- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (AMD) Partners In AI-Driven Drug Discovery With Absci And Oracle

Reviewed by Simply Wall St

Advanced Micro Devices (AMD) recently formed a collaboration with Oracle Cloud Infrastructure and Absci to advance AI-driven drug discovery, leveraging its cutting-edge hardware like the Instinct MI355X GPUs. This partnership, alongside AMD's alliances with Aligned and HCLTech, showcases its commitment to technological innovation. Over the last quarter, AMD's stock price increased by 34%, which aligns with the tech-heavy Nasdaq Composite's overall positive trajectory and new record highs. The strategic partnerships and positive earnings results, including a significant increase in sales and net income, likely contributed to AMD's strong share performance during this period.

Advanced Micro Devices (AMD) is experiencing a notable phase with its recent collaboration with Oracle Cloud Infrastructure and Absci. This partnership could potentially enhance AMD's position in AI-driven drug discovery by leveraging its Instinct MI355X GPUs. While this aligns with AMD's aim to push technological boundaries, it also faces headwinds due to US export restrictions and increased competition. Over the past five years, AMD's total shareholder return was substantial at 103.36%, indicating significant growth compared to its more recent challenges where it underperformed the US Semiconductor industry, which returned 45.9% over the last year.

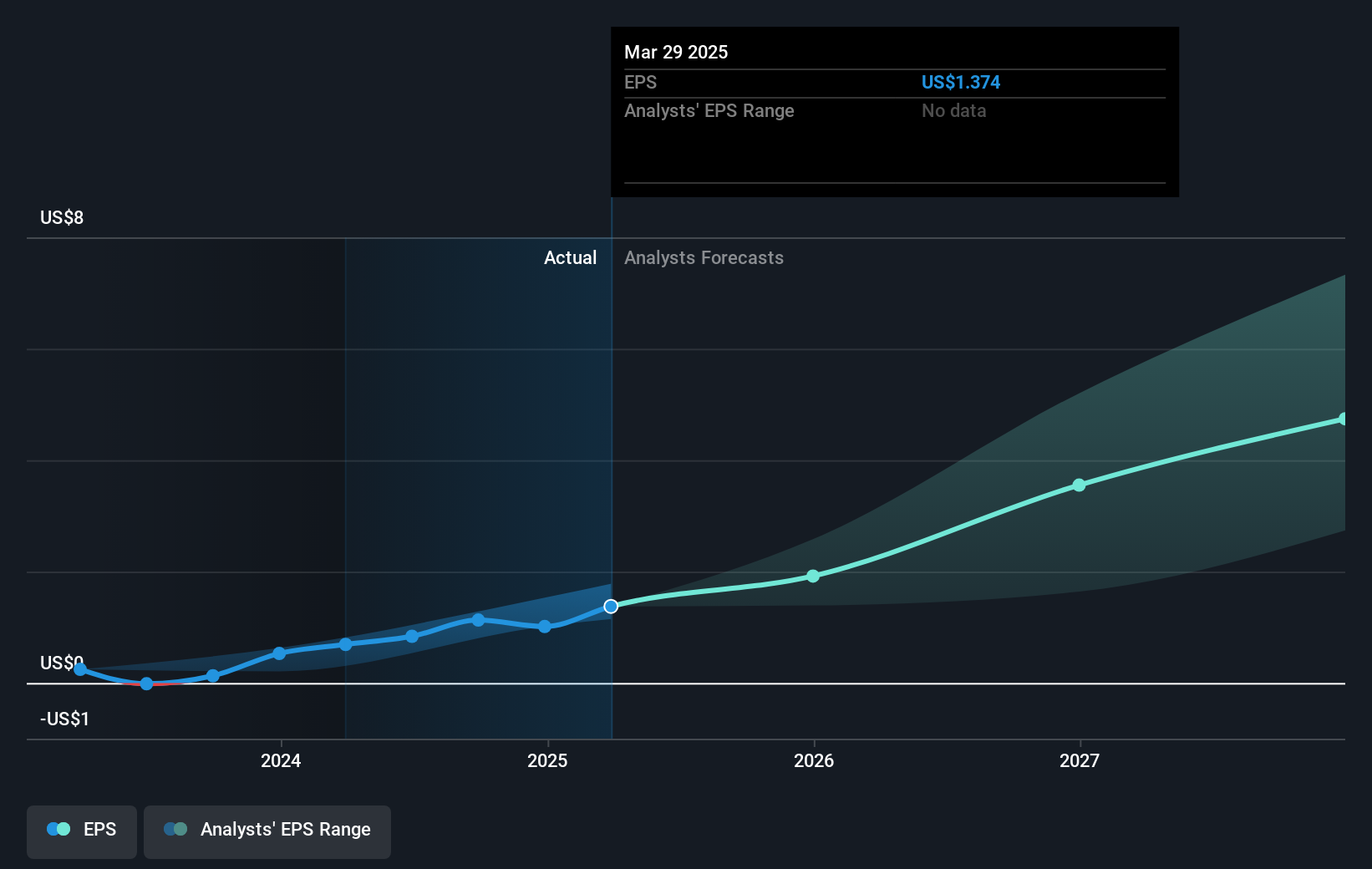

The collaboration could positively impact AMD’s revenue and earnings forecasts, especially in sectors like AI and cloud computing, given the acceleration in these fields. However, geopolitical factors and manufacturing dependencies might offset these gains, potentially affecting the company’s long-term growth trajectory. With its current share price at US$155.67 and an analyst consensus price target of US$185.77, the stock's present valuation reflects a 19.34% discount to the price target. This suggests room for upside based on analysts' expectations, despite potential risks and uncertainties highlighted in the narrative. Investors should consider both the collaborative opportunities and the broader industry challenges when evaluating AMD's market position.

Understand Advanced Micro Devices' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)