- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Assessing Broadcom (AVGO) Valuation After Latest Earnings Provide Fresh Insight into Growth and Margins

Reviewed by Simply Wall St

See our latest analysis for Broadcom.

Broadcom’s share price has powered ahead this year, notching a 59% year-to-date gain, while its 1-year total shareholder return has more than doubled at 121%. Solid quarterly results and momentum in semiconductors have kept sentiment strong, with recent price action suggesting that investor confidence is still building rather than reaching a peak.

If Broadcom’s run has you thinking about opportunities in tech and AI, it could be the perfect moment to explore See the full list for free.

But with Broadcom’s stock surging and valuation near analyst targets, the key question remains: Is there still room for upside for new investors, or has the market already factored in the company’s future growth potential?

Most Popular Narrative: 5.8% Undervalued

With Broadcom’s fair value now pegged at $392 and shares last closing at $369.63, the market is trading just below the narrative’s target. This prompts a closer look at how much upside remains, and whether a premium is justified by projected growth.

Broadcom is experiencing accelerating demand for custom AI accelerators (XPUs) from hyperscale and large language model customers, underscored by the addition of a major fourth customer and a strengthened backlog. This indicates robust multi-year revenue growth in the AI semiconductor segment.

The most closely followed narrative points to explosive demand, high-profile customer momentum and ambitions for market leadership, all driving a valuation few expected. But what are the game-changing assumptions behind this punchy fair value target? There are bold projections on future profits, margins, and growth that will surprise even veteran investors. Click to reveal the forecast that is setting Broadcom apart for bulls and skeptics alike.

Result: Fair Value of $392 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, with rival chipmakers mounting a competitive push and Broadcom’s AI customer base concentrated among just a few hyperscalers, downside risks remain real.

Find out about the key risks to this Broadcom narrative.

Another View: Valuation by Multiples

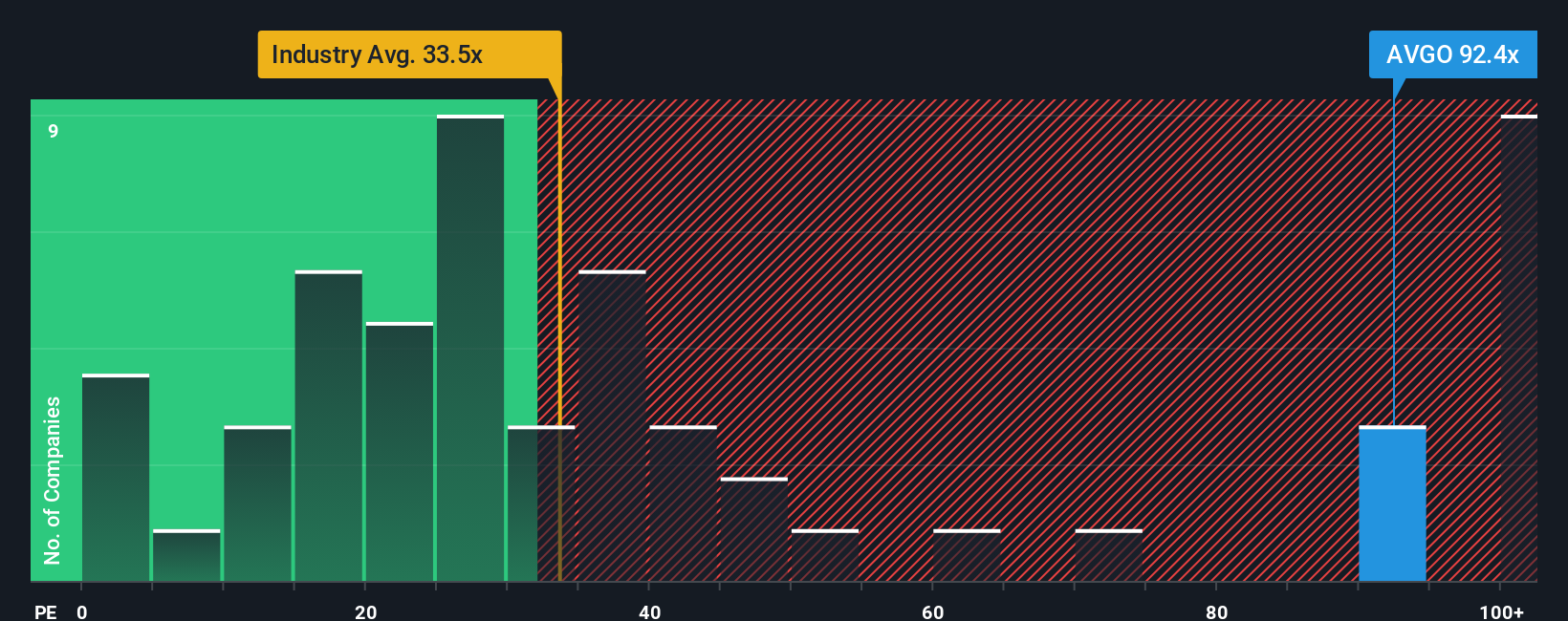

While the fair value estimate paints an optimistic picture, Broadcom’s current price-to-earnings ratio stands at 92.8x, substantially higher than both the US Semiconductor industry average of 36.1x, its peer average of 63.8x, and a fair ratio of 67.4x that the market could move toward. This premium highlights greater valuation risk if growth slows. Is bullish sentiment running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadcom Narrative

If you see Broadcom’s outlook differently or want to dig into the numbers yourself, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your Broadcom research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don’t let your search end here. Some of the market’s most promising strategies are just a click away. Make your next move and leave second-guessing behind.

- Start generating potential passive income as you tap into these 22 dividend stocks with yields > 3%, which offers yields above 3% and stable dividend histories.

- Uncover tech trailblazers by targeting these 26 AI penny stocks, focused on artificial intelligence and powering tomorrow’s breakthroughs.

- Spot hidden bargains before the crowd by zeroing in on these 840 undervalued stocks based on cash flows, selected for strong fundamentals and attractive valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)