- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (AVGO): Valuation in Focus After Record Earnings, New AI Chip Deal, and High-Profile Partnerships

Reviewed by Kshitija Bhandaru

Broadcom (AVGO) stock drew attention after the company reported record quarterly earnings and revealed a multi-year custom AI chip deal, reportedly with OpenAI. New partnerships and credit upgrades have also strengthened its position in the AI infrastructure space.

See our latest analysis for Broadcom.

Broadcom’s stock continues to ride a wave of optimism, following strong quarterly earnings and new AI chip deals that underscore its momentum in the semiconductor space. Recent weeks brought positive credit upgrades and a series of debt offerings to optimize its balance sheet. The share price has steadily reflected investor enthusiasm. With a 1-year total shareholder return near 0.93% and longer-term returns stacking up even stronger, sentiment remains favorable as Broadcom further entrenches itself at the heart of the AI and tech infrastructure boom.

If Broadcom’s latest moves have you thinking bigger, explore what other industry leaders are achieving through our See the full list for free..

Yet with shares hovering just 9% below analyst price targets and future AI growth all but a consensus, investors now face a key question: is Broadcom still undervalued, or has the market already priced in its next act?

Most Popular Narrative: 8.6% Undervalued

Broadcom’s current fair value, according to the most widely followed narrative, sits nearly 9% above its last close. This offers a notable gap. This narrative relies on surging AI demand and bold future integration ambitions as the foundation for that higher price target.

Broadcom is experiencing accelerating demand for custom AI accelerators (XPUs) from hyperscale and large language model customers, underscored by the addition of a major fourth customer and a strengthened backlog, indicating robust multi-year revenue growth in the AI semiconductor segment.

Curious how an ambitious AI surge, integration plays, and deep recurring revenues set the stage for Broadcom’s value jump? The crucial ingredients behind this fair value include trends, assumptions, and future profit targets that break with industry norms. Dig deeper and see which forecasts truly make this narrative tick.

Result: Fair Value of $370.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as heavy reliance on just a handful of AI customers and increased competition from both US and Asian semiconductor firms.

Find out about the key risks to this Broadcom narrative.

Another View: How Does the Price Stack Up?

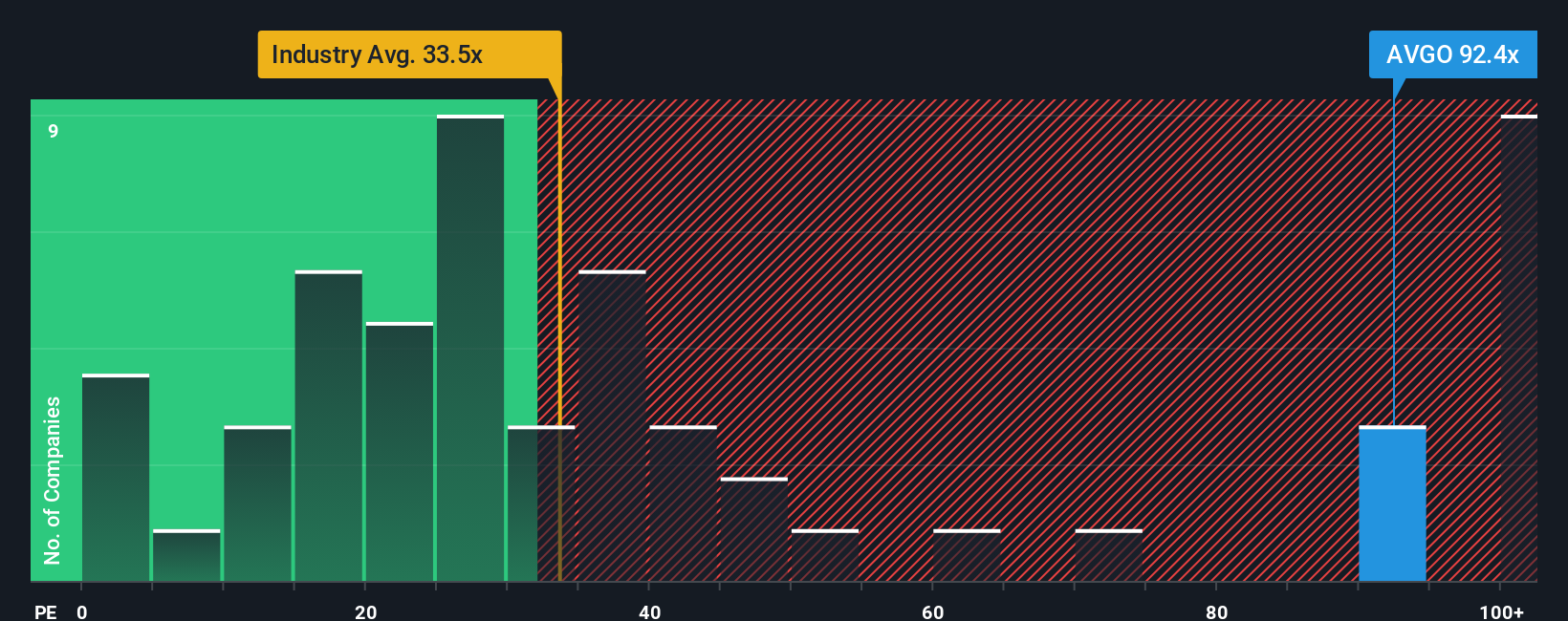

While the fair value narrative points to Broadcom as undervalued, a closer look at its price-to-earnings ratio tells a different story. Broadcom trades at 84.9x earnings, which is much higher than both the US semiconductor industry average of 37x and peers at 47.7x. Even compared to its fair ratio of 61x, it appears expensive. This poses a valuation risk if investor expectations reset. Could the market's optimism be stretching the price too far?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadcom Narrative

If the consensus story does not fit your perspective or you are driven by your own research, the data is there for you to create a personalized view in just a few minutes. Do it your way.

A great starting point for your Broadcom research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take charge of your financial future by tapping into unique market opportunities you might otherwise miss. See what’s heating up beyond Broadcom and set yourself up with more compelling investment options today.

- Unlock growth by searching for strong companies paying reliable yields through these 19 dividend stocks with yields > 3%. This can help power your portfolio income.

- Spot tomorrow’s breakthroughs by following where industry innovation meets medicine inside these 31 healthcare AI stocks. This screener is packed with the latest AI advancements reshaping healthcare.

- Seize the edge in undervalued segments and hone in on fresh potential before the market catches up, starting with these 896 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)