- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Is It Too Late To Consider AMD After Its 2025 AI Surge And Recent Pullback?

Reviewed by Bailey Pemberton

- If you are wondering whether Advanced Micro Devices is still a smart consideration after its huge multi year run, or if the best days are already priced in, you are in the right place.

- Even after a recent pullback, with the stock down 4.7% over the last week and 14.6% over the past month, AMD is still up 74.7% year to date and 66.4% over the last year, reflecting a multi year gain of 226.3% over 3 years and 126.1% over 5 years.

- Recent headlines have focused on AMD's push into AI accelerators and data center GPUs, along with deepening partnerships with major cloud providers and hyperscale customers. At the same time, investors are watching how its roadmap in CPUs and GPUs compares with key competitors in both the PC and server markets.

- Right now, AMD scores a 3/6 valuation score, suggesting it screens as undervalued on half of the checks used here. In the rest of this article, we unpack what that means across different valuation approaches, before finishing with a more nuanced way to think about AMD's worth.

Approach 1: Advanced Micro Devices Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today, to see what those streams are worth in present dollar terms.

For Advanced Micro Devices, the model starts with last twelve month free cash flow of about $5.6 billion and uses analyst forecasts, then extends them further into the future. By 2029, free cash flow is projected to reach roughly $30.9 billion, with further extrapolated growth taking it to around $75.9 billion by 2035. These longer dated projections are based on a 2 Stage Free Cash Flow to Equity framework, where growth is strong in the early years and then gradually tapers off.

Discounting all of those future cash flows back to today produces an estimated intrinsic value of about $376 per share. With the DCF implying a 44.0% discount to the current market price, the model indicates that AMD is trading well below its calculated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Advanced Micro Devices is undervalued by 44.0%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

