- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Are Advanced Micro Devices's (NASDAQ:AMD) Statutory Earnings A Good Guide To Its Underlying Profitability?

As a general rule, we think profitable companies are less risky than companies that lose money. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether Advanced Micro Devices's (NASDAQ:AMD) statutory profits are a good guide to its underlying earnings.

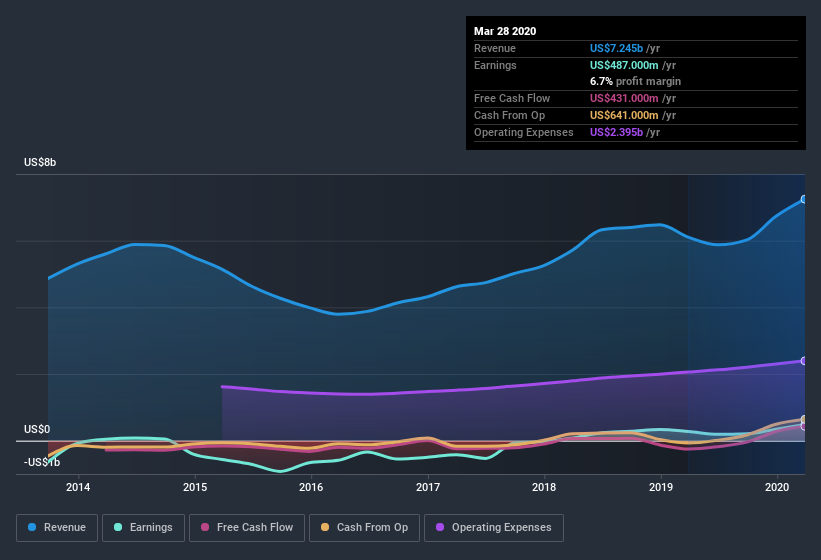

We like the fact that Advanced Micro Devices made a profit of US$487.0m on its revenue of US$7.25b, in the last year. The chart below shows that revenue has improved over the last three years, and, even better, the company has moved from unprofitable to profitable.

View our latest analysis for Advanced Micro Devices

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. In this article we'll look at how Advanced Micro Devices is impacting shareholders by issuing new shares, as well as how unusual items have affected the income line. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, Advanced Micro Devices increased the number of shares on issue by 8.3% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Advanced Micro Devices's historical EPS growth by clicking on this link.

How Is Dilution Impacting Advanced Micro Devices's Earnings Per Share? (EPS)

Advanced Micro Devices was losing money three years ago. The good news is that profit was up 79% in the last twelve months. On the other hand, earnings per share are only up 59% over the same period. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if Advanced Micro Devices can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

The Impact Of Unusual Items On Profit

On top of the dilution, we should also consider the US$168m impact of unusual items in the last year, which had the effect of suppressing profit. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect Advanced Micro Devices to produce a higher profit next year, all else being equal.

Our Take On Advanced Micro Devices's Profit Performance

Advanced Micro Devices suffered from unusual items which depressed its profit in its last report; if that is not repeated then profit should be higher, all else being equal. But on the other hand, the company issued more shares, so without buying more shares each shareholder will end up with a smaller part of the profit. Based on these factors, it's hard to tell if Advanced Micro Devices's profits are a reasonable reflection of its underlying profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. While conducting our analysis, we found that Advanced Micro Devices has 2 warning signs and it would be unwise to ignore these.

Our examination of Advanced Micro Devices has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade Advanced Micro Devices, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)