. This suggests the company's strong positioning amidst broader industry dynamics.

Looking ahead, the integration of AI-optimized technologies is projected to affect revenue and earnings forecasts positively. The current revenue of 54.53 billion and earnings of 10.40 billion are expected to experience significant growth as new AI partnerships mature. Despite these prospects, analysts' consensus price target of US$238.54 reveals potential upside compared to the current share price of US$200.09. Yet, investors must weigh this alongside potential risks such as R&D expenses, customer concentration, and geopolitical factors that could impact projections. As shares are trading at a discount to the consensus target, this may present a valuation opportunity, contingent on how Broadcom navigates its strategic initiatives and market challenges.

Understand Broadcom's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)