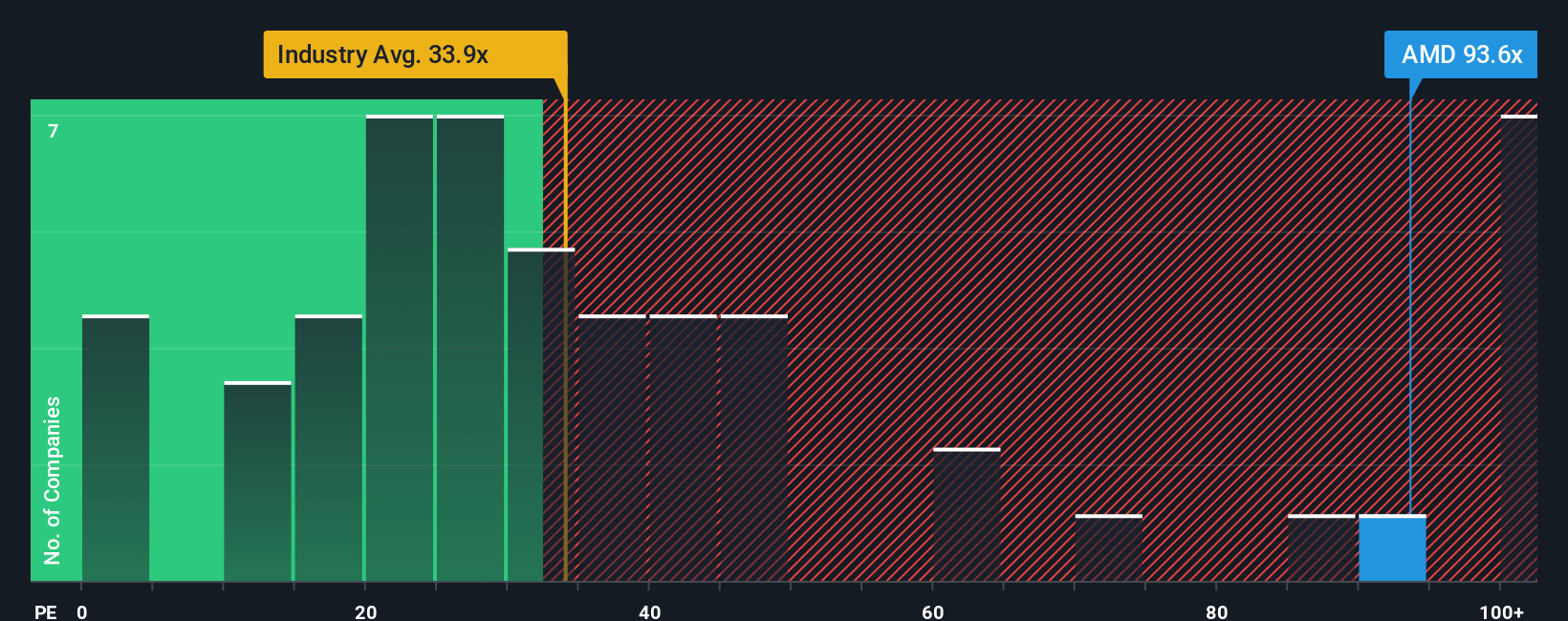

Approach 2: Advanced Micro Devices Price vs Earnings

For profitable companies like Advanced Micro Devices, the price to earnings ratio is often the most intuitive way to think about value, because it directly links what investors pay today to the earnings the business is generating. In general, faster growth and lower perceived risk justify a higher PE multiple, while slower growth or higher uncertainty should lead to a lower, more conservative multiple.

