- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (NasdaqGS:AVGO) Announces AI-Powered Cybersecurity Solution To Combat Evolving Threats

Reviewed by Simply Wall St

Broadcom (NasdaqGS:AVGO) recently launched "Incident Prediction," a groundbreaking AI-driven security feature within its Symantec Endpoint Security Complete suite. This innovation aims to improve cybersecurity by predicting and mitigating potential cyber threats. Over the past week, Broadcom's stock increased by 16%, outpacing the market's 7% rise. While tech stocks broadly benefited from calmer markets and tariff exemptions, Broadcom's specific advancements in cybersecurity likely strengthened its position further. In contrast, broader tech sectors, including AI chipmakers like Nvidia, saw moderate gains, demonstrating robust investor interest in tech solutions amid ongoing trade uncertainties.

Be aware that Broadcom is showing 3 possible red flags in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

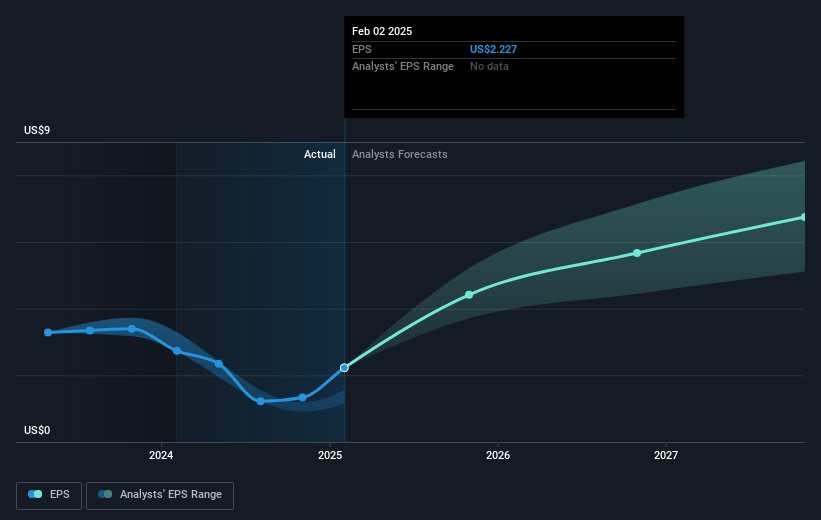

The launch of Broadcom's AI-driven security feature could further solidify its advancements in cybersecurity and have a substantial influence on its revenue and earnings forecasts. As the company continues to invest in AI R&D and forms partnerships with hyperscale companies, the new security feature may attract additional customers, enhancing its competitive edge and potentially increasing future revenue streams. Analysts have forecasted an 18% annual revenue growth over the next three years, suggesting optimism about Broadcom's ability to capitalize on innovations like Incident Prediction.

Over the past five years, Broadcom's total shareholder return, including share price appreciation and dividends, rose by a very large percentage. This performance illustrates the company's strong standing and long-term growth potential in the semiconductor industry. Over the recent one-year period, Broadcom outpaced the US Semiconductor industry, which returned 6.1%, reflecting its robustness in a challenging market environment.

Broadcom's recent price increase of 16% in the context of its price target provides valuable insight. Despite the rise, the current share price remains at a 36.7% discount to the analyst price target of US$246.39. This gap suggests that there is room for further appreciation if the company's growth initiatives align with analyst expectations. As Broadcom navigates these opportunities, the Incident Prediction feature may further bolster investor confidence in its strategic direction.

Assess Broadcom's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)