- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (NasdaqGS:AVGO) Unveils Expanded Optical Solutions Amid Market Decline (14% Last Week)

Reviewed by Simply Wall St

Broadcom (NasdaqGS:AVGO) saw a 14% decline in its share price over the past week, possibly influenced by the broader market turmoil caused by the announcement of new tariffs, which pushed the Nasdaq into bear market territory. This fall coincided with Broadcom's announcement of expanded optical interconnect solutions, indicative of its focus on AI infrastructure. Despite presenting significant innovations at the Optical Fiber Communications Conference, Broadcom wasn’t immune to the market’s downturn, which saw semiconductor stocks, including Nvidia and Intel, particularly hard hit. The market's broader decline of 9.4% compounded challenges, reflecting widespread investor apprehension amidst evolving trade policies.

We've identified 3 weaknesses for Broadcom that you should be aware of.

The recent developments highlighted in the introduction, including Broadcom's expanded optical solutions, align with its strategy to invest in AI infrastructure and secure future growth. However, the announcement coinciding with new tariffs and market volatility might influence investor sentiment, possibly affecting revenue and earnings forecasts by introducing uncertainty around trade impacts.

Broadcom's shares have shown impressive long-term growth, with a total return exceeding 553% over the past five years. Over the last year, Broadcom outperformed the US Semiconductor industry, which faced a decline of 10.7%. This historical performance indicates resilience, although recent share price declines contrast with its long-term trajectory.

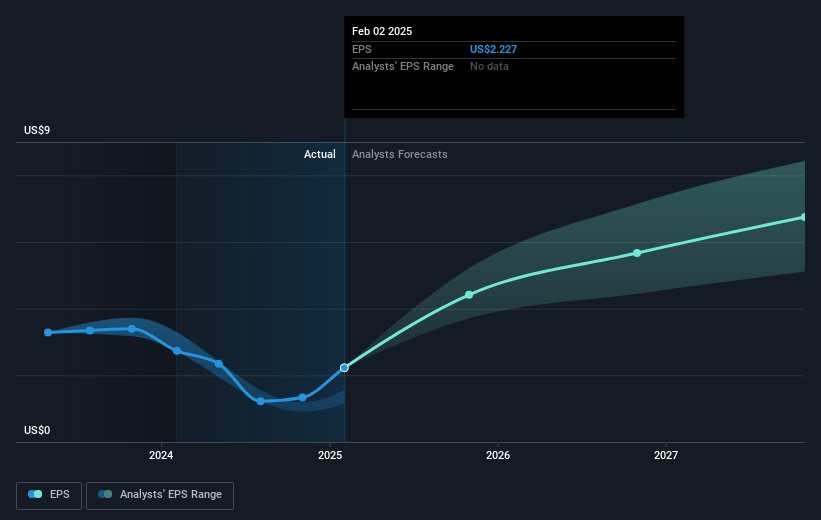

The current share price of US$168.52 reflects a significant discount to the consensus analyst price target of US$250.42, implying a 32.7% potential upside. While analysts foresee strong growth in revenue and earnings, projected to climb to $89.8 billion and $37.4 billion, respectively, by 2028, the recent market downturn serves as a reminder of external risk factors that could affect these forecasts. Investors should weigh these uncertainties against the company's strategic positioning in AI and semiconductor markets.

Review our growth performance report to gain insights into Broadcom's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)