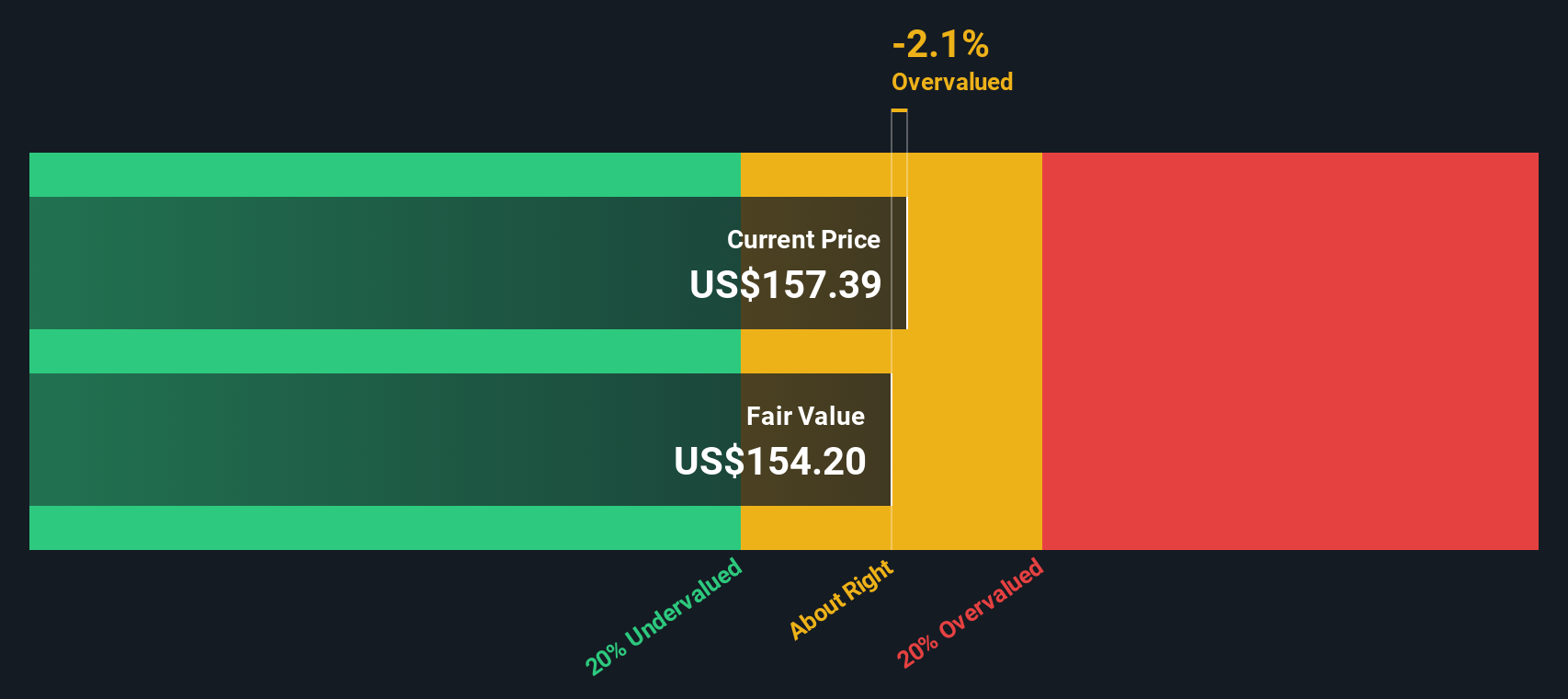

AMD currently trades on a PE of 109.6x, which is well above the Semiconductor industry average of about 37.0x and also richer than the 66.4x average of its closest peers. To move beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what a reasonable PE should be after accounting for AMD's earnings growth outlook, profit margins, industry dynamics, market cap and risk profile. This Fair Ratio for AMD is 64.0x, meaning the stock is trading at a significantly higher multiple than what those fundamentals would typically support.

On this basis, while AMD deserves a premium for its growth and competitive position, the current PE suggests the shares look overvalued relative to their Fair Ratio.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Advanced Micro Devices Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company with the numbers behind it.

A Narrative is the story you believe about Advanced Micro Devices, translated into concrete assumptions about its future revenue, earnings and margins, and then into a Fair Value estimate that you can compare to today’s share price.

On Simply Wall St, Narratives live in the Community page and are easy to use, because each one links a clear thesis about AMD with a full financial forecast and a resulting Fair Value, updating dynamically whenever new information such as earnings, guidance or major news is released.

That means Narratives can guide real decisions by helping you see at a glance whether your Fair Value is above the current price, which might support buying or holding, or below it, which might suggest trimming or waiting.

For AMD, for example, one optimistic Narrative might assume rapid AI data center adoption and justify a Fair Value near $290 per share. A more cautious Narrative, focused on export controls and competition, might support a Fair Value closer to $137. Narratives make both perspectives explicit and comparable.

For Advanced Micro Devices, here are previews of two leading Advanced Micro Devices narratives:

🐂 Advanced Micro Devices Bull Case

Fair value: $283.57 per share

Implied undervaluation vs last close: -25.8%

Revenue growth assumption: 34.7%

- Views AMD as a long-term participant in multiyear AI data center and adaptive computing demand, with the potential for margins to expand as scale improves.

- Assumes strong adoption of MI3xx and future Instinct GPUs, EPYC CPUs and Xilinx-based adaptive platforms, supported by deep hyperscaler and sovereign deals.

- Accepts elevated R&D and capex today in exchange for structurally higher earnings power, which supports a premium multiple relative to the sector.

🐻 Advanced Micro Devices Bear Case

Fair value: $193.68 per share

Implied overvaluation vs last close: 8.8%

Revenue growth assumption: 18.8%

- Highlights AMD's dependence on TSMC, cyclicality in PCs and gaming, and intense competition from Nvidia, Intel and ARM-based designs as key risks.

- Views AI and data center as attractive but crowded markets, where Nvidia's ecosystem lead and custom accelerators could limit AMD's ultimate share.

- Argues that macro uncertainty, export controls and execution risk could cap upside, making AMD potentially more suitable for higher-risk investors who can tolerate volatility.

Do you think there's more to the story for Advanced Micro Devices? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)